Allstate reported about $641 million in August catastrophe losses from 18 events, with about half coming from the Maui wildfire.

The losses for the month of August were $551 million or $435 million, after-tax, partially offset by favorable reserve reestimates for prior events, Allstate said.

For the first two months months of the third quarter 2023, Allstate’s pretax catastrophe losses were $864 million, the company said.

The Northbrook, Illinois-based insurer recorded a second quarter net loss of $1.4 billion, on $2.7 billion in catastrophe losses. Allstate’s property-liability segment combined ratio for the second quarter was 117.6 compared to 107.9 a year ago during the period.

Chief Financial Officer Jess Merten said that in August implemented rate increases and inflation in insured home replacement costs resulted in a 13.2 percent average increase in homeowners insurance gross written premium compared to August 2022.

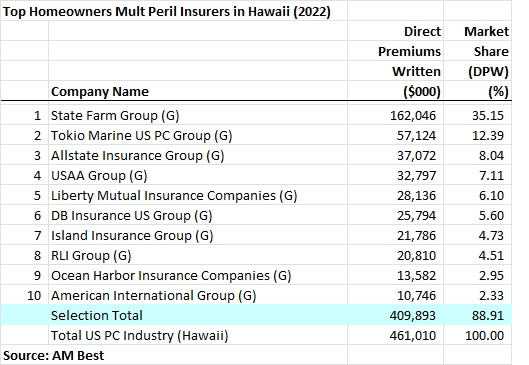

With about 8 percent of the market in 2022, Allstate is the third-largest writer of homeowners multiperil insurance in Hawaii, according to AM Best.

In the same monthly announcement, Allstate said it continued to raise auto insurance rates. The Allstate brand implemented increases of 7 percent across 5 locations in August.

“Allstate continued to implement significant auto and homeowners insurance rate actions as part of our comprehensive plan to improve profitability,” added Merten. “Since the beginning of the year, rate increases for Allstate brand auto insurance have resulted in a premium impact of 8.6 percent, which are expected to raise annualized written premiums by approximately $2.23 billion.

Photo: A general view shows the aftermath of a wildfire in Lahaina, Hawaii. (AP Photo/Jae C. Hong, File)

Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster