Although the growth in industry total net property/casualty insurance premiums slowed in the third-quarter, an unbroken string of quarterly hikes is longer than a prior period of back-to-back declines, industry groups reported early this week.

“In third-quarter 2013, the industry achieved its 14th successive quarter of growth in written premiums, following 12 quarters of declines, and earned premiums have now risen for 13 successive quarters,” reported Robert Gordon, senior vice president for policy development and research for the Property Casualty Insurers Association of America.

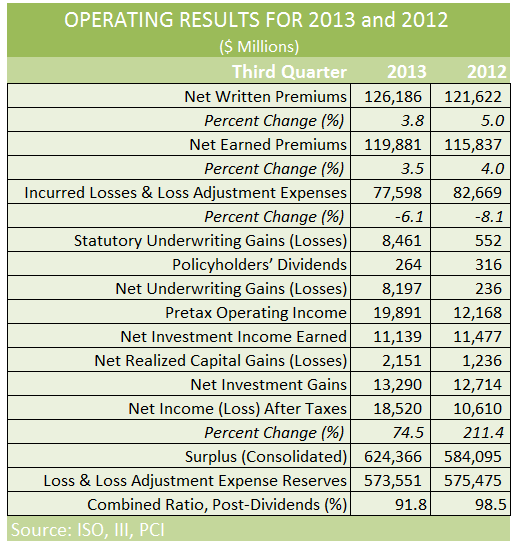

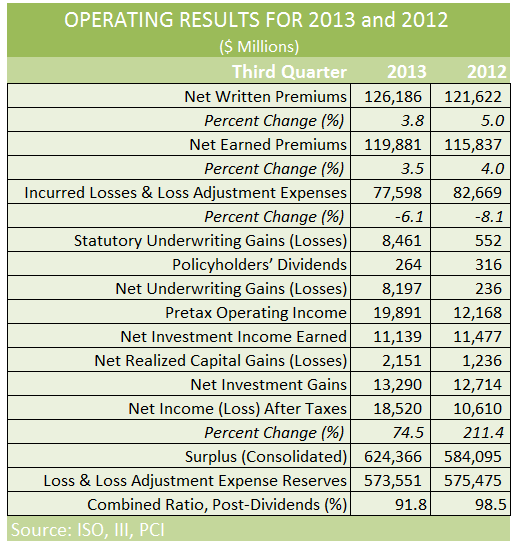

PCI and ISO, a Verisk Analytics company, published industry results for U.S. P/C insurers on Monday for the first nine months and the third quarter of 2013, showing that net written premiums rose $4.6 billion to $126.2 billion in third-quarter 2013 in third-quarter 2012, with growth in net written premiums slowing to 3.8 percent from 5.0 percent in third-quarter 2012.

Net earned premiums grew $4 billion to $119.9 billion in third-quarter 2013. Earned premium growth slowed to 3.5 percent in third-quarter 2013 from 4.0 percent in third-quarter 2012.

With loss and loss adjustment expenses falling more, however, the third-quarter combined ratio improved nearly 7 points to 91.8—the lowest level in seven years.

Loss and loss adjustment expenses fell $5.1 billion, or 6.1 percent, in the quarter to $77.6 billion.

“The growth in earned premiums and the drop in loss and loss adjustment expenses were the biggest contributors to improvement in insurers’ overall results in third-quarter 2013,” Gordon said, commenting on the drivers of an overall 74.6 percent jump in bottom-line net income (after taxes) to $18.5 billion of U.S. P/C insurers.

For the industry overall, net gains on underwriting grew $8 billion, while investment income dropped 2.9 percent to $11.1 billion.

A lower level of catastrophe losses helped to drive down total net loss and loss adjustment expenses, with cat losses coming in at $2.4 billion in third-quarter 2013, compared to $4.2 billion for the same quarter in 2012.

At 91.8 percent, the third-quarter combined ratio fell to its lowest level since the 90.6 percent for third-quarter 2006 and was 13.9 percentage points below the 105.7 percent average for the third quarter based on quarterly records extending back to 1986, ISO and PCI reported.

Dissecting the Top Line; Workers Comp to Lead Growth in 2014

In a commentary released in conjunction with the third-quarter results, Robert Hartwig, president of the Insurance Information Institute, noted that a nine-month written premium climb of 4.2 percent consisted of growth in the first, second and third quarters of 4.1 percent, 4.7 percent and 3.8 percent, respectively.

Further dissecting the premium growth figures, Hartwig noted that the two principal drivers of top-line growth in the P/C insurance industry are exposure growth and rate.

Exposure growth—an increase the number or value of insurable interests—is being fueled primarily by the rebounding economy, Hartwig observed in his commentary.

Real (inflation adjusted) GDP in the third quarter accelerated to 4.1 percent from 2.5 percent and 1.1 percent, respectively, in the first and second quarters of the year, meaning that the P/C insurance industry likely benefited from a quickening in the overall economy in the July through September period.

Still, the most important determinant in industry growth historically has been rate activity, Hartwig said. “With auto, home and major commercial lines [rates] all trending positively, overall industry growth could outpace overall economic growth in 2013, as was the case in 2012,” he wrote.

Looking ahead, Hartwig predicted that moderate growth would continue into 2014, citing these factors as reasons:

- A pick-up in the pace of economic activity

- Strong growth in the workers compensation line

- Recovery in the residential construction sector

- Strength in the manufacturing sector (including motor vehicles)

Commenting specifically on workers comp and improving labor market conditions, Hartwig noted that the U.S. economy added 1.681 million private sector jobs during the first nine months of 2013 (and 2.091 million through November).

“Combined with modest increases in the hourly earnings of employees, payrolls expanded at an average annual pace of $259.0 billion through Sept. 30 relative to the same period in 2012, which will contribute to billions of dollars in new premiums written being earned by workers compensation insurers in 2013.”

“Workers compensation is likely to remain the fastest growing major P/C line of insurance in 2014 if economic growth and hiring accelerate as projected,” he wrote, noting that with direct premium growth up by roughly 10 percent in 2013, the worker comp line, which had been the fastest contracting major P/C insurance line in the post-crisis years, has recently reversed course to become the fastest growing line.

Line By Line

Breaking down growth for other major categories of P/C insurance business, Hartwig reported that:

- For carriers writing predominantly personal lines, premiums written accelerated by 5.3 percent through the first nine months, compared to 3.1 percent in the same period in 2012.

- Carriers writing predominantly commercial lines experienced a deceleration as premium growth slowed to 2.9 percent through the first nine months, down from 5.8 percent in the first nine months of 2012.

- Insurers with more balanced business mixes saw growth change only slightly—coming in a 4.0 percent for the first nine months of 2013, compared to 4.2 percent in the same period of 2012.

Source: ISO, PCI, III

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report