Reinsurers and insurers for years have been worried about systemic risks – those uninsurable risks with the potential of surpassing the capital of the industry. The COVID-19 crisis has renewed attention on these risks, which could also include a global cyber event and climate change. These risks are so worrying that rating agencies, such as AM Best, are taking note.

The question about the insurability of systemic risks is not new, said Torsten Jeworrek, CEO of Munich Re’s reinsurance business, during a virtual media briefing held in lieu of meetings previously held at the reinsurance Rendez-Vous de Septembre in Monte Carlo.

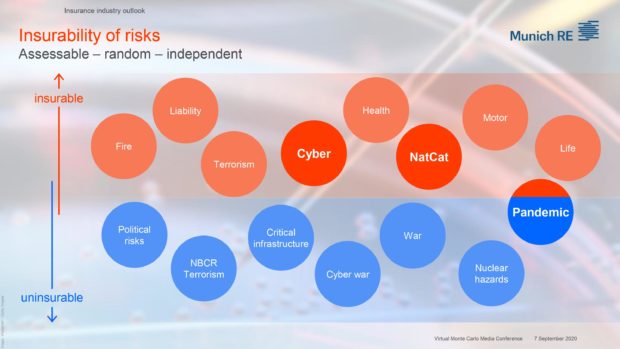

There are a number of risks of a systemic nature, which are “not in the scope of our insurance and reinsurance industry,” he said, pointing to risks including pandemic, political risk, nuclear and biological terrorism, critical infrastructure (such as energy supply), cyber war and war. (Click on Munich Re chart below to expand it. This chart illustrates insurable versus uninsurable risks).

“For an industry founded on the principles of diversification, we are now grappling with the implications of the first global systemic insurance loss,” said David Priebe, Chairman of reinsurance broker Guy Carpenter, during its virtual media briefing.

“One of the most important insurance concepts is the concept of diversification,” agreed Stefan Golling, head of Munich Re’s corporate underwriting, who explained that a major natural catastrophe – such as a big earthquake or a hurricane – will not affect all parts of the world at the same time, unlike a pandemic.

For a large natural catastrophe, the industry can usually “rely on the diversification between various lines of businesses. So we would expect the life business, the health business, the property business, and the liability business to perform rather independently. And of course we can also expect diversification when it comes to various customer groups,” Golling explained.

Pandemic risk, on the other hand, falls into the category of uninsurable risk because geographical diversification is impossible and “all regions worldwide, most lines of business, most industries and most customer segments” are affected by the same crisis at the same time, he continued.

“And beyond that, the insurance industry doesn’t only have to expect a hit on the liability side, but, of course, also on the asset side of our balance sheets,” he added.

AM Best is examining the impact of such systemic risks as pandemic, stating in a recent report that COVID-19 has highlighted weaknesses in insurers’ and reinsurers’ enterprise risk management (ERM).

While ERM has evolved rapidly over the past decade, the COVID-19 pandemic has shown the “unknown unknowns” and “unexpected accumulations” that can affect reinsurers and insurers, said the AM Best report.

“Reinsurance, and to some extent insurance, has thrived on globalization with limited barriers to entry,” said the report titled “COVID-19 Highlights Weaknesses in Insurers’ Enterprise Risk Management.”

“With this has come an increasing interconnectivity of risks between market and participants, and the consequences of a higher risk of contagion between insurance and other sectors,” it added.

“Conventional wisdom had led most observers to expect that the greatest impact of a pandemic would be to the life and health sector, but in reality, it is likely that property and casualty re/insurers will feel the brunt of the impact to this event,” said AM Best.

Unexpected Accumulations

“Unconstrained by geography, the COVID-19 pandemic is very different from other large scale losses suffered by the industry, in that it has caused a global economic downturn with huge economic and social impacts,” said AM Best.

“In addition, the crisis has had a profound impact on both the demand for and the supply of insurance products. It is likely that this impact will be felt for a long time, with the insurance industry needing to adapt to these changes and also to the new risks that may emerge,” said the report.

As a result, the coronavirus pandemic is testing insurers’ ERM approaches, practices and resilience, the ratings agency continued.

Golling also acknowledged there is still huge uncertainty related to the COVID-19 crisis, which could see some secondary effects on areas such such as credit business or liability classes like directors and officers.

“And, of course, we are all aware that we are still in the middle of the crisis, and the second or third wave could lead to an increased amount of losses,” Golling cautioned. “Fortunately, the insured losses from the life business are so far rather moderate. The active prevention measures by governments regarding social distancing and lockdown decisions, helped to reduce the number of losses on the life side enormously….”

However, the industry could face, not only a second or third wave of COVID-19, but also, in the future, it could face “a newer, different and more deadly virus,” in which the losses on the life side could easily surpass the losses on the P/C side, Golling said.

Nevertheless, Golling said, the insurance industry has still managed to provide a substantial amount of coverage for pandemic risk. Munich Re estimates the industry’s COVID-19-related property/casualty losses will range from US$30 billion to $100 billion, coming from various lines of business, such as the travel business, event cancellation business, credit business and workers’ compensation.

Lloyd’s has estimated a combined underwriting and investment loss for the industry of up to US$203 billion. “With uncertainty over the scale and duration of the pandemic and any lockdown measures, the financial impact would be well in excess of this,” said AM Best.

Unforeseen Risks

AM Best said a key area of interest in the coming months is how organizations use lessons learned from this current crisis to strengthen ERM frameworks against such “black swan” risks.

“In line with expectations, higher-rated and more sophisticated insurers and reinsurers responded promptly to the pandemic, demonstrating a superior level of ERM compared with their peers,” said AM Best.

“Generally, these are the companies that perform regular stress testing, including testing for pandemic risk, or the implications of a severe economic downturn,” added the ratings agency.

“However, while the stress testing may have been rigorous and sophisticated, unforeseen risks have emerged as the pandemic has evolved. The contagion effect on the global economy suggests that property and casualty carriers are likely to be more impacted than the life and health sector, and perhaps more than previously thought,” the AM Best report continued.

AM Best noted that there are also likely to be accumulations of risk that insurers have not before considered.

“Globalization is considered to be positive for insurers, enabling the interconnectivity of people and risks,” AM Best continued. “However, when global events like the COVID-19 pandemic occur, this can expose unexpected accumulations of risk, leaving insurers unable to mitigate the effects through geographic diversification.”

As demonstrated by the COVID-19 pandemic, AM Best said, increased global and economic mobility can help the spread of epidemiological risk, with containment measures generally limited in effectiveness if not coordinated globally.

Wake-Up Call for Industry

“Over recent years, companies have sought to measure exposure to unexpected risk, through investment in natural catastrophe research and modeling capabilities,” said the report.

“However, the same level of investment has not been seen in modeling and assessing pandemic risk. The nature of this risk fundamentally differs from natural perils targeted by traditional catastrophe protection. As such, COVID-19 has been a wake-up call for the insurance industry, highlighting the importance of identification, measurement and mitigation of pandemic risk,” it went on to say.

Golling acknowledged that the inability to diversify pandemic risk, the fact that the industry already is exposed to life and P/C risks are “the reasons why we cannot insure all the losses from business interruption.”

“The pandemic risk in its entirety is too big to be covered by the private insurance sector,” he said.

He cited a study by the American Property and Casualty Insurance Association, which said the risk capital of U.S. insurance industry would be exhausted in a couple of weeks, if all the business interruption losses would have been insured. “And the same, of course, would be true for Europe as well as for Asia.”

That is why business interruption policies generally always require physical damage and/or include a pandemic exclusion, Golling said. “The so-called business closure insurance policies that are available the market always targeted local infectious diseases, because those events are not an issue from an accumulation perspective.”

Golling noted that almost 100% of the business interruption losses have so far been caused by political decisions by governments to lockdown economies, which is another reason why these risks are not insurable.

“Who of you or who of us could have forecasted how governments, national governments or federal governments, would have reacted? Who of you or who of us could forecast now how they would react in a couple of weeks if we see the numbers going up again? So how could an underwriter really assess the risk and determine a risk adequate price for that risk?”

Public-Private Partnership

Golling suggested that the solution for the systemic risk of pandemics can only be a combination of continuing with the private insurance market for covering the currently insured exposures while developing government-backed solutions for the currently uninsured exposures. He cited, in particular, the business interruption exposures from the millions and millions of small and medium sized enterprises.

“Whilst the financial contribution of the insurance industry will remain limited to back up these government pools, the industry can of course add value, not only by its know-how, but also offering its infrastructure, for example, by collecting premiums and paying claims,” added Golling.

He suggested the formation of simple national pools, which would focus only on pandemic risk.

“We can’t really immediately also include other systemic risks, such as war or cyber war or terrorism, because it would just increase the complexity too much. We should focus on non-damage business interruption for small and medium enterprises. I think we have to ensure the affordability through government subsidization,” Golling continued.

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?