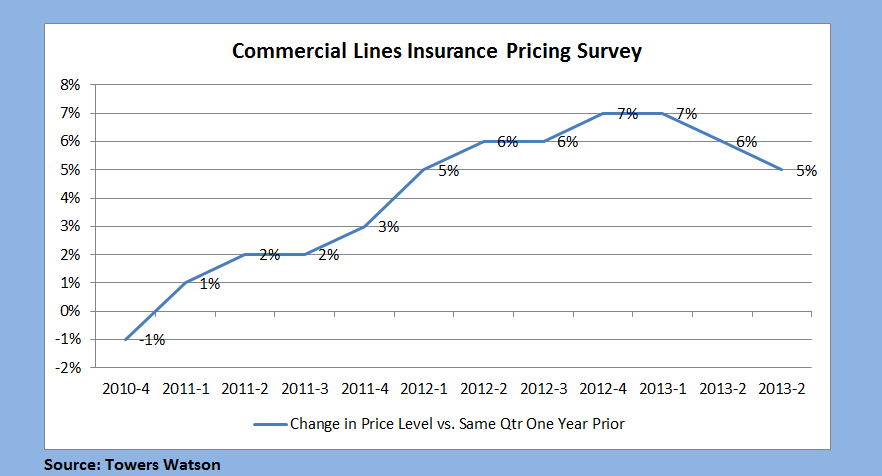

Even though commercial insurance prices increased for the 11th straight quarter—rising by 5 percent in aggregate during third-quarter 2013—price gains are slowing down, according to Towers Watson.

The global professional services company published the third-quarter update to its Commercial Lines Insurance Pricing Survey (CLIPS) on Monday, noting that the magnitude of the 5 percent price-level increase below 6-7 percent gains of the past six quarters.

According to Towers Watson, price hikes by line of business were lower than those reported in the second quarter in all lines, with the exception of employment practices liability where price increases spiked into double digits. The next biggest gains were in the workers compensation and commercial auto lines, Towers Watson reported, adding that price increases for most lines fell in the mid-single digits.

Other key findings were:

- Mid-market accounts had higher price increases than large and small commercial accounts.

- Specialty lines prices increased at a lower rate than standard lines.

- No line of business reported a price decrease.

The survey compares carriers’ pricing on policies underwritten during the third quarter of 2013 to those underwritten in the same quarter of 2012.

“The survey results are really in line with our expectations,” said Tom Hettinger, Towers Watson’s Property & Casualty sales and practice leader for the Americas, in a statement about the survey.

“This hard market is somewhat different from hard markets we have experienced before. Carriers are taking rate, which is logical, as they focus on measuring the capital required to support the business rigorously and realistically, and adjust their return expectations accordingly,” Hettinger said.

Turning to loss ratios, Towers Watson said that survey respondents are reporting improved loss ratios, with accident-year 2013 ex-catastrophe loss ratios anywhere from 3 to 6 points better than accident-year 2012. Offering an explanation, Towers Watson said that earned price increases are more than offsetting low reported claim cost inflation.

Carriers surveyed estimate no claims cost inflation for 2013 on average (the mean response was that claims inflation was flat), although the median response was just under 3 percent.

About CLIPS

CLIPS data are based on both new and renewal business figures obtained directly from carriers underwriting the business. CLIPS participants represent a cross section of U.S. property/casualty insurers that includes many of both the top 10 commercial lines companies and the top 25 insurance groups in the United States.

This particular survey compared prices charged on policies underwritten during the third quarter of 2013 to the prices charged for the same coverage during the same quarter in 2012. For the most recent survey, data were contributed by 43 participating insurers representing approximately 20 percent of the U.S. commercial insurance market (excluding state workers compensation funds).

Source: Towers Watson

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered