New American International Group President and CEO Brian Duperreault began his first full day on the job publicly repudiating the idea of splitting the struggling insurer into pieces and simply returning money back to shareholders.

“I recognize the value of the company’s multiline structure,” Duperreault said during remarks at the start of AIG’s consumer insurance investor day on May 15. “I didn’t come here to break the company up. I came here to grow it.”

Previous AIG CEO Peter Hancock faced serious pressure from activist shareholders including Carl Icahn to split AIG up into three separate units. Hancock resisted this, focusing instead on streamlining (selling off assets) and returning $25 billion to shareholders over two years. Duperreault recognized those efforts but signaled he’d pursue a partial change of course.

“This company has met its tremendous commitment to return capital to shareholders,” he said. “Going forward, capital will also be deployed to expand and grow our businesses with the goal of building long-term shareholder value.”

Duperreault’s Emerging Strategy

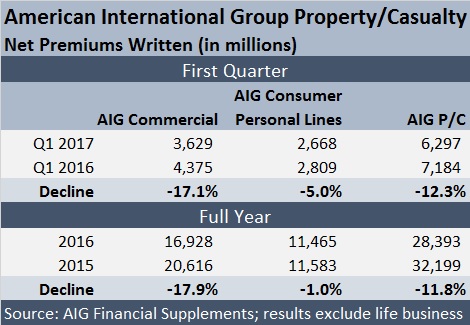

Duperreault acknowledged that the commercial markets continue to present a tough challenge to AIG’s struggling commercial property underwriting business, but he advocated a three-pronged attack to get through this.

Brian Duperreault, AIG

He added that while financial targets are important in managing AIG, they should also be put into perspective.

“Loss ratios are important, but so is a mix of business and the level of expenses,” Duperreault said. Another important element is balance sheet strength, and based on my initial review, the reserves appear reasonable.”

Duperreault emphasized that he’ll focus on areas familiar to those who have followed him through his career, including a 21-year prior stint at AIG as a senior executive.

A Mix of Tradition and Innovation

“My priorities will include a commitment to technology and a focus on growth, accompanied by underwriting discipline,” he said. “I see technology, data analytics and innovation as transforming the delivery of insurance, and [initiatives including an acquisition of Hamilton USA] will put AIG at the forefront of the industry.”

He added, however, that technology, while important, isn’t everything.

“While technology is an essential component of long-term strategy, let me be clear: I am here to grow AIG,” Duperreault said. “This company has the substance in its businesses and people to pursue organic growth and inorganic growth opportunities.”

Duperreault added: “Growth, combined with underwriting discipline, is the path to outperforming our peers.”

Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits