A new survey reveals Americans’ tolerance for insurance fraud — and the findings might be surprising.

Americans aged 45 and younger show a high level of tolerance for insurance fraud.

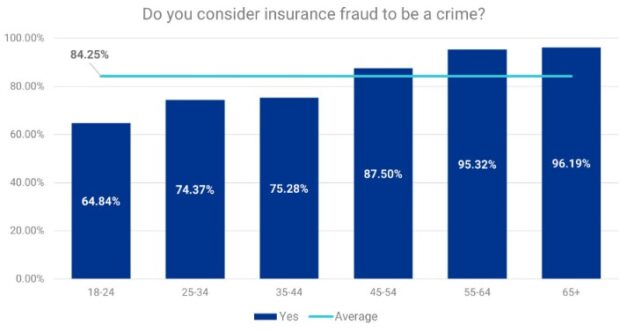

The comprehensive study released by Verisk, a global data analytics provider, and the Coalition Against Insurance Fraud found that while most older respondents consider insurance fraud a crime, only 75 percent of those under age 45 feel the same way, with the percentage skewing downward by age to only 64 percent for the youngest group.

The study focuses on how American consumers view insurance fraud and whether they view it as a crime. As such, it looks at the psychology of insurance fraud to “better understand the motivations and justification for the crime derived from in-depth interviews with those convicted of insurance fraud.”

“This study should sound the alarm for insurers, consumer activists, regulators and legislators on the state of fraud in America. While it is marginally reassuring that 84 percent of Americans in the survey consider insurance fraud a crime, the 16 percent that do not consider it a crime potentially represent more than 53 million Americans,” said Matthew Smith, executive director of the Coalition Against Insurance Fraud. “There is a need for consumer education on the harm insurance fraud crimes have on our economy and on every American citizen and family.”

Whether the fraud involved fake medical bills, padding a homeowners claim, or claiming a home or sports injury as a workers compensation injury – the number of Americans willing to commit insurance fraud appears to be growing.

According to the study, more than 36 percent of all Americans believe it is acceptable to submit an inflated auto damage claim, while over 30 percent of those age 25-34 “definitely would” submit a fraudulent property damage claim.

Of Americans between the ages of 18-24, 27 percent would commit workers compensation fraud, compared to less than 10 percent of those 45 and older.

More than one-quarter of those aged 18-34 are “motivated” to commit insurance fraud, compared to less than 7 percent of those over 45.

“The results prove the continued need for insurers to be hyper vigilant about the impact of fraud on their book of business,” said Maroun Mourad, president of Verisk Claims Solutions. “The fact that younger generations are more tolerant and motivated to commit claims fraud indicates that this problem is not going away and is likely to persist in the future. Carriers would be wise to set up a strong perimeter defense to ensure they are adequately and accurately detecting potential fraud throughout the policy life cycle.”

Conducted by Dynata, the study collected more than 1,500 responses from a group of insurance-purchasing consumers matching the demographic standards identified in the 2020 U.S. Census.

When asked the question “Do you consider insurance fraud a crime?” older respondents said “yes” in a range of 87-96 percent, with responses skewing higher as ages increased.

For those under 45, between 64-75 percent indicated it was a crime, skewing down by age.

The survey found that nearly 9 percent of all respondents justified insurance fraud, indicating they did not believe it was wrong or a crime, citing their belief “insurance companies rip people off, so it’s fair.” When combined with the justification statement “I pay them enough, it’s my money, I’m getting back” at 3.2 percent, the combined response rate rose to 12.03 percent.

Nearly all Americans over age 55 view insurance fraud as a crime. The survey found that between the age brackets of 45-54 and 35-44, there is a major drop of 12.2 percent in recognizing insurance fraud as crime. Even for those aged 45-54, there is an almost equal drop of 12.3 percent compared to persons aged 55-64.

The survey indicates that combined, the numbers demonstrate a drop of 24.5 percent in viewing insurance fraud as a crime for people under the age of 64 years

A substantial number of respondents under the age of 24 years (35.2 percent) do not believe committing insurance fraud should be viewed as a crime. The reasoning: nearly 20 percent justified insurance fraud because they believe “insurance companies rip people off, so it’s fair.”

About 12 percent of all respondents reported that given the opportunity to submit a fraudulent claim, they would “definitely do so.” A substantial number responded they might do so.

For those over the age of 65, only 1.27 percent would do so, as opposed to the 23.4 percent of the youngest respondents (18-24 years) who would do so without hesitation.

The findings suggest that for Americans aged 44 years and younger, “there is a striking difference in their blatant willingness to submit claims for what should be excluded damages.”

Of those aged 44 or younger, 27.34 percent would have their sports or home injuries paid for by workers comp insurance.

The combined overall responses indicate 5.71 percent of people admitted having already submitted a non-job injury to their employer to be paid.

A staggering number of respondents (56.21 percent) equate insurance fraud to stealing or tax evasion.

In addition, a high number of respondents (28.63 percent) indicated insurance fraud was “not a real crime” (8.5 percent) or constituted a “business practice with no real victim” (20.13 percent) in their eyes.

Access the full study and gain more information during a July 18 webinar on the study findings at www.insurancefraud.org.

Markel Group Announces Leadership Changes

Markel Group Announces Leadership Changes  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage