Competition is fierce in the U.S. commercial lines market. Expectations continue to increase in terms of price, product and service. Distributors are pressuring insurers to increase commissions and meet streamlined operational requirements or risk losing the opportunity to quote the most preferred business. Moreover, insurers are not only competing against each other; alternative capital has been flooding the market, and new forms of partnerships between capital providers and managing general agents are slowly emerging.

Executive Summary

While underwriting returns, expense efficiency and asset management each contribute to overall performance, winning companies tend to pull away from the pack based on their underwriting prowess, say experts from PwC. Intense competition and technology advancements have raised the bar on what constitutes an advantage, and companies will need to use technology and analytics to seamlessly and efficiently channel expertise from critical functions in making sound underwriting decisions.At the same time, a prolonged period of low investment returns has made underwriting profitability increasingly important to drive performance, making lower prices/broader terms unattractive levers to win business.

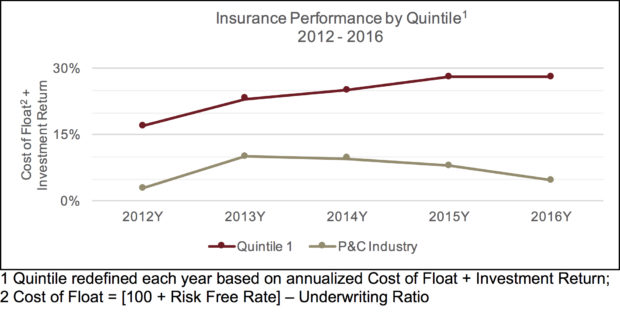

Based on our study of the 100 largest U.S. commercial lines insurers, clear winners are emerging. The top quintile is getting paid handsomely to generate float, as the premium collected far exceeds the total amount of eventual claims and expenses. While this phenomenon happens in some years for the U.S. P/C industry as a whole, it typically attracts competition, quickly driving down prices and eliminating the opportunity. This makes the significant “cost of float” advantage between the top performers and the rest of the U.S. P/C industry—more than 15 points on average from 2012 to 2016—such an impressive result. Even more telling is that while the performance of the P/C industry as a whole has started to deteriorate, the top performers have actually improved, widening the gap between the winners and the rest of the industry from 14 points in 2012 to more than 23 points in 2016.

The top performers over the past five years are not necessarily the winners across the underwriting cycle. Over half are focused on specific lines of business (namely, workers compensation, commercial property and commercial financial lines) that have performed particularly well over the time period that we analyzed (2012-2016), getting an “easier ride” to the top.

- Despite being historically unprofitable, workers comp performance has improved dramatically over the last five years and is forecast to continue improving. Workers comp specialists have ridden this wave, and considering their line of business and often regional focus, they have outperformed in a rapidly improving line.

- Commercial property has outperformed the industry on a rolling basis since 2002, with particularly favorable results due to minimal catastrophe activity in 2013-2016. Given the string of hurricanes this fall, however, the total incurred losses for 2017 are projected to hit an industry peak, driving the loss ratio higher than it has been since 2001. Players focused on commercial property cannot escape natural catastrophes, but those with tight underwriting controls and superior risk control functions can mitigate preventable losses and properly fund for catastrophes to maintain profitability over time. Looking forward, appropriately calibrating catastrophe models and monitoring actual to technical price will be critical for pricing discipline in the face of changing weather patterns and excess capacity.

- Commercial financial lines experienced deep losses following the 2007-2008 financial crisis, which caused the market to harden and as a result has led to significant underwriting profitability for those lines in recent years. However, given the line’s volatility, insurers must price accordingly and fund for tail events.

While there are a few “free-riders” that land in the top quintile in any given period primarily based on their line of business focus, there are a handful of insurers that deliver consistently profitable underwriting returns year-in and year-out, through soft and hard markets. These insurers are able to navigate the underwriting cycle through tight integration of risk selection, pricing and terms/conditions discipline, and reserve adequacy to produce positive underwriting performance in soft markets and take advantage of pricing power when the cycle turns. While these insurers include both multiline generalists and mono-line specialists, each has established a distinct “underwriting advantage” through one or more of the following:

- In-depth industry expertise.

- Line of business mastery.

- Data and analytics insight and application (from front office through claims).

- Disciplined underwriting execution (e.g., training, guidelines, process and governance).

This underwriting advantage cuts across functions. Insurers that establish an operating model that effectively leverages and disseminates expertise across distribution, underwriting, risk control, claims and actuarial are able to systematically generate float at favorable levels across all stages of the underwriting cycle.

It is important to note that the top performers do not necessarily have an expense ratio advantage. The expense ratio across quintiles is in line with the P/C industry average. While expense management does contribute to the cost of float, cost cutting on its own does not provide a sustainable long-term advantage.

It is important to note that the top performers do not necessarily have an expense ratio advantage. The expense ratio across quintiles is in line with the P/C industry average. While expense management does contribute to the cost of float, cost cutting on its own does not provide a sustainable long-term advantage.

That said, the cost base of the entire industry is too high. Leading insurers are therefore focusing now on building a lower cost structure, which should allow them to invest in differentiating capabilities, offer value-added services and/or run a higher loss ratio than competitors going forward. Sustained profitable growth will increasingly depend on cost innovation to compete with new and existing players.

Interestingly, investment performance is not currently a key differentiator between top and bottom performers. In fact, the top quintile actually performs below the U.S. P/C industry average. However, there are examples of insurers that have consistently derived significantly higher returns, proving that opportunity does exist in this area.

Many insurers are heavily concentrated in both investment and high-yield credit. We have found that certain alternative strategies may provide increased yield for a given level of risk in the short term and, more importantly, better position portfolios to respond favorably in certain future extreme events. Therefore, select insurers, especially those in well-capitalized positions, have much to gain from more active asset allocation, considering strategies that enhance portfolio performance across various market scenarios.

In conclusion, while underwriting returns, expense efficiency and asset management each contribute to overall performance, the winners tend to pull away from the pack based on their underwriting prowess. Going forward, the key to winning in the commercial insurance market will likely remain the same: Insurers must have a distinct underwriting advantage to consistently grow premium without forfeiting profitability.

However, intense competition and technology advancements have raised the bar on what constitutes an advantage. The winners will not only have underwriting expertise but also will use technology and analytics to seamlessly and efficiently channel expertise from critical functions (e.g., claims, actuarial) in making sound underwriting decisions.

Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday