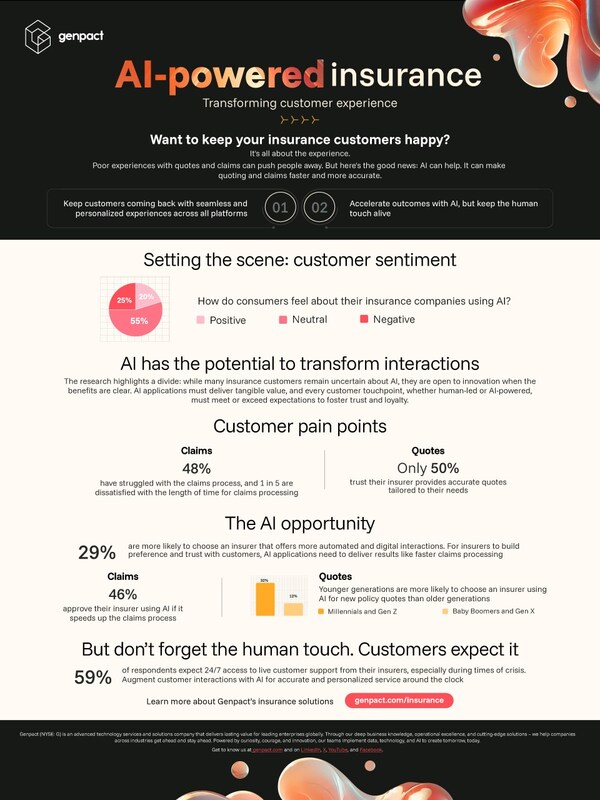

A new survey reveals that while 25 percent of U.S. adult respondents view AI use by insurers negatively, more than half (55 percent) are indifferent. But when AI delivers tangible benefits like faster and more accurate claims processing, customized quotes and improved customer service, customer acceptance increases significantly.

Global advanced technology services firm Genpact commissioned the online survey of 1,000 U.S. adults aged 25 and older to assess perceptions of AI adoption in the insurance industry. Conducted by Dynata, a global market research firm, the survey uncovers uncertainty around AI adoption within the insurance industry.

The findings emphasize an opportunity for insurers to shift perception and build preference and trust with their customers.

“As insurers embrace AI to enhance operations or customer experience, they must ensure that every interaction – whether human-led or AI-powered – meets or exceeds customer expectations,” said Adil Ilyas, global business leader for Insurance at Genpact. “This research highlights AI’s potential to transform insurance, but also the need for insurers to close experience gaps and communicate transparently to build trust and loyalty.”

Though many insurance customers remain uncertain about AI, they are open to innovation when the benefits are clear, the survey found.

Among respondents, 46 percent support AI adoption if it speeds up the claims process, and 29 percent are more likely to choose an insurer that offers automated and digital interactions.

This shift in sentiment is especially pronounced among younger generations.

Millennials and Gen Z are more likely than baby boomers and Gen X to choose an insurer using AI to improve services, including policy quote generation (32 percent vs. 12 percent), claims processing (28 percent vs. 9 percent), and customer service (27 percent vs. 10 percent).

The data highlights areas that are ripe for AI-driven transformation.

Only 50 percent of respondents currently trust their insurer to provide accurate, tailored quotes and 48 percent have struggled with the claims process.

The survey shows that AI offers a path forward by automating and streamlining underwriting and claims processing, improving the personalization of new policy quotes and enhancing the accuracy and speed of claims resolutions.

While 59 percent of respondents expect 24/7 live customer support, especially during times of crisis, just 10 percent are comfortable relying solely on AI-powered chatbots.

To build customer confidence, insurers must show how AI enhances speed and personalization while keeping a human in the loop.

AI can be a tool for augmenting employees in their roles, automating repetitive, high-volume tasks so they can focus on driving value and improving customer service interactions, the company said.

“The integration of AI in insurance is more than a technological shift – it’s a revolution in customer experience,” Ilyas added. “Insurers must align AI strategies with their business goals and customer expectations. Genpact helps insurers harness AI to achieve speed and precision while keeping the human touch central to every interaction.

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut