A new paper by the American Property Casualty Insurance Association (APCIA) finds that the insurance industry is responding to the needs of the transportation sector as the momentum for electric vehicles (EVs), plug-in hybrids (PHEVs), and other low- and zero-emission vehicles grows.

Analysts estimate EV sales in the U.S. were about 6.5 percent of new vehicle sales in the first half of 2023, with the potential to reach over one million in cumulative sales in 2023. Data indicates that in 2022, the U.S. EV market’s top three manufacturers were Tesla (65 percent of total sales), Ford (7.6 percent) and Hyundai – Kia (7.1 percent).

Related article: Electric Vehicles and the New Frontier They Represent for Auto Insurers

The national trade association for home, auto and business insurers released a new paper “Electric Vehicle Adoption and Impacts for the Insurance Industry,” examining electric vehicle adoption and its impact for the insurance industry.

“Many of the risks associated with EVs are similar to those for conventional vehicles,” said Ethan Aumann, senior director, environmental issues and resiliency for the APCIA. “However, EVs present some unique risk factors that can drive insurance costs higher, including higher upfront and repair costs, longer repair times, and increased vehicle weight due to the battery pack. There are also risks related to vehicle and charging station connectivity, such as data security and privacy concerns. The lack of consistency in EV design and battery standardization poses additional challenges for auto insurers. On the other hand, the vehicle’s and driver’s underlying risk characteristics ultimately drive the insurability and premium charged for auto policies. Additionally, there are also opportunities associated with EVs because of enhanced safety through the use of advanced vehicle features.”

High upfront costs and its affect on claims costs is a barrier for consumers considering purchasing an EV.

The paper added that more model options and maturing supply chains are also expected to exert downward pressure on EV prices over time.

In addition to higher upfront costs, some studies have shown that EVs take longer to repair and are more expensive to repair than conventional vehicles. Several factors, including the necessary retooling of auto parts manufacturers, assembly plants and repair shops, required training of repair technicians, and the adaptation of supply chains for new components contribute to these trends, the report added.

Data suggests it costs approximately $800 more to repair an EV versus a conventional vehicle, but that difference dwindles when comparing higher end vehicles in both categories.

EVs offer much faster acceleration than many conventional vehicles, creating a possible benefit if a driver needs to avoid a collision. However, there is a downside if a driver is unfamiliar with the differences between conventional vehicles and EVs or tends to be aggressive on the road. Some early studies suggest there is a learning curve when it comes to EVs.

Another downside, the battery in an EV can account for as much as one-third of the total vehicle weight, making EVs are considerably heavier than conventional cars. Heavier vehicles cause more damage to road surfaces, as well as to other vehicles, people or property involved in an accident, the paper added. There is also no uniformity among manufacturers relating to the standard design of battery packs and their location within the vehicle.

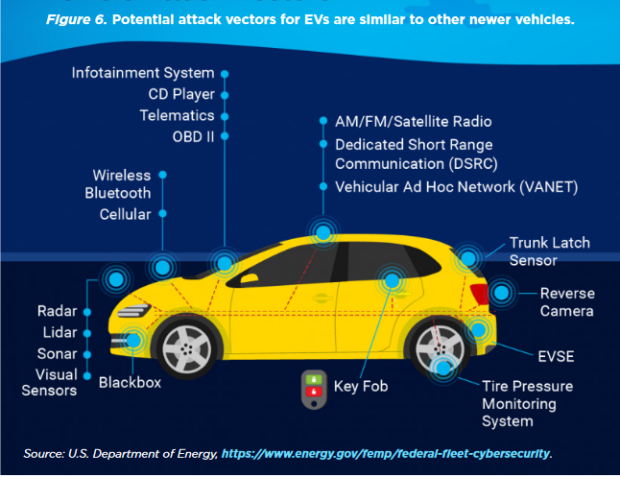

Cybersecurity risks, such as data leaks and vehicle hacking, pose more concerns for EV drivers and their insurers. This image highlights the various vulnerable points of entry where data can be compromised.

In addition, a potential risk of using public charging stations is their vulnerability to being hacked, the paper added.

More challenges for insurers exist with respect to the differences in manufacturer terminology when it comes to advanced safety features available on EVs.

“Increasingly, these and other risk mitigation features are available for EVs and newer cars in general,” said Aumann. “But it is especially important for insurers to have information regarding the safety features to accurately assess risk,”

The rapid adoption of EVs presents challenges when assessing and pricing risk.

“The relatively recent adoption of EVs means there is limited use and loss data for insurers to consider when trying to understand, accurately predict, and price risk associated with increasing numbers of EVs,” said Aumann. “But as a greater number of EVs are on the road for a longer period, insurers will have additional historical data to more accurately assess risks associated with EVs.”

Additional considerations include carbon emission reduction mandates at the state and federal level and the impact to insurers assessing EV risk.

“As a practical matter, insurance companies are prepared to meet the increase in market share of these vehicles by training claims adjusters, making sure their direct repair networks can handle the needed replacements, and using available loss data to help in risk evaluation,” added Aumann.

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report