Consumers purchasing new policies and shopping around for auto insurance in the U.S. helped carriers post positive year-over-year growth and record volumes for the final quarter of the year, according to the latest Insurance Demand Meter released by LexisNexis.

Both new policy growth and shopper growth registered as ‘Hot’ on the LexisNexis Insurance Demand Meter.

Year-over-year shopper growth showed the strongest Q4 growth since 2020, according to LexisNexis.

Quarterly year-over-year growth for new policies outpaced shopper growth for the sixth consecutive quarter, indicating consumers continue to switch carriers at an increasing rate when they shop.

A number of insured households, 41 percent, shopped their auto insurance at least once in 2023, the data showed.

Notably, retention levels dropped three percentage points since Q1 2022.

This heightened new policy and shopping activity counters traditional fourth quarter lulls, the company said.

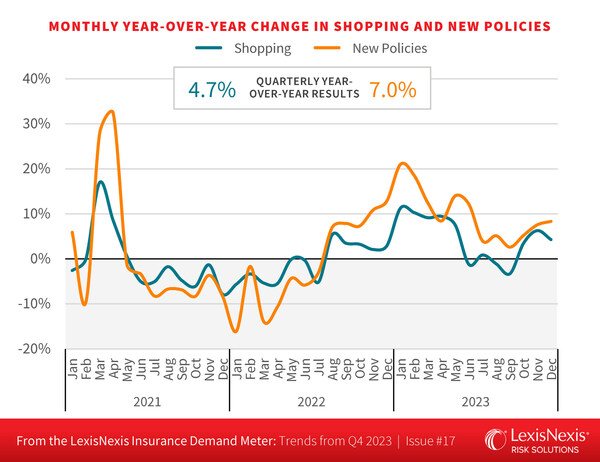

Year-over-year shopper growth rebounded from -1.2 percent in Q3 to 4.7 percent in Q4.

The data revealed quarterly year-over-year growth for new policies rose from 3.9 percent to 7 percent.

2023 Recap

Overall, shopping and new business volumes exploded in the first months of the year, as rate increases impacted the market, the Insurance Demand Meter noted.

Claims costs, inflated vehicle repair costs and unfavorable reserve development slowed growth, detracting from profitability gains.

Insurers slowed new customer acquisition efforts during the summer that resulted in a temporary dip in shopping activity in Q3.

In Q4, “activity bounced back, brought on by elevated rates and increased market efforts, creating prime conditions for a hot market,” the report noted.

Carrier marketing spend, especially in the direct distribution channel, in the last quarter of 2023, increased shopping and switching and brought the year-over-year annual policy growth to 9.8 percent.

“As the industry sees rates spike and expands marketing to prime consumers for increased shopping, it will be key to observe activity on a state-by-state level,” said Adam Pichon, senior vice president, U.S auto and claims, LexisNexis Risk Solutions. “When we look at Texas, a leading state for improved profitability, both the number and size of rate increases have dwindled. While we can’t predict the shopping trajectory for states still looking to achieve rate adequacy, we will watch closely to determine whether Texas can serve as a bellwether for the rest of the country.”

The direct distribution channel saw increased market activity which drove Q4 growth, in contrast to the prior quarter when independent agents zeroed in on consumer desires to shop policies from multiple carriers.

Direct distribution channel growth increased by 27 percent offsetting negative growth in the agent-based channels, the data revealed.

Twelve of the 15 fastest-growing states are located in the West and Midwest regions and were the main driver of growth in Q4.

Within the U.S., 39 states saw positive growth; of that, 15 experienced double-digit growth.

Top-performing states for shopping growth included: Hawaii (67 percent), West Virginia (44 percent), Iowa (41 percent), South Dakota (29 percent) and Utah (23 percent).

Negative growth states year-over-year included Washington D.C. (-15 percent), Oklahoma and New York (-7 percent), Rhode Island (-6 percent), New Hampshire (-5 percent) and Texas (-4 percent).

Opportunities in 2024

Carriers “have an opportunity to seize market share, particularly evident in the direct channel where factors like marketing expenditure and rate adjustments are prompting increased shopping behavior,” LexisNexis said.

Despite initial positive growth, Texas saw negative shopping numbers in the final quarter of 2023. This could emphasize a need for carriers to adapt strategies and balance acquisition with rate competitiveness to capitalize on increased shopping before it stabilizes, the report noted.

The company added the window of opportunity may be temporary.

“With profitability top of mind in 2024, we expect to see many insurers taking a closer look at their portfolios and in some cases re-underwriting certain policies,” said Pichon. “This could yield continued increases in shopping as consumers seek the most affordable policies.”

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes