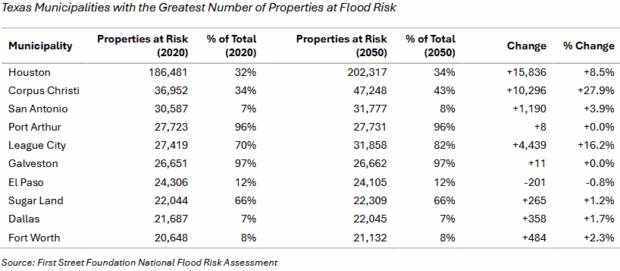

Texas is facing a critical shortfall. With more than 2.1 million properties projected to face flood exposure over the next 30 years, and over 200,000 expected to flood with near certainty, urgent action is needed to close the gap and strengthen the state’s resilience, according to new analysis by Neptune Flood.

There are 2.1 million properties at risk, with 1.15 million facing at least a 1 percent annual chance of flooding, reports First Street Foundation.

According to Neptune Flood, Texas combines nearly every major flooding risk factor:

- 1,200 miles of Gulf coastline, vulnerable to hurricanes and tropical storms;

- Expansive low-lying coastal plains, especially around Houston, Galveston, and Corpus Christi;

- Rapidly urbanizing inland cities like Dallas, Austin, and San Antonio, where heavy rainfall overwhelms stormwater systems;

- Increasingly erratic weather patterns driven by climate change, intensifying the rainfall, storm frequency, and reach of

flood events.

By 2050, the Texas Water Development Board (TWDB) expects mass migration, development trends, and climate intensification to add 2.6 million more people and 740,000 new buildings into high flood risk areas.

FEMA maps identify only 860,000 total at-risk properties, highlighting the mapping inadequacy, according to Neptune Flood.

Nearly 50 percent of all active National Flood Insurance Program (NFIP) policies in Texas are Pre-FIRM homes (older structures more vulnerable to loss), the flood insurance provider added.

Since 2005, over 52 percent of NFIP claims in Texas have occurred outside FEMA-designated high-risk flood zones.

It’s an issue highlighted by the fact that Texas ranks second nationally in NFIP claims, with over 150,000 claims and $11.6 billion paid over the past decade.

Harris County accounts for nearly 50 percent of all NFIP payouts statewide, yet over 78 percent of homes remain uninsured, Neptune Flood analysis showed.

According to TWDB, the state has identified over $54.5 billion in needed flood risk reduction solutions, yet only $10.6 billion in available funding has been identified.

Despite the state’s increased flood risk, the insurance gap is widening.

Only 7 percent of residential properties statewide have flood insurance, and in major inland metros like Dallas, Denton, and Bexar, coverage rates remain below 1 percent despite repeated flood events.

Even in FEMA-designated high-risk zones, only 28 percent of residential buildings have flood insurance coverage.

Since the launch of Risk Rating 2.0 (FEMA’s new property-level pricing model) in 2021, average flood insurance premiums in Texas have risen 35 percent, while the number of buildings covered has dropped 30 percent.

As rates transition to full-risk pricing over the coming decades, affordability concerns grow, with premiums consuming an average of 4-5 percent of household income in some counties, according to the flood insurer’s analysis.

“Texas faces a clear and growing flood risk, yet millions of properties remain without adequate insurance coverage,” said Matt Duffy, president of Neptune. “This report underscores the scale of the challenge and the need to improve both awareness and access to flood protection. As flood risk continues to rise due to climate change and development patterns, and with an active 2025 hurricane season on the horizon, addressing these gaps remains a critical priority for homeowners, insurers, and policymakers alike.”

Texas stands at a critical juncture. The convergence of outdated flood maps, rapid development, climate change, and declining insurance coverage has created a perfect storm of risk and vulnerability, the flood insurer added.

Addressing the issue will require a coordinated effort – leveraging better data, smarter policy, public-private collaboration, and expanded private flood insurance coverage.

Read the full report

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec