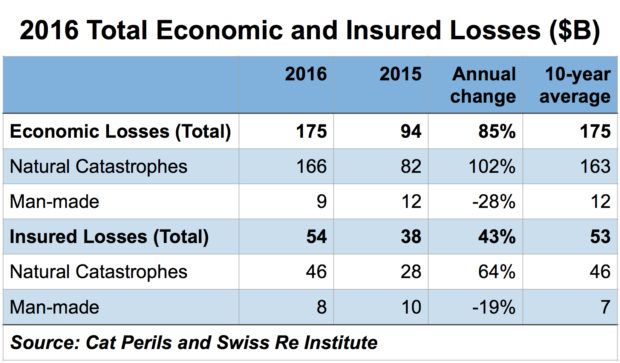

Global insured losses from disaster events hit $54 billion in 2016, up 43 percent from the previous year, as countries around the world dealt with earthquakes, storms, floods, wildfires and other catastrophic damage, Swiss Re said in its latest sigma study.

In 2015, insured losses were at $38 billion, the Swiss Re Institute sigma data indicates.

Economic losses from disaster events nearly doubled, reaching $175 billion in 2016 compared to $94 billion in 2015. Swiss Re noted that both economic and insured losses are at the highest they’ve been since 2012, reversing the downward trend property/casualty insurers dealt with over the previous four years.

Globally speaking, 327 disaster events struck during 2016. Of that number, 191 were natural catastrophes and 136 were man-made.

Why was there such an uptick? Swiss Re said that disaster events soared around the world, “across all regions.” Some catastrophe events hit areas that had a high insurance penetration, which accounted for the 42 percent jump in insured losses.

There’s a plus side to that statistic. As Swiss Re noted, having a disaster event strike an area with high insurance penetration meant that many affected folks could turn to their insurance to help recover from the disaster.

Other statistics from the Swiss Re sigma report:

- Asia dealt with 128 disaster events, making it the worst-hit in terms of number of events. It also scored highest in terms of resulting economic losses, which reached $60 billion. Of that number, the Japan earthquake on Kyushu Island in April caused the worst economic losses, which were between $25 billion and $30 billion.

- Globally speaking, about 11,000 people lost their lives or went missing in 2016 disasters versus 26,000 in 2015.

- Natural catastrophes resulted in $46 billion in claims in 2016, the same as the 10-year annual average.

- Insured losses from man-made disasters were at $8 billion versus $10 billion in 2015.

- North America accounted for more than half of the global insured losses for 2016, thanks to a number of convective storms in the U.S. The worst of the bunch: a hailstorm that slammed Texas in April, causing $3.5 billion in economic losses, of which $3 billion was insured. That means about 86 percent of losses were covered.

- Disasters in 2016 struck Japan, Ecuador, Tanzania, Italy, New Zealand, Canada, the U.S., and Haiti, among other locations.

- Hurricane Matthew caused the largest loss of life for a single event in 2016, with 700 deaths, mostly in Haiti.

Swiss Re’s numbers are similar to those from Munich Re, which issued its annual assessment of global natural catastrophe losses in January. The reinsurer said that global losses reached $175 billion in 2016, almost hitting the $180 billion level reached in 2012. Of that number, insured losses came in at $50 billion, Munich Re said.

Source: Swiss Re/Swiss Re Institute

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?