Baseball’s future is in the minors. There are 30 major league baseball teams in the U.S., but they are supported by an operational infrastructure of 120 additional teams that make up the minor leagues. These teams are the pipelines of the pros — preparing and funneling the best players into coveted spots in the major leagues. Each professional team has four minor-league affiliates. Just this year, Major League Baseball reduced the number of affiliated teams from 162 to 120 in an effort to standardize player development and pour more money into the lower parts of the system.[i]

Like any change, there was a downside to consolidation. Many communities either lost their team or their affiliation or their status changed from AAA to a lower rank.

The upside is that minor league players, who traditionally live and work in suboptimal conditions with extremely low salaries (often as low as $8,000-$12,000), will now reap the benefits of reorganization. In 2021, the MLB increased minor league salaries 38-72% and reduced travel requirements. In 2022, teams will be required to provide housing for their players, some of whom would find themselves piled into small apartments or sleeping in cars.[ii]

The net effect is this: Operations shifts will improve the experience. Major League Franchises will be establishing a pool of better selections. Players will receive better treatment and more sleep. Fans will enjoy better facilities and an improved view of their team’s prospects. Time will tell, but it seems like baseball’s core development process has shifted to meet the needs and dreams of nearly everyone involved.

It’s November. Baseball season has just ended and Majesco’s Field of Insurance Dreams has been a resounding success. Throughout the playoffs, we’ve discussed the profound influence of next gen technologies on insurance, lately focusing on Group and Voluntary benefits. Group and Voluntary benefits markets are undergoing a tremendous shift. Employee and employer trends are creating an entire new generation of value for insurers who are ready for something new. In Majesco’s recent report with Deloitte, The New Reality and Future of Group and Voluntary Benefits, we outline the differences between Group and Voluntary’s past and it’s future — full of opportunity. Today we are going to discuss how Group and Voluntary benefits providers will reach that future safely and effectively.

The Group and Voluntary Scouting Report — Products Dramatically Change to Fit Revitalized Benefits Landscape

This generation has the potential to turn the downward tide of insurance ownership through increased enrollment of group and voluntary benefits that can be ported to individual insurance, keeping them as a customer.

A February 2017 LIMRA study noted that employment-based benefits (group and voluntary) life insurance covered more people than individual life insurance as of 2016, [iii] positioning this segment to turn the tide of insurance ownership from a low of 44% in US households. A recent LIMRA study found that 50% of North American employers currently not offering voluntary benefits are considering adding them, and 40% who do offer them are looking to add additional benefits.[iv] Combine the growth in employee interest with the growth in employer offerings and you get the recipe for a growing opportunity.

Everyone knows that voluntary benefit products need to change, but is there that much of a difference between what is offered now and what will be offered in the future? Judge for yourself.

Group and Voluntary Products of the Past

- Products are one-size fits all.

- Limited data on individual employees.

- Business sold in blocks.

- Employer or broker does the marketing.

- Voluntary benefits are terminated when employee leaves.

- No personalization.

- No ability to grow the relationship.

Group and Voluntary Products of the Future

- Products and services are holistic in nature and they are flexible based upon the size of the employer, the employee demographic, geography and other variables.

- The individual customer journey is as important as in individual sales.

- Brokers are supported with better data and better products.

- Employers are supported with tools that will help them save time and improve uptake.

- Insurers help to educate the employee.

- Products can be “data smart,” with selection and automation based on knowledge of the individual.

- Many products are portable and can go with the employee when they leave.

- Insurers establish and build relationships with the insured.

Future products will do more. They will fit lives and lifestyles, but they will also fit new employer and employee digital experiences. While many employers continue to offer the traditional products of health, dental, vision, STD, LTD and life, there is an increasing demand for new, innovative products such as pet insurance, school loan assistance, critical illness, long term care, auto, hearing, identify theft, homeowners, and legal services. Group and Voluntary Benefits insurers must be in constant pursuit of innovative solutions to differentiate themselves.

To help insurers rethink their scope, it may help to consider how products, experiences and services will move away from a life insurance transaction to a broader lifestyle experience across health, wealth and wellness:

- Insurance Product: Products (risk, services, experience) will be redefined, but selling those products will require insurance to participate and play within ecosystems, rather than simply existing as an ecosystem unto itself.

- Lifestyle – Health, Wealth and Wellness Experience: Employees will be looking for one unified experience to cover all aspects of their life from health, wealth and wellness for banking, insurance, wellness activities, 401K accounts, and more, in a holistic way instead of separate transactions or policies for each. Insurers will need to ask themselves how they fit within the full picture of financial well-being, a growing area of interest that we’ll discuss in a moment.

- Value-Added Services: Provide value-added services such as wellness discounts, preferred access to gym memberships, and access to online brokerage accounts that provide a powerful, single engagement, eliminating points of friction between the different participants of the ecosystem.

Relate to Employees: The Core of Relationship

Group and Voluntary insurers are no longer going to be looking for large “blocks” of business, they are going to be looking for groups where they can funnel likely candidates into an operation that will include individual, dynamic relationships. Before creating a system that produces the best customers, revamping internal strategies and overhauling operations, it will be best for insurers to do some thinking around what these new customer types might truly want and what their employers want for them. Can insurers relate?

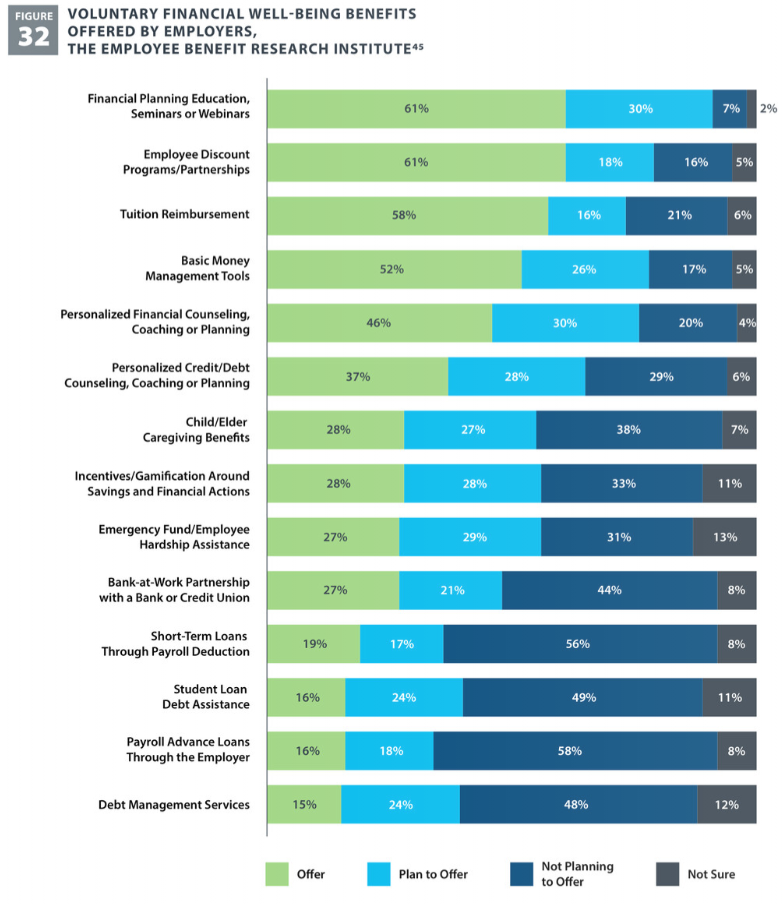

The NFP’s 2021 Trends Report highlights the spectrum of solutions that are being offered, planned to offer or not offered in the chart below.[v] When adding the offered and planned to offer categories, nearly all of the areas are 50% or more, reflecting broadening view on group and voluntary benefits beyond just the risk product to additional value-added services across the health, life, wealth and wellness spectrum.

Note the popularity of financial well-being products in the chart. COVID has forced many employees to reconsider their overall financial picture. Between Q3 2019 and Q3 2020, credit card balances fell 24%.[vi] People have sensed their financial instability and they are now willing to focus on what will bring them stability — that includes insurance and related services. This makes Group and Voluntary benefits an excellent place for insurers to build meaningful, lasting relationships; helping workers of all types to find supportive, consistent comfort in a rapidly-changing world.

Figure 1: Financial well-being benefits offered

The growing gig economy is ripe for an insurance foundation that supports portability. Pre-COVID, it was predicted that 52% of US workforce would be in the Gig economy by 2023, up from 36% in 2019.[vii] Majesco’s research previously highlighted where both generational groups gave portability high marks – Millennials and Gen Z at 64% and Gen X and Boomers at 57%. The older generation sees value as they ease into retirement and participate in the gig economy, getting value from benefits offered as a gig worker.

Customer-First: Redesigning the Operating Model Through a Different Prioritization Lens

A successful operating model should always start with a customer first approach, identifying capabilities that should be provided as well as how they should be provided to drive growth, retention and profitability. The full relationship journey for brokers, employers and employees should be taken into account, as well as the vital connections with ecosystem partners and existing benefits platforms.

While designing the desired customer journeys, there needs to be a conscious effort towards identifying current state processes that need to be re-adapted or re-engineered to support the new digital core. A good starting point to undertake this effort is to begin with a customer-first lens, listing out the capabilities your organization needs to provide and how they should be delivered, then weighing that list against your existing process inventory. This will allow for creation of a prioritization framework, specifically customized to the organization’s transformation goals. Processes that need to be re-adapted or re-engineered will stand out. This effort needs to be collaborated with business units and functions that are most impacted by the transformation effort.

Next Gen Core: Built for Relationships

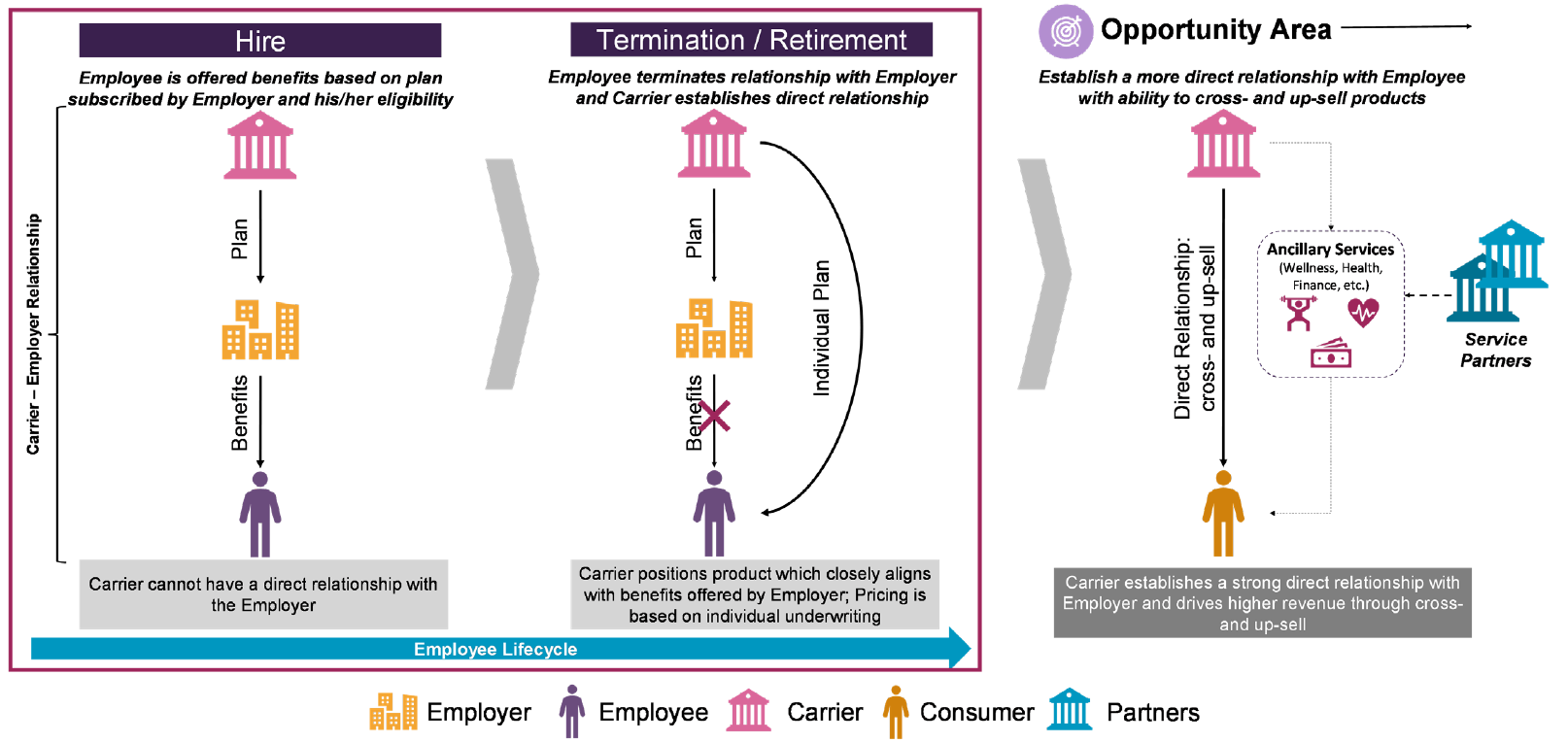

Next gen core systems must support the customer across their lifecycle – whether for group, voluntary benefits or individual insurance, recognizing the need to transition between these as people change employers, gig on or off, and have new product needs based on where they are generationally.

Optimally, these systems will support group and voluntary benefits with individual policy servicing on a single platform, recognizing that customer retention, regardless of where they originate, is critical to insurers’ growth strategies. It supports portability to allow employees to take benefits upon termination or retirement, allowing insurers to establish direct relationships with them for a deeper and broader relationship as reflected in Figure 2.

Figure 2: Deepening relationships beyond the traditional lifecycle

Using Data and Analytics to Improve the Experience

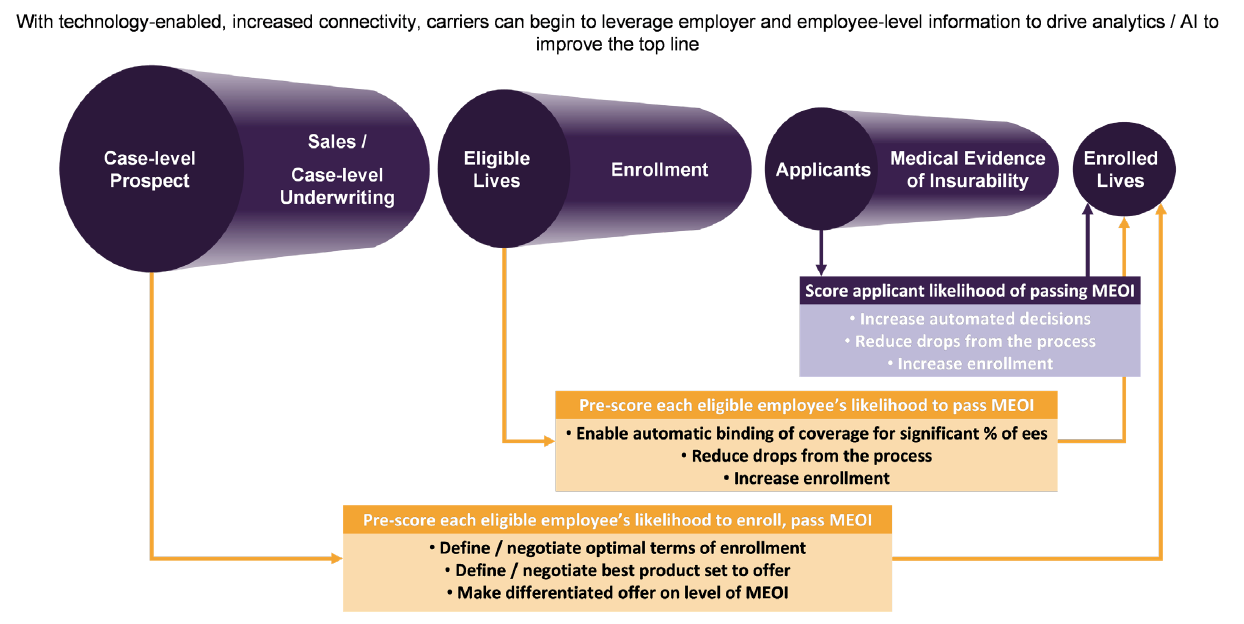

The importance of capturing, enriching, and using data for identifying opportunities and then delivering a relevant and engaging experience for employees is crucial for Group and Voluntary benefits providers in today’s digital era. Whether the data is structured, unstructured, real-time IoT or machine generated, it must be leveraged by advanced analytics to enable the creation of tailored propositions and more compelling customer experiences … aligning employee needs to the appropriate products and services, thereby creating deeper trust, loyalty and engagement.

The visual below portrays a group voluntary product sales funnel, highlighting points in the process in which advanced analytics—fueled by richer data sourced from connectivity to benefit administration platforms—can be used to create a better experience for insurers, employers and employees.

Figure 3: Connectivity-enabled analytics / AI opportunities

Every digital or customer focused business process and solution are ripe for embedded analytics. Key opportunities for smart insights that can transform the business and drive growth include:

- Analysis of participation rates, other data

- Analytics to cross-sell voluntary benefits

- Sponsor reporting on participation

- Experience rating for existing groups

- Reporting and analytics for plan sponsors

- Group-level reporting

- Reduce claims costs for employers, sponsors

- Billing and payment reconciliation

- Compliance reporting

Building the Team of Dreams

Insurance’s future is in its people, operations and technology. If Group and Voluntary benefits companies are going to match their technology and operational model to the opportunity, they are first going to have to focus on their team. Are the right people, partners, and processes in place to make this transformation a reality?

For the past several months, Majesco and Deloitte, have been laser-focused on Group and Voluntary market preparation and education. If you are ready to build your Field of Insurance Dreams, there is no better place to begin than in a conversation with us. Our teams are built to prioritize your processes, build your relationships, and expand your channels through next gen technologies, cloud-based digital capabilities, and API-native connections. Learn more about the opportunities awaiting Group and Voluntary Benefits carriers by downloading The New Reality and Future of Group and Voluntary Benefits today.

Co-authors:

Abhishek Bakre, Senior Manager, Strategy and Financial Services at Deloitte Consulting LLP

Denise Garth, Chief Strategy Officer at Majesco

[i] Fagan, Ryan, Minor league baseball restructuring; Full list of 119 affiliate invites sent out by MLB teams, Sporting News, December 9, 2020.

[ii] Pasan, Jeff, Major League Baseball to require teams to provide housing for minor league players starting in 2022, ESPN, October 17, 2021.

[iii] “For the First Time in History, More Americans Are Covered by Employment-Based Life Insurance than by Individual Life Insurance, LIMRA Reports,” LIMRA press release, August 30, 2017

[iv] Howe, Barbara, “A Fresh Look At Voluntary Benefits,” Corporate Wellness Magazine.com

[v] Ibid.

[vi] Rosenbaum, Eric, Credit card debt is rising again. Bank CEOs are betting on it., CNBC, July 30, 2021

[vii] Primack, Dan, “Exclusive: Mary Meeker’s coronavirus trends report,” Axios, April 17, 2020

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit