The nation’s biggest insurer, State Farm, announced late last week that its homeowners provider to the nation’s most populous state will no longer accept new applications there.

State Farm General Insurance Company will cease accepting new applications including all business and personal lines property and casualty insurance in California, effective May 27, 2023, State Farm said in a media announcement a day earlier.

The decision does not impact personal auto insurance. It also does not impact existing customers for the homeowners and property products. State Farm independent contractor agents licensed and authorized in California will continue to those customers and new customers for products not impacted by the decision.

“State Farm General Insurance Company made this decision due to historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure, and a challenging reinsurance market,” State Farm said in a media statement.

“We take seriously our responsibility to manage risk,” the statement continued, going on to acknowledge wildfire mitigation efforts made by the Governor’s administration, legislators, and the California Department of Insurance.

“We pledge to work constructively with the CDI and policymakers to help build market capacity in California. However, it’s necessary to take these actions now to improve the company’s financial strength,” the insurer said, also noting that it would continue to evaluate its approach based on changing market conditions.

Last year, State Farm recorded the largest underwriting loss in its 100-year history for 2022, over $13 billion for P/C insurance , mainly attributable to a $13.4 billion underwriting loss in the auto insurance line. Other P/C lines, including homeowners, commercial multiple peril and other lines, generated an underwriting profit of $849 million last year.

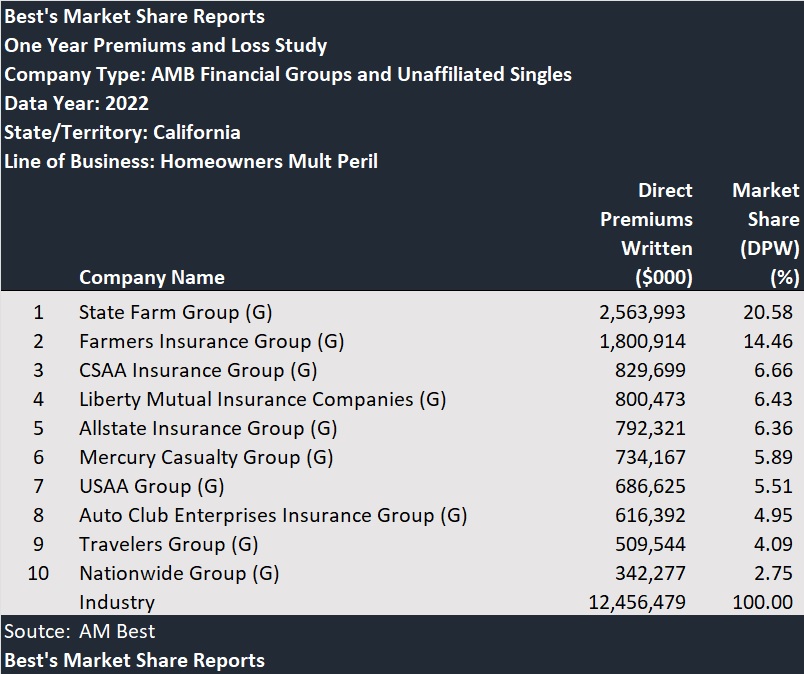

According to AM Best, State Farm is the the largest writer of homeowners insurance in California, with more than 20 percent of the market (based on 2022 direct written premiums).

Over the weekend, the American Property Casualty Insurance Association reacted to the news of State Farm’s decision. “California insurers operate under an outdated 1988 statute and regulatory structure that does not allow them to adapt to 2023 climate-change created increased risks,” said Mark Sektnan, APCIA vice president for state government relations, in a media statement on Saturday.

“To expand market capacity and availability of coverage for consumers and businesses, insurers need greater stability and regulatory flexibility to navigate the current difficult market conditions and manage rapidly evolving risk, including potential solvency-related threats,” the statement continued, noting that the first step, which the CDI is already working on, is to make sure “insurers can charge rates that reflect the increasing risk of loss.”

“Next, we need to allow admitted insurers to include the cost of reinsurance in their rates and use forward-looking probabilistic models to accurately assess future risk. Finally, we all have one common goal: mitigate properties and reduce the risk,” Sektnan said.

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  The Future of HR Is AI

The Future of HR Is AI