Global commercial insurance prices rose 11% in the first quarter of 2022, marking the fifth consecutive reduction in rate increases since pricing peaked at 22% in the fourth quarter of 2020, according to the Global Insurance Market Index published by insurance broker Marsh.

The first quarter of 2022 was the 18th consecutive quarter that global composite prices rose, which continued the longest run of increases since the inception of the Marsh Global Insurance Market Index in 2012. However, the rate of increase continues to moderate across most lines of business and in almost all geographies, said the Marsh report.

The major exception, said Marsh, was cyber insurance, driven largely by the continued increase in the frequency and severity of ransomware claims with many insurers seeking to tighten coverage terms and conditions, especially in relation to the conflict in Ukraine. “The war in Ukraine exacerbated concerns surrounding systemic exposures and accumulation risk,” added the report.

Rising cyber insurance rates were driven largely by the continued increase in the frequency and severity of ransomware claims, with many insurers seeking to tighten coverage terms and conditions, especially in relation to the conflict in Ukraine. Prices increased 110 percent in the U.S. (down from 130 percent in Q4 2021) and 102 percent in the UK (up from 92 percent).

In the first quarter of 2022, slower rates of increase in financial and professional lines led to moderated rates in most geographies, but financial and professional lines continue to outpace property and casualty lines—driven primarily by cyber pricing—with rate increases averaging 26 percent compared to 7 percent in property and 4 percent for casualty, the report said.

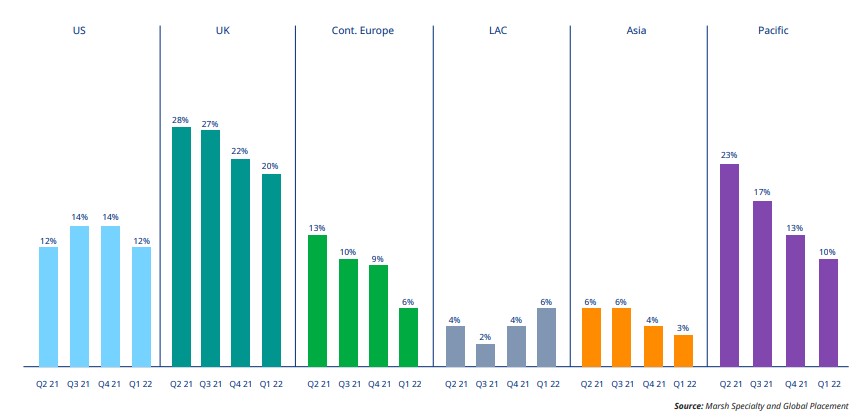

Global Insurance Composite Prices

Global commercial insurance price increases across most regions moderated due to a slower rate of increase in financial and professional lines. The UK, with a composite pricing increase of 20 percent (down from 22 percent in Q4 2021), and the U.S., where prices increased 12 percent (down from 14 percent) continued to drive the global composite rate.

The rate of increase in Pacific was 10 percent (down from 13 percent), in Asia 3 percent (down from 4 percent) and 6 percent in Continental Europe (down from 9 percent).

For the second consecutive quarter, the one exception to the moderating trend for composite prices was Latin America and the Caribbean, where rates increased by 6 percent (up from 4 percent in the fourth quarter of 2021).

In the United States, property insurance pricing increases mirrored those of fourth-quarter 2021 at 7 percent, said Marsh, noting that clients with significant losses, as well as those that showed poor risk quality or had significant exposure to secondary catastrophe (CAT) perils—including wildfire, convective storm and pluvial flood—generally experienced rate increases that were well above average.

In two sections of the report—about U.S. and Continental European property pricing trends—Marsh indicated that insurers had shown an increased focus on the adequacy of valuations due to the challenging environment caused by rapidly rising inflation. For example, in the U.S., according to Marsh: “Valuation has become a focal point at virtually every renewal for all insurers, particularly related to concerns about the current inflationary environment, supply chain challenges and labor shortages. Loss experience where adjusted loss amounts were well above the reported values has further heightened insurers’ focus on this issue.”

Other findings from the survey include:

- Global property insurance pricing was up 7 percent on average in Q1 2022, down from an 8 percent increase in Q4 2021.

- Global casualty pricing was up 4 percent on average, down from 5 percent in the previous quarter.

- Pricing in financial and professional lines, largely driven by cyber, again had the highest rate of increase across the major insurance product categories, at 26 percent. However, this was down from 31 percent in the previous quarter, due to a slower rate of increase for directors and officers insurance.

- Increases in inflation are already impacting claims in several lines of business and have been flagged by insurers as a concern in affected geographies.

- U.S. property insurers appear to be managing their line sizes for secondary catastrophe perils and tightening their pricing; as such, the capacity has significantly reduced, negatively impacting client portfolios that are predominantly exposed to wildfire.

- U.S. casualty insurance pricing increased 4 percent, in line with the fourth quarter of 2021 but excluding workers compensation, the increase was 6 percent. “The competitive workers compensation marketplace has helped to offset some of the increases in auto liability and general liability,” said the Marsh report, adding that insurers demonstrated willingness to negotiate on auto liability and general liability rates in order to secure more profitable workers compensation lines.

- UK property insurance pricing increased 9 percent compared to 10 percent in the fourth quarter of 2021. Marsh noted that significant price increases were seen by clients “with major loss activity or a challenging occupancy or business process, such as food production, warehousing or waste recycling.”

- “Insurers have moved from seeking to impose blanket price increases to targeting specific areas of the book they believe are underpriced or impacted by loss,” Marsh added.

- UK casualty insurance pricing increased 3 percent compared to a 4 percent increase in the prior quarter (Q4 2021). The report said employers’ liability pricing was similar to that of the prior quarter. Electric vehicles (EV) impacted the auto insurance market significantly, with damage repair costs on electric vehicles running approximately 25 percent higher than cars with internal combustion engines, said Marsh, explaining that parts are hard to source and EV repair specialists are in short supply.

- Continental Europe’s property insurance pricing rose 6 percent, a decrease from 10 percent in the prior quarter. Catastrophe-exposed risks remained challenging and experienced the largest increases, though at a reduced level compared to prior quarters.

- Continental Europe’s casualty insurance pricing increased 6 percent, down from 7 percent during Q4 2021. Rates showed signs of stabilization, but with regional variations some territories saw double-digit rate hikes. Excess casualty and U.S.-exposed placements remained challenging, said Marsh, with some countries experiencing general liability pricing increases as high as 20 percent.

“The war in Ukraine, while most importantly a humanitarian tragedy, has added pressure to what is already a challenging insurance market for our clients. We are also beginning to see the impact of rising inflation on loss costs and exposure growth, which in turn could affect pricing,” commented Lucy Clarke, president, Marsh Specialty and Marsh Global Placement.

“However, market fundamentals remain strong, and we expect rate increases to continue their moderating trend. We will continue to help clients find competitive pricing and coverage, as well as meaningful insights into how the quickly changing market dynamics may impact their risks.”

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance