Small insurers are expecting to do most of the hiring in the industry, according to a new survey, which also highlights the high demand for niche specialty commercial lines underwriters and claims professionals.

Just over two-thirds of companies surveyed plan to increase staff during the next 12 months—indicated by 69 percent of respondents in the property/casualty segment and 73 percent in the P/C commercial lines category—according to results of the Semi-Annual U.S. Insurance Labor Study conducted by The Jacobson Group and Ward Group, a part of Aon Hewitt.

The 73 percent of commercial lines insurers who said they expect to increase staff during the next 12 months exceeds levels recorded in prior surveys. Reporting on a January 2016 survey earlier this year, Jacobson and Ward revealed that 61 percent of commercial lines companies expected more new hires during the upcoming year; in July 2015, the figure was 63 percent.

The 73 percent of commercial lines insurers who said they expect to increase staff during the next 12 months exceeds levels recorded in prior surveys. Reporting on a January 2016 survey earlier this year, Jacobson and Ward revealed that 61 percent of commercial lines companies expected more new hires during the upcoming year; in July 2015, the figure was 63 percent.

Still, when commenting on the July 2016 results during a webinar earlier this month, Jeff Rieder, a partner of Aon Hewitt and head of Ward Group, said that large commercial lines insurers now appear to be more cautious in adding staff as the market softens, noting that hiring expectations generally track revenue growth expectations. The surge in commercial lines insurers’ hiring expectations is coming from the aggressive hiring plans of small insurers, he said.

“The small, niche market commercial lines companies, and those that have more of a specialty or E&S type play, are the ones that appear to be growing and plan to grow at a greater rate right now,” Rieder said.

Overall, the Jacobson/Ward midyear 2016 survey encompassed roughly 9 percent of the U.S. insurance carrier employment market, weighted toward the P/C industry, representing 77 percent of respondents. Participants included both regional carriers (47 percent) and those writing national and multinational business (53 percent), with the average number of employees per respondent coming in at 1,478.

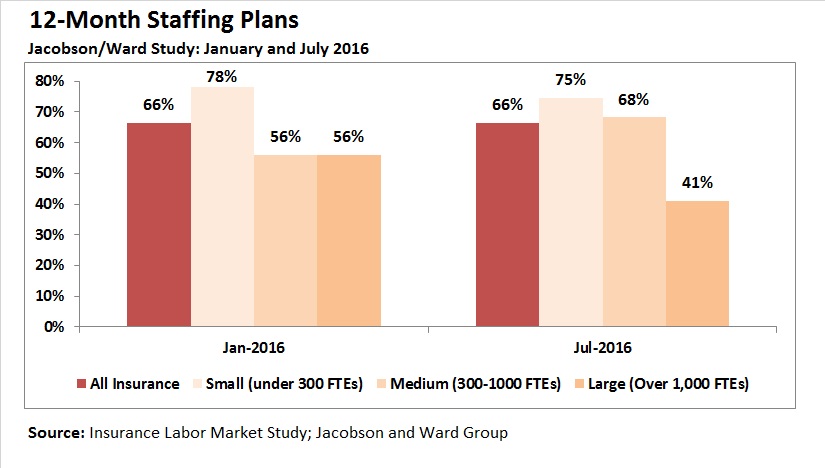

Displaying the survey results for all types of insurers (P/C, life/health and reinsurance) by size, Rieder noted that 75 percent of small companies (defined as those with less than 300 FTEs) are expecting to increase staff in the next 12 months compared to 68 percent of medium (300-1,000 FTE) and just 41 percent of large companies (greater than 1,000 FTEs) surveyed.

Comparing these July 2016 survey figures to survey results from January 2016 reveals that while small insurer hiring expectations have remained high throughout the year, the more recent July 2016 survey results indicate a pullback among large insurers.

Rieder noted specific changes for large national life insurers, which are unloading blocks of business and focusing on expense management.

On average across all segments, 9 percent of large insurers are now expecting to decrease staff over the next year compared to just 2 percent of small companies, according to the July 2016 survey. According to Rieder, when companies are decreasing staff, the cuts tend to be in clerical positions, customer service and processing activities that can be automated. In part, “that does appear to be because of technology gains rather than wide-sweeping reductions in force [related to] economic conditions,” he said.

Double-Digit Growth Plans

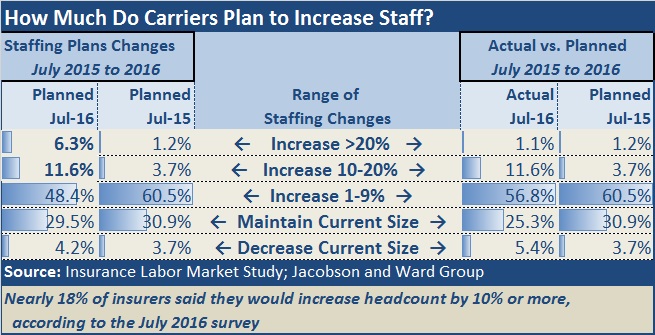

Pulling results together for all types and sizes of insurers, Rieder and Gregory Jacobson, chief executive officer of The Jacobson Group, discussed the magnitudes of expected hiring increases and actual hiring counts compared to those anticipated in last July’s survey.

The most eye-popping figures appear at the top to the scale, with nearly 18 percent of insurers saying they expect to increase headcount by 10 percent or more for the July 2016 survey.

- In July 2015, projected increases were smaller, with less than 5 percent of insurers expecting double-digit jumps in staffing during the subsequent 12-month period.

- Almost 70 percent of carriers actually increased staff in the 12 months from July 2015 to July 2016 compared to 65.4 percent that thought they would.

- 13 percent ended up boosting staff by at least 10 percent.

“More companies hired people than intended to—and the projection was very high,” said Jacobson. “In addition to that, there were more companies that hired more people [than] they expected to,” he said, referring to the last two results.

Referring to the fact that a few more companies reduced staff than were expecting to, the executive recruiter said he didn’t view any meaningful trend there. “I don’t think any of that is out of the ordinary,” he said, noting that staffing plans follow business plans. “Some companies are going to hit their business plans,” while others miss their revenue goals.

“The big thing is that [overall results were] driven by the smaller companies who are hiring more people than expected as a percentage of their total population than the large companies,” he said.

Later in the webinar, Jacobson pointed to another indicator of this trend, noting that the overall actual rate of job growth for the P/C industry fell short of the level anticipated—coming in at just 1.49 percent vs. a projected rate of 1.96 percent. That’s because of “smaller companies growing faster than larger companies,” he said.

Early in the webinar, Jacobson noted that merger and acquisition activity has nothing to do with this. Voluntarily answering an unasked question that he says he gets “almost on a daily basis” about the M&A impact on overall insurance employment trends, Jacobson said: “We are seeing little impact…P/C companies generally when they’re making acquisitions are looking to acquire market share, expertise and talent.”

“They are not generally letting people go. It’s not a play for expenses,” he said, adding, however, that this could change depending on what Federal Trade Commission rulings are in respect to some large health insurance company mergers. If those are allowed to move forward, that could decrease insurance industry employment overall.

Compensation Plan Revamps

Asked by a webinar participant whether aggressive hiring plans are having an impact on compensation levels, Rieder said pay hikes are happening across both the base compensation plans and the incentive programs being offered. Currently, increases are in the 3.2-3.3 percent range, he said, citing a historical figure of around 2.5 percent when the study began seven years ago.

“More companies are providing bonus opportunities to a greater number of employees,” with about 89 percent of companies providing bonus programs down to the lowest-level employee, he said.

And many executive compensation plans are being redesigned, “particularly among the mutual companies to allow for long-term compensation,” he added, noting that many mutual insurers have not offered long-term incentives before.

Jacobson agreed that the change is critical for mutuals that want to move their businesses forward successfully. “I don’t think that mutual companies can really act in a significantly different manner than stock companies anymore in terms of setting up long-term incentive programs,” he said.

Underwriters, Claims Professionals in Demand

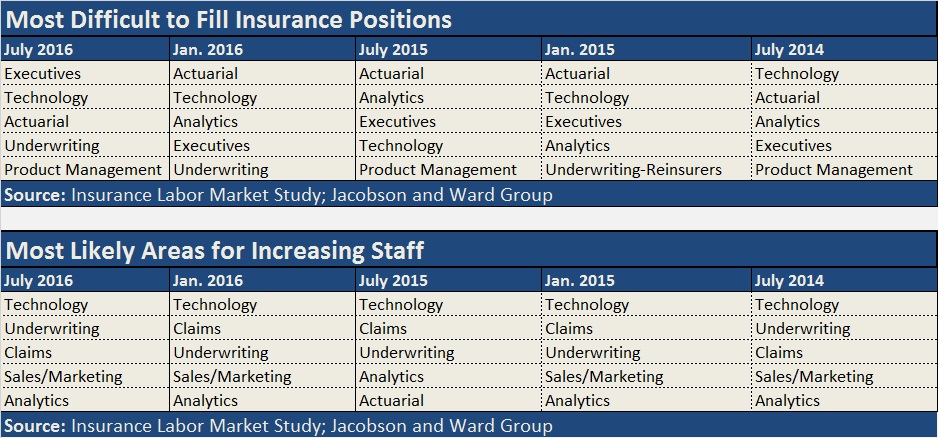

Rieder and Jacobson also reviewed the types of professionals that are in high demand among insurance carriers, highlighting both the positions that are toughest to fill and those that carriers are most keen to fill.

Noticeably absent from among the top five positions that carriers are most likely to fill in the coming year was actuarial staffing, which also fell down from the top spot in terms of recruiting difficulty.

While companies are still increasing actuaries and analytical staff, levels are not quite as great as they used to be, Rieder said, noting “a bump in July last year, where both [disciplines] were scoring significantly higher” than historically high scorers like technology and executive positions.

Among 12 disciplines that the Jacobson/Ward Survey tracks, five saw the level of recruiting difficulty ease up, with the most notable being the actuary and analytics functions, according to survey respondents for the July 2016 analysis. Respondents score the degree of difficulty in recruiting for various types of positions on a 1-10 scale, with higher numbers indicating more staffing problems.

Most jobs, however, are still considered difficult to fill—achieving difficulty scores of 5 or more. Only operations and accounting jobs were viewed by respondents as relatively easy to fill.

Overall, Jacobson reported that the average difficulty to hire came in at 5.8 across all positions compared to 5.6 in January. “So there actually was an uptick, but it was in different areas than you would expect,” he said. According to Jacobson:

- Personal lines product management and personal lines IT are hot spots.

- Commercial underwriting had its highest rating ever—a lot of that driven by the E&S/specialty lines market, new startups and companies getting into new lines of business.

- Claims also had its highest rating ever in the history of the survey, as did technology.

Analyzing the claims result, Rieder noted that claims frequencies had been declining for many year, but auto claims frequency started to pick up in 2016. “Absent major catastrophe events over the past couple of years, companies have taken the opportunity to try to reduce claims staff,” he added. “In a couple of cases, I think maybe they cut a little close to the bone,” he said, explaining the renewed need to hire again.

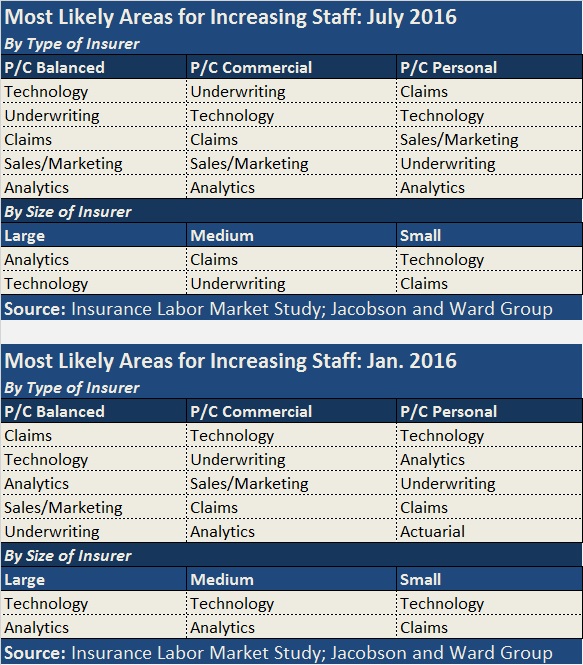

The chart below indicates top-ranked positions among hiring plans for commercial, personal and balance insurers from the July 2016 and January 2016 iterations of the Jacobson/Ward study.

The Jacobson Group is a global provider of insurance talent, offering solutions including executive search, professional recruiting, temporary staffing, subject matter experts, and onsite and work-at-home operations support.

Ward Group is a provider of benchmarking and best practices studies for insurance companies, which analyzes staff levels, compensation, business practices and expenses for all areas of company operations and helps insurers measure results, optimize performance and improve profitability.

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster