Rates for commercial property/casualty insurance fell 4 percent in the first month of the new year, continuing a downward trend that is unlikely to halt anytime soon, according to Richard Kerr, CEO of MarketScout.

“Commercial property insurers are getting ready to scratch each other’s eyes out as they fight for market share,” Kerr said on the release of his firm’s monthly rate barometer. “We see nothing to prevent commercial property rates from dropping further.”

The composite rate in MarketScout’s index for commercial lines in the U.S. also dropped 4 percent in December 2015.

MarketScout’s results are based on new and renewal placements across the country and pricing surveys by the National Alliance for Insurance Education and Research.

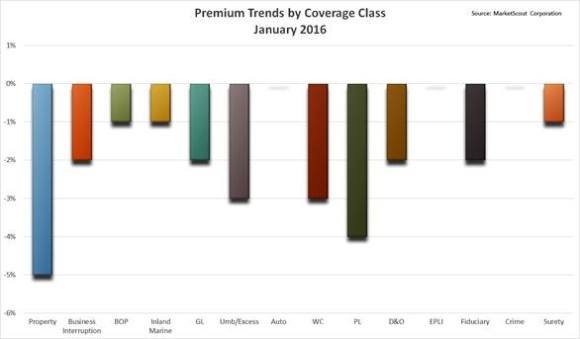

In addition to commercial property, business interruption, business owners policies, professional liability, and directors and officers coverages were all more competitively priced in January 2016 vs. December 2015, MarketScout found. Umbrella/excess liability and workers’ compensation rates actually increased slightly over the same period.

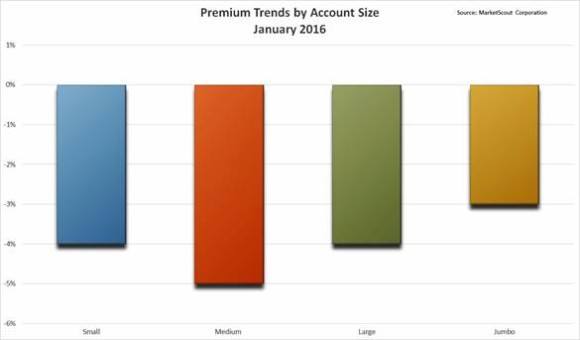

By accounts size, rates for small and medium sized accounts (all under $250,000) were more competitive in January 2016 than in the prior month. Large and jumbo accounts (over 250,001) were assessed rates slightly higher in January versus December.

Transportation companies were assessed rate decreases of 4 percent in January 2016 versus 2 percent in December 2015. Rates for manufacturing and energy accounts were slightly higher in January 2016 than in December 2015. All other industries remained unchanged.

MarketScout’s report tracks with predictions by Kroll Bond Rating Agency in its U.S. Property/Casualty Insurers 2016 outlook issued in late December Kroll said ricing will either be flat or down over the next 12 to 18 months, with the biggest pressure in commercial lines, property and reinsurance.

According to Kroll’s expectations, commercial lines rates will dip in the low- to mid-single digits, but property lines and reinsurance rates could decline by more than 10 percent in response to continued favorable experience and a lack of major weather events (going back to 2012 now).

Personal Lines

Meanwhile, MarketScout’s personal lines barometers showed personal lines insurers are maintaining an even pace for pricing with a slight decrease in rates from the same time last year.

“All is steady in the personal lines market. Rates continue to fall at an even pace. We expect an ongoing competitive market,” Kerr said.

Homeowners’ rates were flat for homes under $1,000,000 in coverage A value. For homes over $1,000,000, rates were down 1 percent in January 2016 versus down 2 percent in December 2015.

Automobile rates were down 1 percent, which is slightly more competitive than the flat rate in December 2015. Personal articles rates were steady at down 1 percent.

MarketScout-compiled Summaries of the January 2016 commercial lines rates by coverage, industry class and account size are below.

Source: MarketScout

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash