Workers’ compensation premiums in California continue to grow at double-digit rates, according to the Workers’ Compensation Insurance Rating Bureau.

The WCIRB recently released its “State of the California Worker’s Compensation Report,” and authors of the report highlighted developing trends over the past few years in the wake of the state’s massive workers’ comp reforms.

The report would perhaps be best described as a “mixed bag,” a descriptor of the positive and negative trends as well as a result of the impact that the Senate Bill 863 workers’ comp reforms passed in 2012 are having on the massive system for dealing with injured workers.

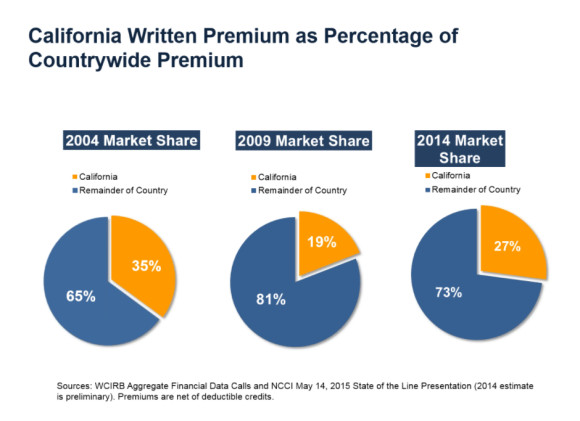

If nothing else, the report shows the magnitude of California workers’ comp system on a national scale.

The state’s workers’ comp written premium accounts for more than a quarter of the U.S. total, but only 12 percent of America’s workforce, according to the report.

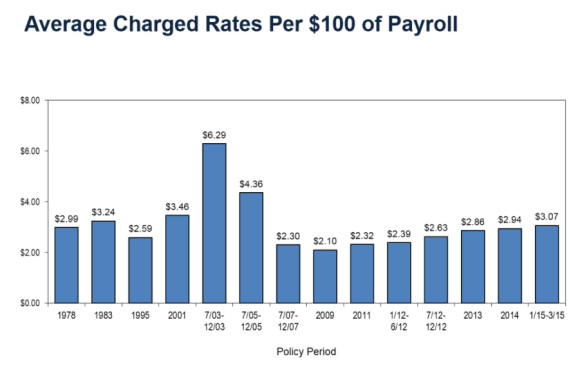

The report shows the rising premiums in California are due to higher premium rates and to growth in insured payroll resulting from economic expansion and wage level increases.

It also shows California has the highest premium rates in the country. While California employers are paying ever higher rates per $100 of payroll since 2009, workers’ comp rates are less than half what they were before the 2003 reforms, the report shows.

“What it shows is there’s a mix of news,” said Dave Bellusci, the WCIRB’s executive vice president, chief operations officer and chief actuary.

The good news is rates aren’t much higher than nearly 40 years ago; the bad is that rates are on the rise. Worse yet, the state compares poorly with the rest of the nation, he said.

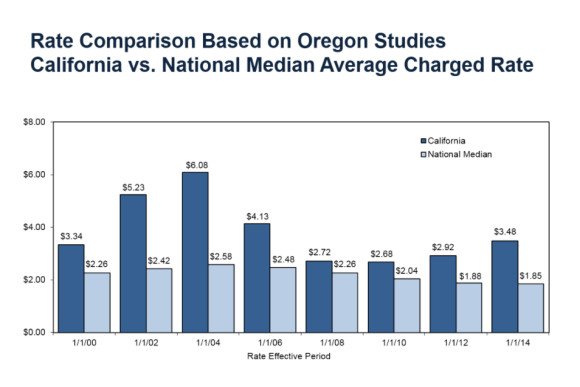

The authors referred to an annual report from Oregon that in 2014 placed California at the top of the list of states for average premiums paid by employers. The 2014 Oregon Workers’ Compensation Premium Rate Ranking Summary, which differs slightly from the WCIRB figures, showed California’s workers’ comp premium rates were $3.48 last year, topping No. 2 Connecticut by 61 cents.

Not everyone yielded to the Oregon report’s assertions. Following the Oregon report California’s Department of Industrial Relations Director challenged its findings.

Why are California’s workers’ comp premiums so high?

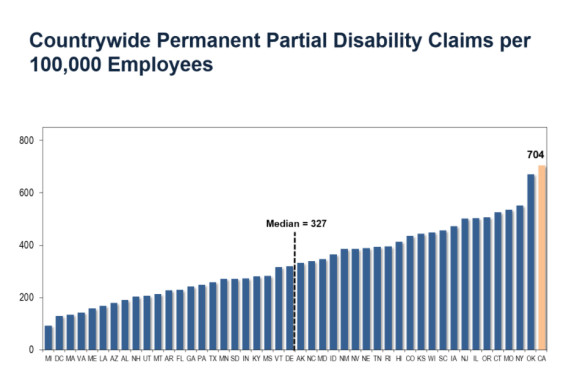

The report cites three principal factors as answers to that question: California has the highest permanent disability claims frequency in the nation, the state has among the highest claims in terms of medical costs and it has a high cost of delivering benefits.

According to Tony Milano, the WCIRB’s vice president and chief actuary, the state’s claims frequency is being driven up by claims from Southern California, particularly the Los Angeles area. This increase goes against a nationwide trend of falling claims frequency.

“In the Los Angeles area we see an aberration in claims frequency,” he said. “Take L.A. out of California’s claims frequency and it’s pretty similar to the rest of the country.”

In California there are on average 14.5 claims per 1,000 employees, putting it roughly 50 percent greater than the national median.

And partial permanent disability claims is 704 per 100,000 employees in California, more than twice the national median of 327. This is despite the state’s hazard level being considered below the typical state, with on average fewer manufacturing and other potentially dangerous jobs.

Another driver of California’s higher premiums is the state’s medical treatment costs, largely due to prolonged medical treatments. Nearly 20 percent of indemnity claims in California were open after five years, which is nearly four times the national median, the report shows.

The report also offers a take on the effectiveness of SB 863:

“Senate Bill No. 863 impacts have generally been emerging consistent with initial WCIRB projections with potentially greater-than-projected savings in medical cost reductions offset in part by less-than-projected savings in reduced frictional costs.”

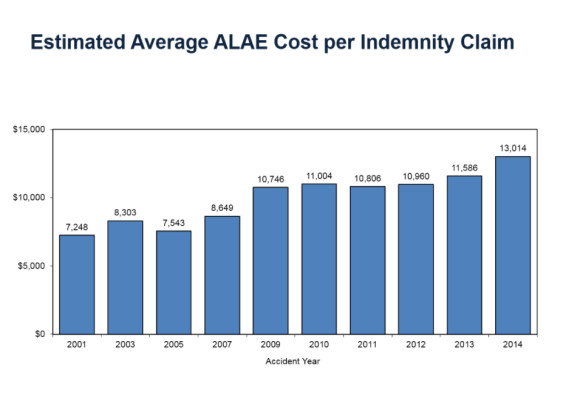

The allocated loss adjustment expense cost per indemnity claim are growing, they are not shrinking, as would be expected following the passage of SB 863.

“California has the highest ratio of loss adjustment expenses to losses in the country,” the report states.

The figure has been on the rise since 2011, and is nearly $5,000 higher than at the point of the 2003 reforms.

SB 863 was intended to minimize litigation costs, but continued expedited hearings and a higher volume than expected of Independent Medical Reviews being conducted may have driven that up, the authors said.

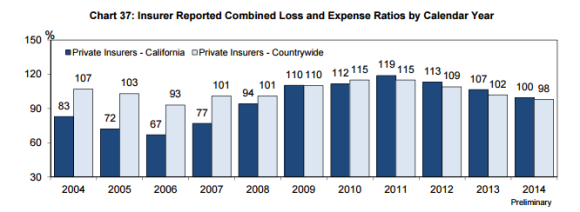

There was some interesting news for insurers. In recent years, California workers’ compensation combined ratios have generally been higher and returns on net worth lower than countrywide averages, however the combined ratios have been falling since 2010.

The report shows that many of the intended changes made by SB 863 are having a positive impact. Medical lien filings have dropped considerably, new rules on spinal implants are saving money and changes to the physician fee schedule are also reducing costs.

*This story ran previously in our sister publication Insurance Journal.

Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  The Future of HR Is AI

The Future of HR Is AI  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage