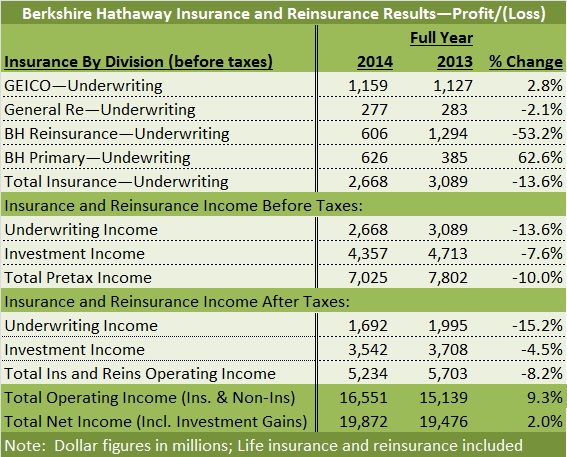

Insurance operations contributed $5.2 billion to total operating income of $16.6 billion for Berkshire Hathaway in 2014—with the underwriting component of $1.7 billion (after taxes) representing the 12th straight insurance underwriting profit for the Nebraska-based conglomerate.

“Our underwriting profit totaled $24 billion during the twelve-year period, including $2.7 billion earned in 2014,” wrote Berkshire’s Chair Warren Buffett in the company’s annual report released on Saturday, referring to the pretax underwriting profit for all insurance operations.

“And all of this began with our 1967 purchase of National Indemnity for $8.6 million,” Buffett wrote in his annual letter, which features narratives describing the purchase of National Indemnity and other highlights of the last 50 years.

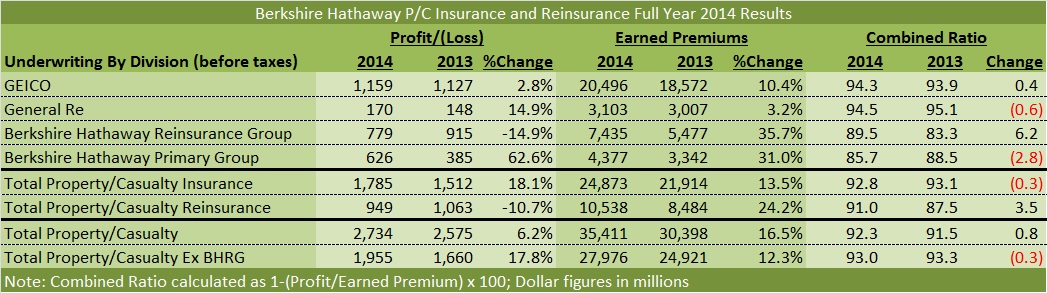

While the overall pretax underwriting profit $2.7 billion figure actually represents a 13.6 percent dip from $3.1 billion in 2013, the life and annuities side of the insurance business accounted for the decline. Taken together, pretax underwriting profit for the property/casualty businesses jumped 6.2 percent to $2.7 billion, while life insurance and reinsurance businesses posted a $66 million loss.

Much of Buffett’s discussion of the P/C results repeats his analysis last year, nearly word-for-word, with shoutouts to individual unit leaders such as Jain, General Re’s Tad Montross, GEICO’s Tony Nicely, and even GEICO’s gecko.

Buffett also repeats some remarks about Jain’s formation of Berkshire Hathaway Specialty Insurance last year. “This initiative took us into commercial insurance, where we were instantly welcomed by both major insurance brokers and corporate risk managers throughout America. Previously, we had written only a few specialized lines of commercial insurance,” Buffett wrote, noting that BHSI’s leader, Peter Eastwood “expanded his talented group” in 2014, moving into both international business and new lines of insurance.

“We repeat last year’s prediction that BHSI will be a major asset for Berkshire, one that will generate volume in the billions within a few years,” Buffett added this year.

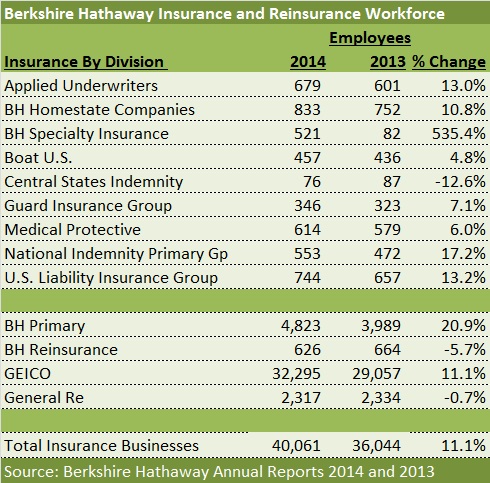

One interesting revelation from the final pages of the report is that Eastwood’s unit now employs some 521 professionals, up from just 82 listed in the previous report.

In fact, nearly all of Berkshire’s primary P/C insurance businesses saw their workforces increase in 2014, with an overall increase in headcount of nearly 21 percent. The reinsurance businesses, in contrast, experienced slight declines in employee numbers.

It remains difficult to gauge the validity of Buffett’s prediction that BHSI will write “billions” of premiums in the next few years from 2014 and 2013 premium figures presented in the report, which lump BHSI together with Berkshire’s other primary insurers. As a group, however, the primary insurers did in fact write $1 billion more in 2014 than 2013.

That increase—of 31 percent bringing BH Primary Group earned premiums up to $4.4 billion—was primarily attributable to volume increases from BHSI, NICO Primary, Berkshire Hathaway Homestate Companies (providers of commercial multiline insurance, including workers compensation) and Guard Insurance (providers of workers compensation and commercial P/C insurance to small and mid-sized businesses), according to the text of the annual report.

The primary group also recorded the biggest jump in underwriting profit—a 63 percent leap to $626 million.

Berkshire Hathaway Reinsurance Group reported the biggest percentage increase in P/C earned premiums of the four P/C divisions summarized in the report—35.7 percent to $7.4 billion. But much of that is attributable to a retroactive reinsurance deal with Liberty Mutual Insurance Company announced in July.

“Last year, our premier position in reinsurance was reaffirmed by our writing a policy carrying a $3 billion single premium,” Buffett said in his annual letter, referring to the Liberty deal. “I believe that the policy’s size has only been exceeded by our 2007 transaction with Lloyd’s, in which the premium was $7.1 billion. In fact, I know of only eight P/C policies in history that had a single premium exceeding $1 billion. And, yes, all eight were written by Berkshire.”

“Certain of these contracts will require us to make substantial payments 50 years or more from now. When major insurers have needed an unquestionable promise that payments of this type will be made, Berkshire has been the party—the only party—to call,” he boasted.

Retroactive reinsurance deals aside, P/C reinsurance premiums earned fell 21 percent—or $1.1 billion for Berkshire Hathaway Reinsurance Group in 2014—a decline largely attributable to the wind-down of a quota-share contract with Swiss Re, now in runoff. The annual report also notes that property-catastrophe reinsurance premiums earned fell 14 percent in 2014.

“Our volume with respect to these coverages continues to be constrained, as rates, in our view, are inadequate. However, we have the capacity and desire to write substantially more business when appropriate pricing can be obtained,” the annual report notes.

Industry Pressures; Float Declines Possible

In the fourth quarter, both of Berkshire’s reinsurance operations reported lower earned P/C premiums than in fourth-quarter 2013—13.7 percent lower for Berkshire Hathaway Reinsurance and 7.0 percent lower for Gen Re (calculated by Carrier Management from full-year totals in the annual report and nine-month totals in third-quarter report). The reinsurers also reported lower fourth-quarter underwriting earnings than in the prior year (with Gen Re actually reporting a small pretax loss for P/C business).

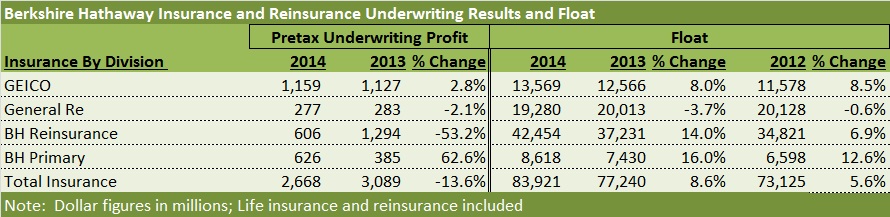

Throughout the Buffett’s letter accompanying the report, he refers to a key benefit of insurance and reinsurance businesses: that they are operate under a collect-now, pay-later model enabling insurers to invest the float.

During the 12-year stretch of underwriting profits, Buffett said: “Our float—money that doesn’t belong to us but that we can invest for Berkshire’s benefit— has grown from $41 billion to $84 billion.”

While this type of insight is common to many of his annual letters, what’s new this year is Buffett’s signal that “further gains in float will be tough to achieve” at Berkshire going forward.

“On the plus side, GEICO and our new commercial insurance operation are almost certain to grow at a good clip. National Indemnity’s reinsurance division, however, is party to a number of runoff contracts whose float drifts downward.”

Still, Buffett predicted: “If we do in time experience a decline in float, it will be very gradual—at the outside no more than 3 percent in any year.”

Turning his attention to the P/C industry overall and commenting on the future of underwriting profits, Buffett had this to say: “Unfortunately, the wish of all insurers to achieve this happy result creates intense competition, so vigorous indeed that it frequently causes the P/C industry as a whole to operate at a significant underwriting loss. This loss, in effect, is what the industry pays to hold its float.

“Competitive dynamics almost guarantee that the insurance industry, despite the float income all its companies enjoy, will continue its dismal record of earning subnormal returns on tangible net worth as compared to other American businesses. The prolonged period of low interest rates our country is now dealing with causes earnings on float to decrease, thereby exacerbating the profit problems of the industry.”

What about Berkshire?

“Looking ahead, I believe we will continue to underwrite profitably in most years,” Buffett predicts. “Doing so is the daily focus of all of our insurance managers, who know that while float is valuable, its benefits can be drowned by poor underwriting results.

“That message is given at least lip service by all insurers; at Berkshire it is a religion.”

Adding Everything Up: Berkshire Results Overall

For the year, after-tax operating earnings for all Berkshire’s businesses—insurance and non-insurance—totaled $16.6 billion.

Adding investment and derivative gains to operating earnings, total bottom-line net earnings were $19.9 billion in 2014, compared to $19.5 billion in 2013.

For the fourth-quarter, after-tax operating income dropped 17.5 percent for insurance and reinsurance businesses to $1.1 billion, with $880 million making up the bulk of the figure. After-tax underwriting profits declined 51.5 percent to $191 million with underwriting losses at the P/C reinsurance units and lower profits at GEICO contributing to the slide.

Total operating earnings for all Berkshire’s businesses rose 5.0 percent to nearly $4.0 billion in the quarter. Net earnings, including lower investment gains as well as derivative losses for the quarter, brought the fourth-quarter 2014 bottom line down to $4.2 billion, 16.7 percent lower than fourth-quarter 2013.

For more highlights of the 2014 Berkshire Hathaway report, see related articles: The Big Tease: Buffett Remains Mum About Chosen Successor and Buffett, Munger on Leadership, Success in Business.

Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut