According to the World Bank, 12.7 percent of the population earns below $1.90 per day. This segment of the population is underserved and it has been estimated that insurance coverage could extend to four billion people and translate into potential premium volume of up to $40 billion.

Executive Summary

Chris O’Kane, Chief Executive Officer of Aspen and a Board director of Blue Marble Microinsurance, highlights the importance of innovation and customer satisfaction—attributes that have sometimes proved elusive to the insurance industry, using the example of the microinsurance potential innovations of the Blue Marble venture to support his ideas.Providing risk protection for the underserved emphasizes the importance of economic sustainability and satisfying the needs of all stakeholders—ensuring continued development for underserved communities and sustainable levels of profit for insurers, he notes.

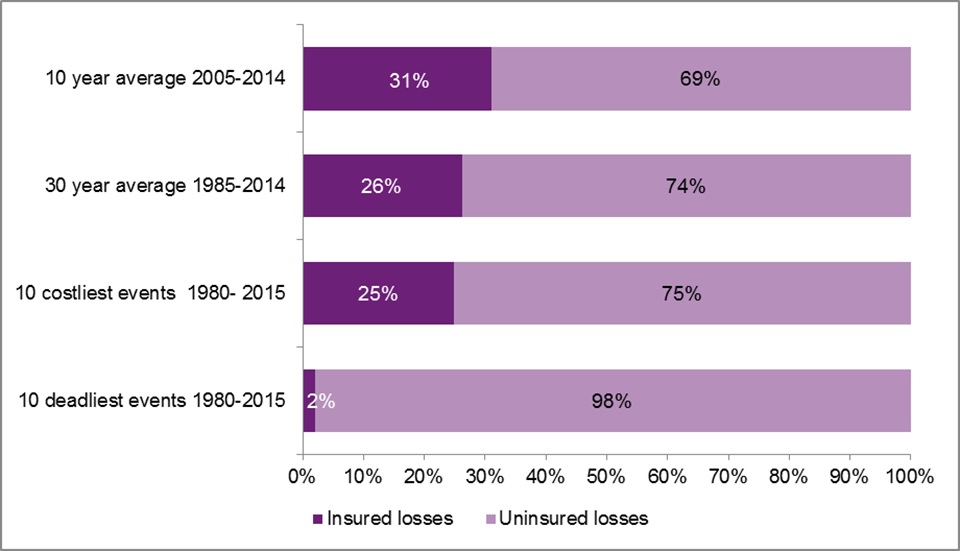

The graph below demonstrates that there is plenty of scope to narrow the difference between insured and economic losses often referred to as the “protection gap.” Insured losses arising from natural catastrophes account for less than one-third of average total losses in a number of time periods, but a comparison of the costliest and deadliest events is perhaps more interesting. The latter comprises events with a greater bias to emerging economies where the percentage of insured losses is significantly lower. Unsurprisingly, the impact of a disaster hits those with the lowest incomes hardest, and if economic development is to prove sustainable, then this impact has to be minimized.

The opportunity to take an active role in this white space and work towards narrowing the protection gap in underserved geographies around the world is a real opportunity. Success will not be found in a traditional product-centric solution. Rather, it will be discovered through employing new models, new ideas, new approaches, new relationships and innovative technologies.

These principles are clear to participants in the Blue Marble microinsurance venture. The Blue Marble venture, which is based on a consortium of eight global companies, has recently announced its inaugural pilot project in Zimbabwe with ambitions to extend this across the African continent. Blue Marble has targeted 10 new ventures for launch in the next 10 years.

Dynamic Tension

The Blue Marble venture, which is based on a consortium of eight global companies, has recently announced its inaugural pilot project in Zimbabwe to provide drought protection to maize farmers.

The insurance product is supported by a proprietary index which is the collaborative innovation of the consortia data scientists and agronomists. It employs innovative sensor technology to measure rainfall and crop welfare and uses mobile technology to communicate with customers.

Despite these differences, there is a core value to both traditional and microinsurance providers and there are strong arguments for a shared central principle—namely, longevity. This has to be based on sustainability, which requires adequate returns.

Aspen, together with the other Blue Marble consortium founder members, believes that the for-profit nature of the venture will provide the motivation for long-term success. Proposals are viewed through both a social impact lens, as well as a commercial one, with particular attention paid to ensuring that the desired social outcome is achieved. In effect, there is likely a continuous—and importantly—an ever changing trade-off between development and sustainability goals. Success will be evaluated in relation to how the ventures deliver value to both Blue Marble customers and consortium members. The acceptance of this dynamic tension is an important factor.

Creation and Collaboration

Blue Marble is based on a mission-driven business model with collaborative innovation to extend insurance protection in a socially responsible and sustainable manner. The aim is to create active markets through profitable ventures. The outcomes must have social relevance (for example, greater food security) and they must be measurable to gauge effectiveness.

Goals to achieve greater food security include an increase in continuity of yield and cultivated land. Sustainability goals include, for example, lower expense ratios through reduction of frictional and intermediated costs.

The challenge lies not only in creating products that meet demand but also in devising efficient processes for collecting premiums and managing claims. This is not simply about adaption of existing generic product offerings, but rather about considering the real needs of risk management in this environment to achieve economic growth.

As a specialty insurer, Aspen is attuned to business that is specialist and non-standard. The sharing of knowledge among Blue Marble members and the expertise of the Blue Marble management team will help ensure an efficient delivery to market.

Leverage

Each venture will leverage support and learnings from the Blue Marble management team, consortium members and other stakeholders. The goal is to develop services and solutions which either enable or support insurance carriers to enter the market. This includes business services such as distribution platforms, premium collection and claims settlement. Innovation services and impact services include measuring and monitoring the effect of insurance on development. Local third-party partners, such as governments or other third-party administrators, are key to the success of any project.

Blue Marble’s inaugural project, which is now in pilot stage, provides drought protection to Zimbabwean maize farmers. The insurance product is supported by a proprietary index which is the collaborative innovation of the consortia data scientists and agronomists. It employs innovative sensor technology to measure rainfall and crop welfare and uses mobile technology to communicate with customers.

“Success will be evaluated in relation to how the ventures deliver value to both Blue Marble customers and consortium members. The acceptance of this dynamic tension is an important factor.”

“Success will be evaluated in relation to how the ventures deliver value to both Blue Marble customers and consortium members. The acceptance of this dynamic tension is an important factor.”

Chris O’Kane, CEO, Aspen

These ventures also yield an important benefit in terms of inspiration for reverse engineering, as Blue Marble is leveraged into the corporate culture of the consortium members.

Talent

Technology—particularly mobile technology—is likely to play a key part in the Blue Marble ventures and is a cornerstone of the Zimbabwe project. Traditionally, insurance has relied on banks to provide the financial infrastructure, but a different approach is needed where such banking organizations are absent. Blue Marble’s management includes software engineering expertise with experience in analyzing demographic data and monetizing markets, but is also reliant on experience with the potential venture consortia. This provides a key benefit for the consortia as the ventures are inspired by, and also inspire, millennials who value the opportunity to work for those firms that can offer flexibility, freedom and space to grow. They also want to be stretched and challenged and able to fulfill strong beliefs and expectations within the work place. The benefits of microinsurance extend beyond the insurance contract and include access to growth markets and attracting a more diverse talent pool.

Entering the White Space

- The World Bank, Poverty Overview, (October 24, 2016).

- Swiss re, sigma 6/10, Microinsurance–Risk protection for 4 billion people

New models, new ideas, new relationships and innovative technologies will be needed our success as we take an active role in the white space of protecting underserved economies.

Our lives are ruled by increasing complexity. Understanding those complexities and breaking new ground are universal goals for insurance innovation.

(Editor’s Note: A version of this article was published on Aspen’s website.)

The Future of HR Is AI

The Future of HR Is AI  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec