Loss reserves for the U.S. property/casualty industry are still adequate, but the fat was trimmed down to roughly 2 percent of overall carried reserves for year-end 2015, an analyst reported last week.

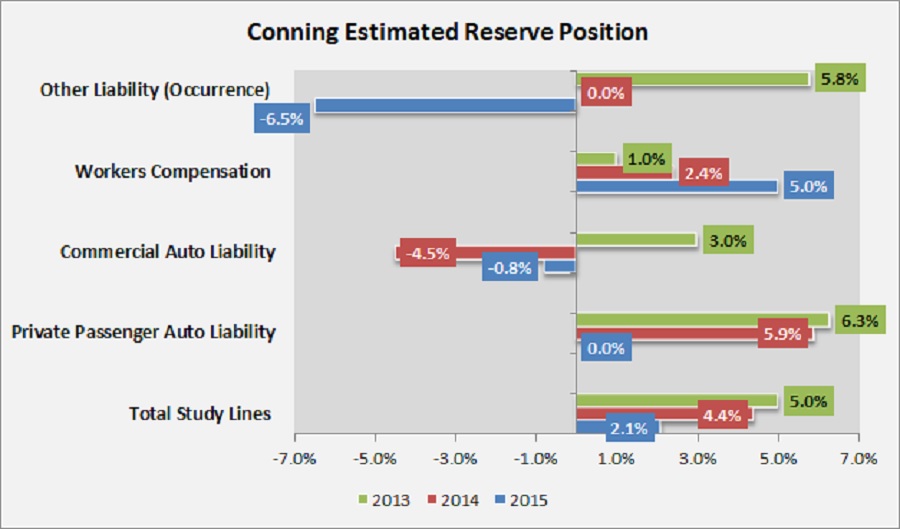

Robert Farnam, vice president of Insurance Research for Hartford, Conn.-based Conning, shared the latest estimate developed by his firm during a session of the Standard & Poor’s 2016 Insurance Conference, noting that the percentage fell from a prior level of 4 percent for year-end 2014.

Reporting the overall result and some line-by-line numbers originally revealed in Conning’s study, “2015 Property/Casualty Loss Reserves: Reserves Weaken but Some Redundancies Remain,” Farnam said the biggest surprise of the analysis was in the personal auto liability line.

“2001 is the last time we thought reserves were deficient there. We don’t think they’re deficient [now], but we think the redundancy has pretty much been wiped away,” Farnam said, referring to the 0 percent indication for 2015 for personal auto on the chart below.

S&P doesn’t think there’s anything left in the tank for personal auto liability either, according to Sridhar Manyem, a director for S&P Global Ratings. Looking at takedowns of prior-year reserves rather than actually projecting margins of redundancy or deficiency as Conning does, S&P saw prior-year reserve strengthening in the personal auto line “for the first time in close to 10 years,” Manyem said.

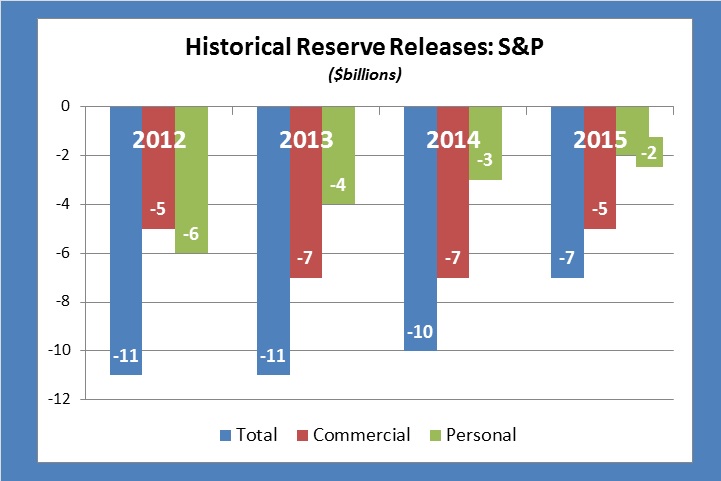

While Manyem characterized the amount of strengthening—roughly $500 million—as very minimal, the reversal continued a progression of lower and lower amounts of reserve releases for personal lines overall (auto and homeowners together) in the past few years. Personal lines releases dropped to $1.7 billion in 2015 from $2.8 in 2014, $4.0 billion in 2013, $6.0 billion in 2012 and lower amounts before that.

According to a written report published by S&P on the subject (“Favorable U.S. P/C Industry Loss Reserve Development: The Gift That Keeps On Giving,” published June 9, 2016), the $1.7 billion total takedown for personal lines is the smallest since 2002 (when the industry actually boosted reserves by $0.5 billion, according to a slide displayed during the conference).

A Broken Record

“Overall, claims trends are relatively benign. The frequency trend has been going down. It may have bottomed around now, but it’s still pretty good,” said Farnam, explaining the good news on reserve levels to date.

“The severity trend has been going up, but it’s been relatively easy for companies to be able to absorb,” he continued. “And several lines have had declines in severity,” he told the S&P conference attendees.

But the favorable trends can’t last forever. “We still expect some favorable development to help earnings in the near term. But that benefit is going to wane in the coming years. I feel like a broken record. We have probably been saying that for years and years and years,” said Farnam.

“We’re guilty of the same,” said John Iten, a director for S&P Global Ratings and moderator of the session. The industry has been releasing reserves for the past 10 years, which has helped to mitigate the impact of a slow but steady deterioration in commercial lines pricing, he said. “Ten years, however, is an unusually long period. That raises the question of how much longer this trend of positive development can continue,” Iten said, addressing the question to Manyem.

“We got it wrong, thankfully,” said Manyem, referring to the fact that S&P analysts—and P/C insurance analysts, generally—have been predicting that the reserve cushions which benefitted combined ratios by roughly two points in the last two years would evaporate.

By S&P’s tally, the U.S. P/C industry released a total of $6.7 billion on a net basis (for all lines excluding mortgage and financial guaranty) last year—more than 10 percent of industry’s pretax operating income of $57 billion and just about 1 percent of total carried reserves of $583 billion at Dec. 31, 2015.

That $6.7 billion actually incorporates $3.6 billion of strengthening from American International Group, Manyem noted. “Discounting that, the trend has been overall healthy,” he said, showing a slide that indicated releases of nearly $10 billion for 2014 and nearly $11 billion in each of the two prior years.

Focusing just on commercial lines, the total aggregate takedown for the industry last year was $5.0 billion. “Despite the healthy release, we are still cautious because as you [we know from the period] between 2001 and 2004, things can quickly turn around,” he said, displaying a bar graph that showed huge spikes representing reserve boosts of $20 billion, $17 billion and $14 billion in 2002, 2003 and 2004, respectively. “A number of factors caused insurers to strengthen reserves in a quick amount of time and led to a lot of defaults in the industry. So we are very skeptical about commercial lines reserves,” he said. “We will always keep an eye on that, especially for carriers with significant legacy portfolios.”

“Lines like workers compensation and liability written on an occurrence basis could flare up pretty quickly,” he said, suggesting that changes in tort environment impacting California workers compensation claims and hiccups related to legacy asbestos and environmental exposures fueled some of the strengthening during the post-9/11 hard market.

Still, even though last year’s $5.0 billion aggregate reserve release for commercial lines is lower than a $6.8 billion figure that S&P tallied for 2014 and lower than the 10-year average of $6.3 billion, Manyem stopped short of saying the party was coming to an end. “The discipline that has been exhibited by the industry in terms of reserving practices because of better analytics, combined with reasonable pricing environment that you saw in the last few years and also tailwinds caused by lower inflation [have] all…led to us having an overall comfortable view with the industry reserve position,” he said.

Line by Line: The Workers Comp Wildcard

The good times may already be past for the other liability line, where Conning’s estimated levels of reserve adequacy show a rapid deterioration from nearly 6 percent redundant at year-end 2013 to more than 6 percent deficient at the end of 2015.

Commercial auto, however, is moving in the opposite direction. The industry has strengthened commercial auto liability reserves for four straight years, Farnam reported, noting that the level of deficiency is now under 1 percent compared to 5 percent deficient at year-end 2014.

The biggest commercial line, workers comp, which represents about one-quarter of the industry’s reserves, is an even better story. That line has been developing favorably for almost 10 years, Farnam said, noting that favorable development recorded last year shaved a “still pretty meaningful” four points off the workers comp industry loss ratio.

Explaining the results for workers comp, Farnam said claims severity “has just not been too substantial,” noting that low medical cost inflation trends are a contributor. “Ten or 15 years ago, we probably had twice the medical inflation” rate compared to the one impacting claims now.

But the real story is on the frequency side, he said, noting that the number of claims dropped sharply in 2008 and 2009, largely as a consequence of the recession, in industries including transportation, construction and manufacturing. “The surprising thing about this is that [claims frequency] hasn’t really rebounded,” he said, showing an array of lines, each representing the development of the number of reported claims for an individual accident from the initial count to ultimate value. While all the lines were upward sloping, initial frequencies for 2009 and subsequent accident years were all more than 14 percent lower than the accident-year 2007 level, and ultimate claims for each year were all more than 12 percent lower.

“That’s been great for the [insurance] industry. That’s also a concern. At some point, those claims will pick up. As the economy improves, more hiring comes, and the claims frequency will probably start to increase. And that’s where the trouble will begin,” Farnam said.

Manyem had a different concern about the workers comp. “We’ve seen increased reserve releases in the greener accident years. Usually we will look at [that] with a lot of skepticism for long-tailed lines. I think that skepticism is going to remain as we work with issuers to try to figure out exactly what caused them to be comfortable with those releases,” he said, referring to the prospect of a “rapidly changing social inflation-type environment” like the one that sparked reserve increases back in 2002 in California.

Putting numbers behind Manyem’s observations, S&P’s written report notes that the industry released $2.3 billion of reserves for prior accident years for workers comp in calendar-year 2015—a big jump from the $840 million amount released during calendar-year 2014 (and three-times the 2014 figure, if AIG’s $400 million of strengthening is ignored). Roughly 90 percent of the 2015 release was from the 2011-2014 accident years, the published report says.

Turning to commercial auto, Farnam noted that while the industry has strengthened liability reserves for four straight years, the problem in that line has been claims severity. While frequency declined over the last 10 years, the average cost per claim grew by about 4 percent annually over the same time period.

Manyem suggested that growth in the economy could put more trucks on the road, bumping up frequency trends. Anemic growth in the economy in the past may have meant that truckers neglected maintenance, he added. He also noted statistics showing increasing tonnage per truck. A heavier truck will cause increased severity, he reasoned.

Global View

Conning’s analysis of reserve adequacy also includes estimates for homeowners, medical professional liability (claims made and occurrence), commercial multiple peril, and the claims made portion of the other liability lines, as well as asbestos and environmental. But all the estimates relate solely to the U.S. P/C insurance industry.

During the S&P conference, Susan Cross, executive vice president and group chief actuary at XL Catlin, gave a more global assessment, noting that more than half of XL Catlin’s business is written outside the U.S. Cross said that while her company believes industrywide reserves are still redundant overall on a global basis, “insurance reserves are probably much closer to that level of just adequate,” while reinsurance reserves remain very strong.

Like Farnam, she said fairly benign claims trends have been a big part of the story on the insurance side, noting some favorable frequency in specialty lines. “Aviation is a good example, where you have had significant tech-driven safety improvements” that have resulted in a drop in the frequency of events. “That’s an area that’s also been under some pricing pressure,” she said, noting that those trends often come together and can balance each other out to produce favorable results. “We’re watching that one pretty carefully. There has to be a limit to the degree of favorable improvement on the frequency side,” she said.

The Last Wave of Reserve Strengthening

An audience member asked the panel for more specifics on what drove the last round of significant reserve strengthening in the industry early in the decade.

A lot of it came from reinsurance operations, and U.S. casualty reinsurance, in particular, Cross said, recalling the problems that XL and other casualty reinsurers faced. “What we found is there had been weakening of terms and conditions in years leading up to 2000, 2001. There were contracts written over a multiyear time horizon,…some for professional liability lines extended for four or five years, [and] they weren’t identified as such in the data,” she said. The underlying development potential wasn’t picked up in historical patterns, she said.

“That is a lesson learned” for the industry—”to make sure you track changes in terms and conditions, and really how that exposure is changing,” she said, referring to changes in exclusionary wordings or coverages thrown in a soft market. Insurers and reinsurers need to monitor those changes and account for them as part of the loss reserving exercise, she said.

Manyem suggested that better reserving practices since that time may also be a consequence of something S&P did in 2004—introducing enterprise risk management reviews are part of the rating process. “I think that introduced a lot of discipline to the market,” he said.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists