With inflationary effects still hitting the books of property/casualty insurers, including Travelers, analysts are worrying about the next macroeconomic shoe to drop—a recession.

But the leader of the Hartford, Conn.-based carrier, which one analyst referred to as “essentially the insurer of the U.S. economy,” said the company’s underwriters and executives aren’t seeing any signs of recession materializing so far.

“I’d say, not yet,” Travelers Chief Executive Officer Alan Schnitzer said, responding to the final question raised on the company’s earnings call last week—the question of whether signs of a recession are evident and in what sectors they are emerging.

“The business underlying fundamentals we’re still seeing from our customers are strong,” Schnitzer said. “I think macroeconomic data…confirms that. As you know, the Fed continues to increase interest rates in an effort to bring down demand…”

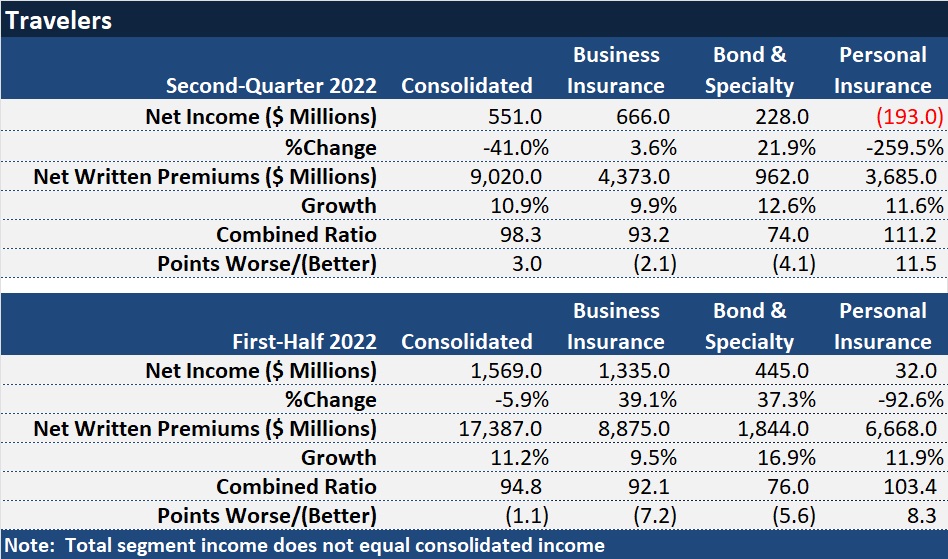

“We’re all reading those tea leaves and imagining it’s coming, but we’re not seeing it in our data—not to any significant degree,” Schnitzer said, wrapping up a one-hour conference, which started with the CEO reporting “a very strong second quarter” and highlighting bottom-line net income of $551 million, or $2.27 per share, along with double-digit top-line growth and profitable commercial lines underwriting results.

Still, inflation had a clear impact on Travelers underwriting results for personal lines business, where Michael Klein, executive vice president and president of Personal Insurance reported a personal auto second-quarter combined ratio of 104.3—10 points above last year’s second quarter—attributing much of the jump to elevated vehicle replacement and repair costs.

Travelers homeowners combined ratio of 118 was also 10 points higher in second-quarter 2022 than in second-quarter 2021, with 29 points of catastrophes compared to 20 points of cats in last year’s results, explaining the increase.

For personal lines overall, the combined ratio was 111.2 for the second quarter, up 11.5 points from second-quarter 1011

Across all three underwriting segments—business insurance, bond and specialty, and personal insurance—the combined ratio came in at 98.3, 3 points higher than last year’s 95.3.

Schnitzer, reporting an underlying combined ratio of 92.8—ex-cats and prior-year reserve development, which favorably impacted the two commercial segments—noted the benefit of having a diversified portfolio of businesses.

Michael Klein, Travelers Personal Insurance

“We’re on the right track in addressing the environmental issues” impacting the industry, he said, referring to upcoming remarks from Klein about the magnitude of rate increases to address the inflation-driven rise in personal auto severity.

Klein reported that renewal premium change was 6.3 percent for domestic personal auto—up a full three points from 3.3 percent for the first quarter of 2022.

“We continue to increase renewal premium changes and expect RPC to reach double digits by the fourth quarter,” he said.

For domestic homeowners, renewal premium change jumped to “a record high” of 13.5 percent, Klein said, noting that both higher insured values and increased rate drove the increase.

Both Klein and Schnitzer noted that strategic initiatives, in particular, investments in new capabilities, continue while the company works to improved personal lines underwriting results.

Klein noted, for example, that Travelers introduced new artificial intelligence-enabled aerial imagery during the quarter to enhance property underwriting and risk selection while simplifying the quoting process for agents and customers.

Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best