At some point between preschool and first grade, a parent or a teacher may have introduced you to the balance beam. It’s an important physical and psychological step. Walking the beam gives kids confidence, and it helps them to appreciate the importance of balance.

The balance beam also introduces children to an element of the mysterious — one of their first big mind tricks. If they look forward (out toward the end of the beam) they find it much easier to balance than if they look down at their feet. It’s counterintuitive. Ignore the feet and let the mind guide the steps to the endpoint.

This simplicity and psychology are in play in the working world. There are times to focus on today — the here and now. But if we don’t look out at the future, we’re destined to tumble off the beam. Keeping the future in focus allows us to take incremental steps with the assurance of knowing we are headed in a precise direction. The big picture is the future. The small steps are our tactics. The journey to the end of the beam is the strategy in motion.

Every year, Majesco surveys insurers on the beam; insurance executives who are in motion and headed toward their future destinations. What do they see out in the future? How are they adapting their steps? Are they too focused on their feet? Are they too far from the end to see success on the horizon? By looking at the strategic initiatives weighed against the current trends they are focused on, we can get a good view of the industry’s overall direction and progress. This year’s findings are available in Majesco’s Strategic Priorities report, Realignment in Insurance: Strategic Priorities for Success.

In our last Strategic Priorities article, we considered how operational and technology alignment is crucial to achieving growth. Today we are going to look strictly at the types of strategic initiatives that are most crucial for insurers building growth-ready organizations. This forward focus makes it much easier to envision, implement, and plan for technology and operational alignment, as well as adapt to continuous shifting trends.

Insurers rank their strategic priorities

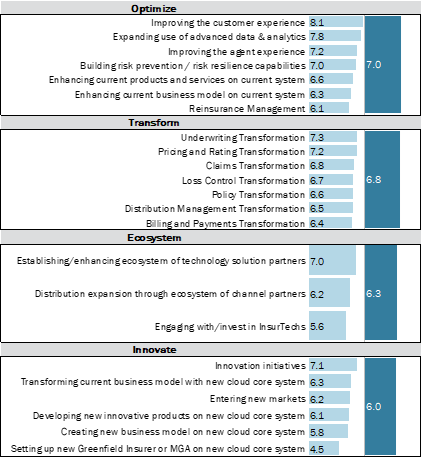

In Majesco’s report, we found four high-level themes emerged based on the 23 strategic initiatives assessed in the survey including:

- Optimize

- Transform

- Ecosystem

- Innovate

Each thematic group represents a bucket of high priorities. (See Figure 1.) These are the locations on the beams that will lead to new and transformed insurance organizations. They aren’t the steps themselves. The steps themselves are technology or operational changes that are aligned with these initiatives to create a new foundation for the future.

The Optimize and Transform initiatives are highly aligned and close in ranking, reflecting a response to the Top 3 top-of-mind issues.

Figure 1: Insurers’ strategic initiatives

Top-of-Mind Issues

Majesco assessed top-of-mind issues that influence strategic priorities with the top issues being:

- Operations

- Economic

- Risk

- Technology

- Talent

- Customers

- Competition

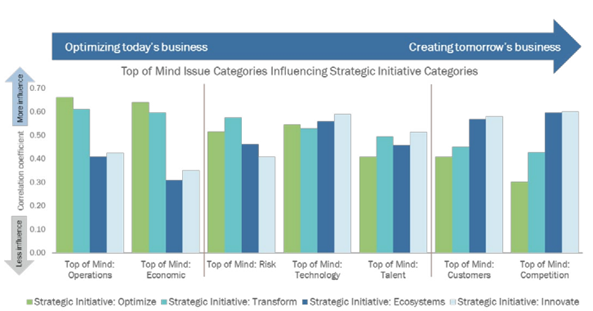

The Technology top-of-mind issue category strongly influences all strategic initiative categories as shown in Figure 2. Dealing with today’s macro-economic headwinds encourage insurers to improve their ability to grow, make capital more efficient, and reduce costs while meeting growing customer expectations and new risk demands. The only way it can all happen at once is if insurers focus on innovating to create tomorrow’s business while optimizing today’s business. This keeps insurers relevant and competitive along their journeys to their future.

The Customers and Competition categories have the strongest influence on creating tomorrow’s business. Operations and Economic categories outweigh the other top-of-mind categories in their influence on optimizing today’s business. Risk, Technology, and Talent are the priorities that enable the transition from todays to tomorrow’s business. A lack of focus on these makes it difficult to address the others.

Figure 2: Influence of Top-of-Mind Issues on their Strategic Initiative priorities

Interdependence and Interconnected Initiatives

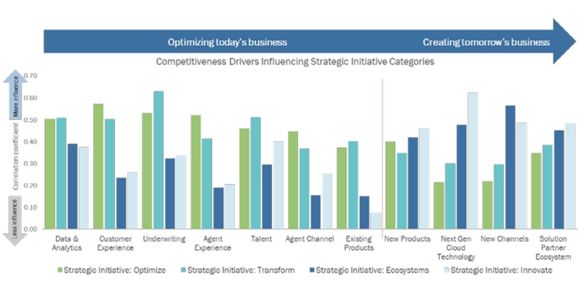

Top to bottom, priorities and strategic initiatives are interconnected. In other words, even if we examine and prioritize areas within Optimizing Today’s Business areas, they don’t stand alone. Every one of today’s crucial optimizations contributes to tomorrow’s transformation. This is the reason why insurers must consider a holistic approach that transforms for today’s needs but with the future in focus. Data & Analytics support new products. New Channels need an improved Customer Experience. Solution Partner Ecosystems drive and be driven by strategic optimizations across the full spectrum of operations.

As seen in Figure 3, there are intuitive relationships between companies’ self-assessed competitiveness drivers and the priority of their strategic initiative categories. Those who cite strength in New Products, Next Gen Cloud Tech, New Channels, and Solution Partner Ecosystems place a higher priority on strategic initiatives in the Ecosystem and Innovate categories. On the Optimize today’s business end of the spectrum, those with competitiveness driver strength in Data & Analytics, Customer Experience, Underwriting, Agent Experience, Talent, Agent Channel, and Existing Products give higher priority in the Optimize and Transform strategic initiative categories.

There are blind spots, such as the lower priorities of Innovation in the Agent Experience or the Ecosystem’s role in optimizing Existing Products. Even so, every area stands to be enhanced when priorities are future-focused. For example, Existing Products may improve as new products are launched to the market. — new features can be added. Underwriting’s speed and effectiveness will both improve as Next Gen Cloud technology is implemented.

Figure 3: Influence of companies’ Competitiveness Drivers on their Strategic Initiative priorities

Taking eyes off the prize

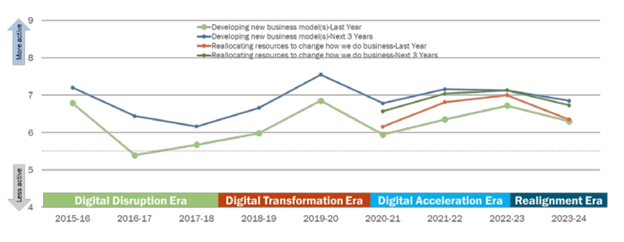

Expectations and activity around developing new business models reached a peak in 2019-20, the middle of the Digital Transformation Era. COVID’s disruption, followed by the increasing macro-economic challenges, has seen this decline as insurers shift their focus to optimizing today’s operations in the face of the risk, economic, climate, and societal challenges.

Figure 4: Insurers’ prior-year and planned strategic activities in developing new business models and reallocating resources to change how they do business

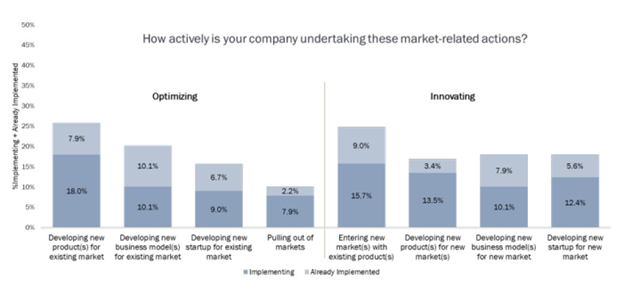

When looking at the contrast of existing versus new markets, the activity is relatively balanced between the two. There is strong activity in developing new products and business models for existing markets while also entering new markets with existing products as seen in Figure 5.

Interestingly, despite insurers pulling out of markets, creating a lot of headlines in 2023, this is the lowest level of consideration across all market-related actions. New startups no longer have a strong focus as they did during the height of InsurTech with the launch of companies like Lemonade, Haven Life, Root, and others.

Figure 5: Market-related actions insurers are implementing or have implemented

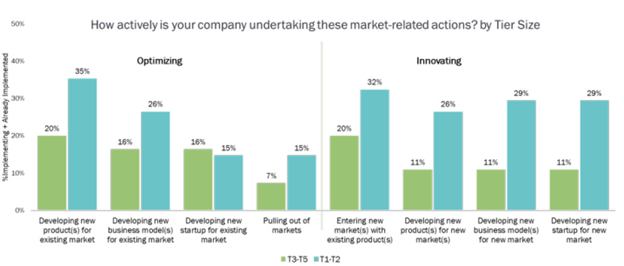

When looking at the difference between the size of insurers, larger (tier 1-2) insurers are more active across all the categories as compared to smaller (tier 3-5) insurers. Their dual focus on optimizing and innovating stands out as a significant strategic differentiator, to keep them in a strong position today but also for the future as shown in Figure 6.

Smaller insurers will need to up their game to compete in the future as the market landscape continues to rapidly change and reshape. Given their limited resources, the gaps could become a competitive challenge.

Figure 6: Market-related actions by insurer size

The operational transformation and innovation areas of focus embraced by the industry over the last number of years have an increasing focus on driving a new business model and technology foundation to meet the demands of today and the future, not the past. Those insurers moving to a new or enhanced business model and next-gen technology foundation are bending the cost curve today while driving profitable growth and efficiency that creates competitive differentiation and the ability to invest in innovation for the future.

Even more importantly, they are creating customer-centric products and experiences, expanding market reach with new channels, and launching new business models, clearly positioning themselves as market leaders today and in the future.

Case in point: Next steps are required, but worth it!

The Majesco Strategic Priority for data and analytics becomes real as we look at specific examples.

AI and GenAI are revolutionizing today’s customer service and operations. However, the future of AI for insurance looks far brighter than what can be accomplished today. The drawback is that any application of technology, no matter how fast it is implemented, takes time to integrate itself within the organization. With AI, there’s no gymnastic jump that will get your organization to the end of the beam. You must begin now to get to its potential later because AI applications are those that “learn” through Machine Learning. That learning happens both inside and outside of your organization. Learning, for both people and systems, may become tomorrow’s greatest competitive differentiator, particularly in the fight for talent and customer growth and retention.

This is why Majesco is at the leading edge with AI and GenAI, with our investment in our portfolio to provide embedded analytics into our solutions. Our Spring 2024 release will accelerate these capabilities, putting our customers at the forefront of leveraging data and analytics – from business intelligence, having access to all their data in a lakehouse to embedded AI / ML models for underwriting or claims to Gen-AI for operational efficiencies and productivity. We are focused on making these valuable for today’s business, but helping insurers create a new foundation for the future. Check out the webinar Microsoft from last month that highlights what we are doing.

The future focus requires your next step now, and each step is worth it. Each step toward the future of insurance operations that meet the needs and demands of customers are investments with duplicate dividends.

Are you ready to learn more? Be sure to read Majesco’s Strategic Priorities report, Realignment in Insurance: Strategic Priorities for Success, and tune in to our recent webinar that digs into the meaning behind the data, Connecting the Dots: Strategic Priorities and Realignment in Insurance for Success.

By Denise Garth

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Preparing for an AI Native Future

Preparing for an AI Native Future  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers