More than half (62 percent) of U.S. insurers are willing to take on more investment risk in 2024 despite mounting concerns about election year politics, fiscal and monetary policy, as well as persistent inflation and volatility, according to a survey sponsored by Conning, an insurance asset management firm.

“Years of historically low interest rates demanded that insurers consider unfamiliar asset categories to help improve portfolio yields,” said Matt Reilly, Conning’s head of Insurance Solutions and co-author of the survey report. “The increase in rates has helped make those more traditional investments appealing again. While many insurers appear poised to take advantage of those yields, they also remain committed to adding to less traditional assets such as real estate, private credit and private equity.”

Conning’s third annual survey of 300 investment decision-makers within insurance companies was divided almost equally between insurers who manage assets internally versus managing some or all with a third-party asset manager.

Insurers who choose to outsource report lower levels of concerns about inflation, domestic political environment, monetary policy and other portfolio concerns than those who managed assets internally.

“The growth in private assets and portfolio diversification, the rising prominence of artificial intelligence (AI), and the increasing challenges of staying current with investment markets can be a challenge to any insurance company,” said Scott Hawkins, head of Conning Insurance Research and co-author of the survey report. “Outside expertise can be an answer for many.”

Respondents cited several factors they consider when choosing to outsource their assets.

- Cost-saving was the leading factor, followed by the need for access to investment strategies and the need for outside expertise for risk management and asset allocation strategies.

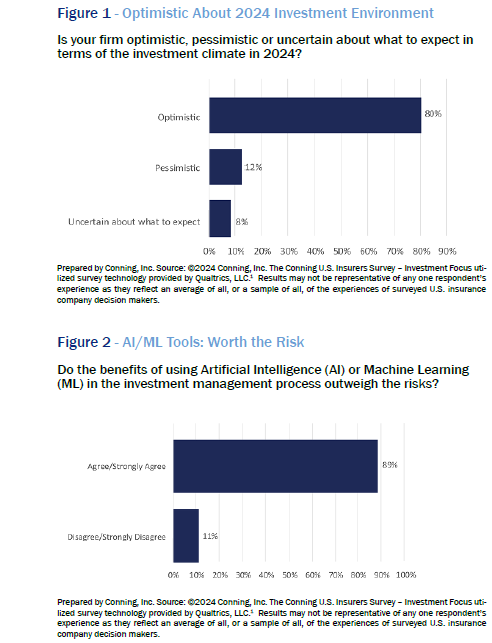

- Companies of all sizes and sectors — 80 percent overall — are optimistic about the 2024 investment environment, thought inflation will remain a top concern for the next few years. This survey marks the third consecutive year inflation has held the top spot for concerns.

- The other top concerns in order of importance are the domestic political environment in an election year, the impact of monetary policy, market volatility, the impact of fiscal policy and the impact of artificial intelligence, the survey results found.

Despite 2022 being a year of significant inflation, falling bond portfolio values, rising interest rates and the growth of AI technology solutions, U.S. insurers surveyed said they would still embrace risk.

Respondents said they will allocate more to private assets such as private equity (61 percent said they will add exposure), private credit and private placements (56 percent will add exposure), and real assets including real estate (52 percent) and infrastructure (48 percent).

More than half (51 percent) said their portfolios would consist of at least 20 percent in private assets in two years.

The survey also identified insurers’ challenges to investing in private assets, with regulatory/rating agencies, followed by liquidity and access to the analytics supporting their private asset allocations topping the list.

Artificial intelligence ranked sixth among risk factors cited by insurers.

Respondents’ top concerns about the use of AI (via a weighted average of responses) are ethical considerations, lack of human oversight, unexpected market changes, cybersecurity and data privacy, and data quality and bias.

Despite the aforementioned concerns, a surprising 89 percent of insurance investment professionals think the benefits of implementing AI in the investment process outweigh the risks.

Three out of four respondents reported they are already using or piloting AI and ML (machine learning) across investment-related activities such as investment research, portfolio management, investment accounting and trading.

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Jury Orders PacifiCorp to Pay $305M in Latest Oregon Wildfire Class Action Verdict

Jury Orders PacifiCorp to Pay $305M in Latest Oregon Wildfire Class Action Verdict  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance