If you’ve ever been to the symphony, you are probably familiar with the pre-performance ritual. The players take the stage, find their places, and begin tuning instruments. A sweet cacophony fills the room. It feels disorganized, but if the performance is going to have any chance of achieving success, tuning is necessary. Strings need adjustments. Reeds need preparation. A few blog

It’s a principle that bridges disciplines and occupations. When a Top Fuel drag car pulls up to the line, mechanics are still tuning the idle mixture and making adjustments. Before a rowing team gets onto the water, the coach chooses the rowers and their positions in the boat based on their individual ability and fit.

Performance, it seems, is almost universally about proper tuning and preparation before it ever involves execution. The highest level of performance can only be achieved if the tools to be used are finely tuned before their use. Execution then becomes a matter of practice.

Part of this preparation involves alignment. The conductor comes to the platform and sets the time so that the orchestra stays together. The timing on the dragster is set to keep cylinders in synch. The coxswain keeps the rowers in rhythm to maximize pace and keep oars from getting tangled. Alignment directs all efforts, power, and energy toward achieving the goal.

Realigning for growth

Companies become leaders when they understand the links between preparation, alignment, and execution. As many insurers are starting to realize, current operational business models are falling out of synch, and the technologies that once helped need to be re-tuned or replaced. Current business and technology frameworks are no longer meeting the challenges and opportunities of today’s let alone tomorrow’s fast-changing world.

To better understand insurer perspectives on operational business models and technology priorities, Majesco conducts an annual survey comparing and contrasting executive top-of-mind issues with actual strategic plans and activities. For a comprehensive look, be sure to read the full Majesco report, Realignment in Insurance: Strategic Priorities for Success.

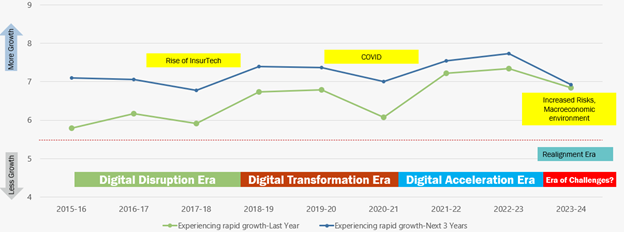

Majesco’s research and analysis across the last decade allows us to differentiate several eras of focus. We are now entering a new era underpinned by these tumultuous factors that we call the Realignment Era. (See Figure 1.) Each era represented in the chart reflects the non-stop pace of change over the last decade, to transform, optimize, and innovate the business. Unfortunately, over the years and eras, the initiatives and efforts have been incremental at best, creating many of the operational and technology challenges faced today because we did not shift our thinking. What is now required is a whole business model, process, mindset, and technology rethink that realigns to a very different world and market to ensure continued growth and profitability.

Figure 1: Insurers’ growth assessments through different areas of transformation

What is currently out of synch or misaligned?

It can be tough to define the scope of what’s wrong when an organization is misaligned. Sometimes the business seems to be doing well, but you can sense that something is missing. Other times, a gradual decline in profitability or market share signals the necessity for change. Insurance expertise and the knowledge of “how insurance works,” can cause a blind spot in how much re-alignment and tuning are truly needed. Our previous experiences and our “secret sauce” can cause us to miss how customers and markets have been changing.

Most organizations are familiar with their customers. But that is only the tip of what we need to know to rethink and adapt. Some questions to ask include: How are your customers interacting with other businesses and technology? How have their behaviors and risk profiles changed? Do they have new expectations on product, price, and service? How are your current interactions influencing their satisfaction and retention?

And this blind spot impacts what products are needed and expected in the market. Product innovation stalls when companies aren’t aligned. Prevention efforts are viewed as add-ons and not game-changers. Cultivating multi-channel options seems like a moot point because in-house data and digital technologies can’t handle it yet.

Customized, legacy solutions are also standing in the way. What is the impact of your legacy technology debt? Not just operationally, but also in attracting and retaining talent. Are you able to leverage new sources of data and analytics like Gen AI to drive improved operations, underwriting, and claims.

Does tuning and alignment actually improve performance?

Insurers can’t expect to change without supporting change. Navigating the tumultuous waters of transformation will likely require increased technology spending rather than the traditional 3-4% of DWP particularly when you factor in inflation and the pace of change.

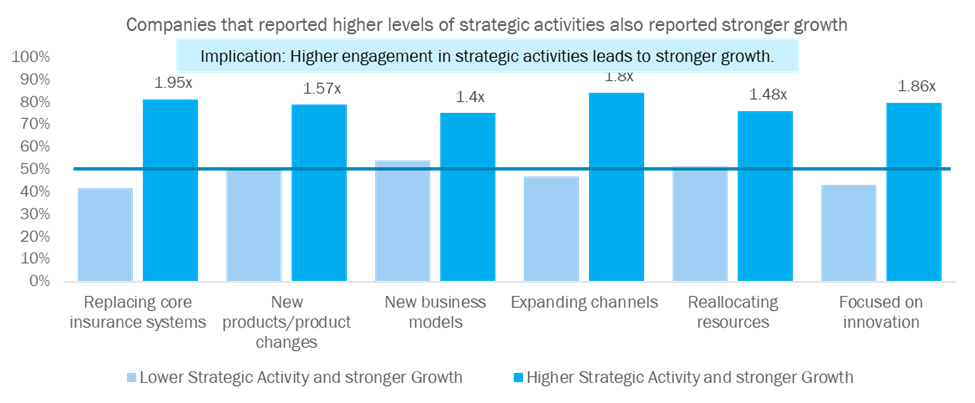

This is where realignment must come into focus by weighing business model and technology foundation investments to achieve strong performance in terms of growth and profitability. Growth is always a result of investment. We have found in our research that those companies focused on the right investment across six key areas, make a substantial difference in growth, as reflected in Figure 2. Investment in tuning and alignment proves itself to be valuable.

Those focused on and investing in replacing legacy core, creating new products, defining new business models, expanding channels, reallocating resources to the future business, and innovation initiatives report significantly higher growth than those who do not – from 1.4 to 1.95 times difference.

Figure 2: Impacts of strategic activities on growth

As 2024 unfolds, decisions will be made on priorities. Those decisions will influence who will remain or emerge as leaders and winners over the coming years. They will be sought after as insurance providers, partners, and employers due to their ability to realign and adapt to today’s and tomorrow’s world rapidly. More importantly, they will have a foundation both operationally and technologically to achieve operational optimization, cost-effective scalability, and adaptability to shifts through innovation. Strategic efforts to realign the business to the customer and the market will not only compensate for issues of loss, but will propel insurers forward when the economy and claims rates adjust.

Digitalization as a source for new growth

According to the latest projections by the Insurance Information Institute (III) and Milliman, the P&C insurance industry will not return to profitability until 2025, with a combined ratio forecast of 102.2 for 2023, following 102.4 in 2022. This has resulted in an increasing number of AM Best downgrades for insurers, including some big brands. As a result, many carriers are pulling back in states and lines of business to curb the losses. Increased repair and replacement costs, increased risk, and lower than approved rate increases are all contributing to the dilemma.[i]

For the L&AH insurance industry, AM Best’s Market Outlook in March 2023 indicated a stable outlook due to rising interest rates boosting net yields and relieving potential reserving concerns. However, the industry is still working through inflationary headwinds, risks due to recession, and the impact of COVID-19 on mortality rates. High inflation has eroded consumer savings, resulting in lower or nominal premium growth, but higher interest rates are creating tailwinds for annuities and pension risk transfer opportunities.[ii]

The unifying theme between P&C and L&AH growth is digitalization and implementing strategies for growth. The Swiss Re Sigma report, The economics of digitalisation in insurance: new risks, new solutions, new efficiencies published October 2023, notes that digitalization revolutionized value creation across firms and sectors and for insurance, it will be a source of new growth, new risk pools, and new efficiencies in the industry value chain.[iii]

“Digitalization…will be a source of new growth, new risk pools and new efficiencies in the industry value chain.”

The report further states that digital transformation remains high on the industry agenda. The research found that more than 40% of consumers in advanced markets had bought new or additional insurance online, and 50% in emerging markets had done so. In addition, insurers are experimenting across the value chain with digitalization to drive efficiency gains, with some insurers targeting a 3‒8 percentage point reduction in loss ratios and up to 20% savings in other areas. The report further notes that 31 of the 50 largest reinsurers invest in InsurTech in pursuit of first-mover advantage.

The accelerated proliferation and use of AI, including GenAI, is giving rise to a next gen technology foundation and architecture that is being integrated into all aspects of insurance. But as the Swiss Re report notes, there still must be a focus on transparency, ease of use, and customer-centric values to retain and build trust with customers to be successful.

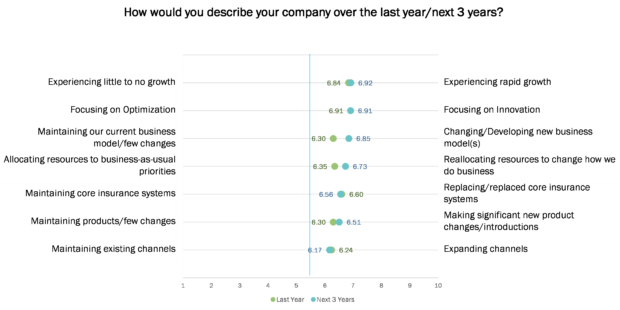

In looking at companies’ view of the state of their business last year and in the next three years, as shown in Figure 3, there continues to be a focus on accelerating the digital transformation and innovation of the business through new business models, innovation, replacing legacy technology, developing new products, and expanding channels.

Figure 3: Insurers’ assessments of their companies last year and in the next three years

This continued focus reflects the reality of accelerated change and disruption, from risk to technology, which demands the insurance industry continue forward with digital transformation. As the Swiss Re report highlights, countries that are more digital show greater resilience to other risks and realize gains from better underwriting, risk mitigation, risk measurement, and more. Digitalization can improve the accessibility and affordability of insurance – driving growth and helping to reduce the protection gap.

Top-of-mind issues signal the need for immediate rethink and realignment

Risk, customers, and the market are shifting, and a new reality is unfolding. In the last few years, first with COVID-19 and now with challenging market economics, we have seen the negative impact of insurers who are reluctant or simply unable to change. Operations, finances, and competitive positions have caused some insurers to compromise and make moves that they were forced to make — instead of moving to realign their business with the new realities of business.

Insurance mindsets are now changing as these concerns have grown. The industry’s 2024 top-of-mind issues shifted and expanded from previous years. These top-of-mind issues reflect challenges insurers are now facing in terms of both their business model and technology foundation being out of step with a new reality taking hold.

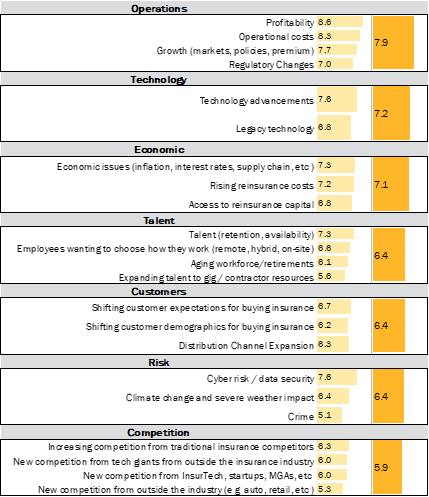

This year’s Majesco Strategic Priorities survey results fall into seven categories as reflected in Figure 4. Operational issues collectively scored the highest priority, reflecting the continuing quest for growth, operational costs, and profitability given the current market environment. However, technology came in second quickly followed by economic factors that influence most of the categories.

Figure 4: Insurers’ top-of-mind issues

Technology has always been top-of-mind for insurers, but the current environment with rapidly advancing technologies like AI and Gen AI, coupled with the challenges of legacy technology due to the highly customized, on-premise solutions that are costly and difficult to upgrade, if even possible in some cases, limit insurers’ ability to meet digital customer expectations, rapidly launch new products, drive innovation, meet distribution channel demands, and leverage new technologies.

Legacy debt is a significant operational risk for insurers. With retirements increasing and loss of institutional knowledge and skills, coupled with a new generation of employees who will not work with legacy technology, the patchwork of legacy solutions struggles to keep the business running, much less improving. Legacy technologies can’t leverage the data they hold or ingest new data sources to provide meaningful, actionable insight to improve decision-making. This is critical to meet the challenges of rising customer expectations, increasing risk, and growing competition from both inside and outside the industry.

In our next Strategic Priorities article, we’ll discuss how a forward focus will make it much easier to envision, implement, and plan for technology and operational alignment. If you’re ready to talk about how realignment can impact your organization, we would love to show you how Majesco is helping insurers shift from “legacy to the future” with next gen intelligent core systems and the modern data management frameworks that will support them.

Be sure to read the full Majesco report, Realignment in Insurance: Strategic Priorities for Success, and gain other future perspectives through Majesco’s exciting webinars, including 2024 Trends Reshaping the Insurance Business — Are You Ready?

By Denise Garth

[i] “Inflation, High CAT Losses to Lead to 2023 Underwriting Loss for P&C Industry, But Recession Likely Avoided This Year, New Triple-I/Milliman Report Shows,” iii.org, August 3, 2023, https://www.iii.org/press-release/inflation-high-cat-losses-to-lead-to-2023-underwriting-loss-for-pc-industry-but-recession-likely-avoided-this-year-new-triple-i-milliman-report-shows-080323

[ii] Kohlberg, Edward, “Market Segment Outlook: US Life Insurance,” AM Best, March 29, 2023

[iii] Anchen, Jonathan, et al., “sigma 5/2023 – The economics of digitalisation in insurance: new risks, new solutions, new efficiencies,” Swiss Re Institute, October 11, 2023, https://www.swissre.com/institute/research/sigma-research/sigma-2023-05-digitalisation.html

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers