Weather catastrophe activity slammed into 39 states during the 2016 first half. But in a six-month period where insured losses rose well above typical levels, Texas was by far the worst hit, according to a new industry report.

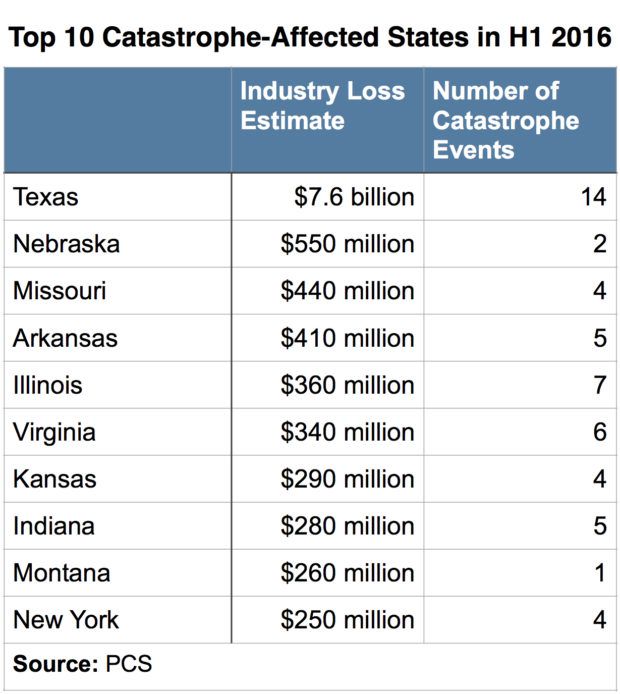

Texas sustained more than $7.6 billion in insured losses in 14 catastrophe events, the Property Claims Services unit of Verisk Insurance Solutions noted in its second-quarter 2016 catastrophe review.

While it is too early to tell if the Lone Star State will be among the worst affected in 2016 in terms of catastrophe-related insured losses, Texas had a number of catastrophe weather events last year. In 2015, the state was the most affected in terms of catastrophe events, but aggregated losses came to $2.4 billion, PCS/Verisk said.

For H1 2016, Nebraska was the second most-affected state in terms of catastrophe-related insured losses, tallied at $550 million over two events. The states that placed number 3-10, in order of succession: Missouri, Arkansas, Illinois, Virginia, Kansas, Indiana, Montana and New York.

It has been a rough year for catastrophe events across the board. PCS/Verisk tallied 39 states that had major events, versus 27 over the same period in 2015 and 24 in the 2014 first half. One of the drivers of this year’s uptick: wind and thunderstorms that produced major hail and flooding.

For the first six months of 2016, 27 U.S. catastrophe events caused $13.5 billion in insured losses, 20 percent higher than the 10-year historical average of $11.6 billion in losses (from 2007 through 2016). Also, the number lands much higher than the 10-year frequency average of 21 events, PCS/Verisk said.

PCS/Verisk said the total could go even higher, because of surveys still pending for 7 first-half events.

Broken down, 61 percent of insured losses in H1 involved personal losses. Auto losses generated 24 percent of the number and commercial losses took 15 percent of the pie.

Canada was the other big catastrophe loss story during the first six months of 2016. With aggregate insured losses of C$4.7 billion through H1, the Fort McMurray wildfire caused 98 percent of the total, and 29 percent of PCS-tallied North America catastrophe losses during the six-month period, according to the report.

Source: PCS/Verisk Insurance Services

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered