An auto insurance carrier has to work a lot harder to please customers in New England and California than in other parts of the United States, according to a recently published survey.

The J.D. Power 2016 U.S. Auto Insurance Study, published last week, also shows that Amica Mutual and Ameriprise have clearly risen to the challenge.

The study provides satisfaction ratings for individual carriers in 11 regions of the country—with anywhere from nine to 16 carriers listed for each region. Satisfaction is measured on a 1,000-point scale, with an average rating of 811 measured for the industry overall, according to J.D. Power.

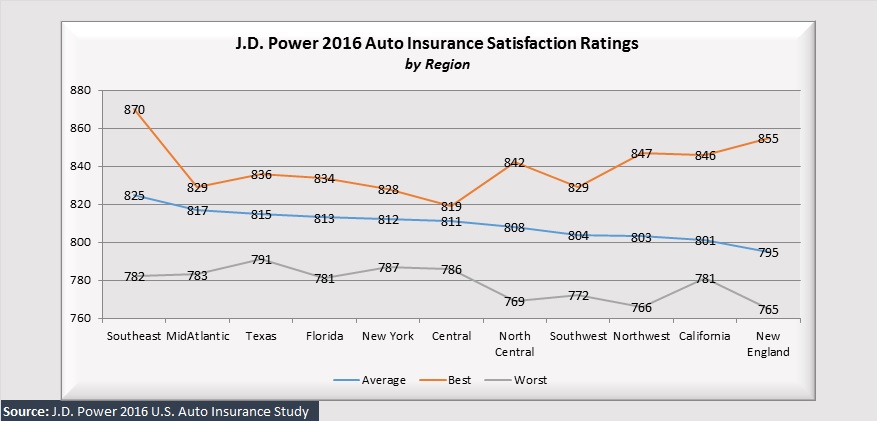

But the ratings vary widely by region, with drivers in New England scoring carriers 30 points below car owners in the Southeast—the area with the most satisfied auto insurance customers.

Even though the regional average rating for New England is a 795, Amica Mutual garnered a score of 855 there. Ranked No. 1 among 15 carriers whose ratings are listed by J.D. Power for the six-state region that includes Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont, Amica’s score is a full 90 points above the lowest-ranked carrier (The Hanover)—making the spread of ratings from best to worst the largest range of scores in any region studied.

The spread of ratings is tighter in California—the home of the next most dissatisfied group of customers—where Ameriprise’s 846 rating outpaces the average for 16 insurers writing in California by 45 points and the worst score (for Mercury) by 65 points.

In other areas of the country, smaller regional insurers tended to pull in the scores that were off the charts on the positive side—PEMCO in the Northwest and Farm Bureau Insurance of Tennessee in the Southeast.

In the Northwest, where an 803 regional average for the industry ranks as the third worst among the regions, only national carriers make up the rest of J.D. Power’s 11-carrier ranking. In the Southeast, by contrast, five regional carriers beat the statewide average, pulling satisfaction ratings up above any other region included in the J.D. Power report. (For the purposes of this article, Carrier Management is referring to carriers that write in 20 states or less as regional carriers.)

Below, Carrier Management presents a summary of the ratings of all the regional auto insurance carriers that are listed in just one regional ranking in the J.D. Power report.

While some regional carriers did score below-average customer ratings in their regions, 10 out of 17 earned ratings higher than their regional averages and nine of them landed in the top five when J.D. Power ranked the ratings for their regions.

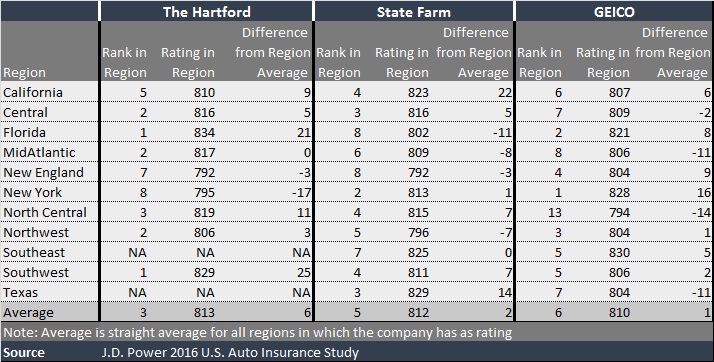

Among national carriers, no carrier earned ratings above the regional averages in all regions where they do business. Coming the closest was The Hartford, with satisfaction ratings in seven of nine regions ranked among the top five. While State Farm and GEICO ratings displayed less consistency across the regions, their ratings also tended to outrank national competitors and regional averages.

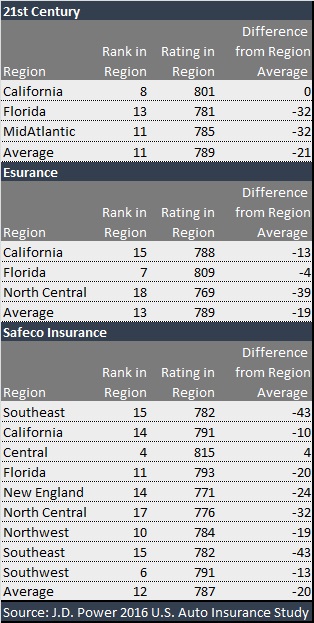

On the other end of the spectrum, customer satisfaction ratings for 21st Century, Esurance and Safeco fell roughly 20 points below the average satisfaction ratings in the regions where customers assigned scores to their experiences with the three carriers. Travelers and MetLife had slightly better satisfaction ratings but also fell roughly 15 points short of the regional averages in areas where customers rated them. All five of those national carriers, along with Liberty Mutual, Nationwide and Farmers, earned scores across the 11 regions studied that averaged out to 799 or lower.

Top Ranked Carriers

The following list summarizes J.D. Power’s highest-rated auto insurance brands for customer satisfaction by region, together with their ratings:

- California: Ameriprise, 846

- Central: Shelter Insurance, 819

- Florida: The Hartford, 834

- Mid-Atlantic: Erie Insurance, 829

- New England: Amica Mutual, 855

- New York: GEICO, 828

- North Central: Auto-Owners Insurance, 842

- Northwest: PEMCO Insurance, 847

- Southeast: Farm Bureau Insurance–Tennessee, 870

- Southwest: The Hartford, 829

- Texas: Texas Farm Bureau Insurance, 836

Industry Satisfaction Declines

Announcing the results of the latest study, J.D. Power said the overall industry average score of 811 is a “significant 7 points” below an overall average satisfaction of 818 for 2015.

The study examines customer satisfaction in five factors (in order of importance): interaction, policy offerings, price, billing process and policy information (formerly billing and payment), and claims.

Among the five factors, interaction and policy offerings were the primary drivers of the overall decline in customer satisfaction, J.D. Power said.

Explaining the interaction issues, the firm noted that lower levels of satisfaction with call center representatives (down six points to 839) and the local agent (down seven points to 864) pushed down the interaction factor.

Meanwhile, satisfaction with policy offerings dropped eight points (to 809).

Customers also reacted to carrier-initiated price hikes, fueling a three-point drop in the price component of the overall score.

In addition, J.D. Power noted that customers rated carriers lower for service elements this year, including the ease of making changes to an existing policy and ease of obtaining a new policy.

Still, there are some carriers that continue to rise above the pack when it comes to pleasing customers. Two notable examples are New Jersey Manufacturers Insurance Co., which earned an 862 ranking in the Mid-Atlantic region, and USAA, with ratings averaging over 890 across the country. These two carriers are not included in the rankings due to the closed nature of their respective memberships.

The 2016 U.S. Auto Insurance Study is based on responses from 44,681 auto insurance customers. The survey data was collected from Jan. 29, 2016 to March 25, 2016.

For more information about the 2016 U.S. Auto Insurance Study, including regional rankings for more than 40 insurers included in the study, visit http://www.jdpower.com/resource/jd-power-us-auto-insurance-satisfaction-study.

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best