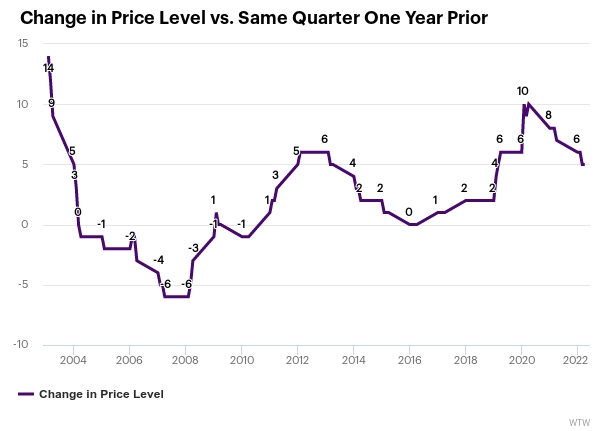

U.S. commercial insurance prices grew in the fourth quarter of 2022 by an average of 4.8 percent, down from the rate of 5.2 percent in the previous quarter (Q3 2022), according to WTW’s most recent Commercial Lines Insurance Pricing Survey (CLIPS).

The aggregate commercial price change reported by carriers spiked upward to nearly and above 10 percent in the second through fourth quarters of 2020 and since then has started declining to just below 5 percent, now in the fourth quarter of 2022.

“Rates continued to harden across nearly all lines of coverage in the fourth quarter, however at a slower pace. While the average change still showed an increase [of 4.8 percent], overall market tempering demonstrates a trend of sustained market stabilization,” commented Yi Jing, director, Insurance Consulting and Technology, WTW, in a statement.

Prices for Lines of Business

Data for nearly all lines indicate moderate to significant price increases in Q4 2022 with the exception of workers compensation and directors & officers liability.

CLIPS continues to indicate a slight price reduction for workers compensation, while directors & officers liability saw another quarter price decrease, larger than the prior quarter.

Both commercial property and commercial auto liability saw a larger price increase than last quarter, in contrast to all other survey lines, said WTW. Commercial auto saw reported price increases near or above double digits for the 21st consecutive quarter.

Cyber, which was first introduced into the survey in the fourth quarter of 2021 with the volume being much smaller than all other lines, slowed down its price increase to a single digit, said the WTW survey.

The third largest price increase came from excess/umbrella liability, which saw significantly accelerating prices over the previous 14 quarters and experienced a slightly lower increase than the prior quarter although still a close to a double-digit price increase.

Account Sizes

When comparing account sizes, WTW said reported price changes were all below double digits including specialty lines, which now has a small price decrease driven by directors & officers liability.

Source: WTW

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb