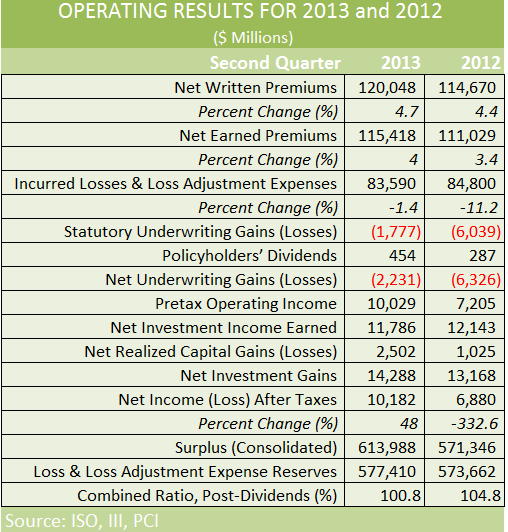

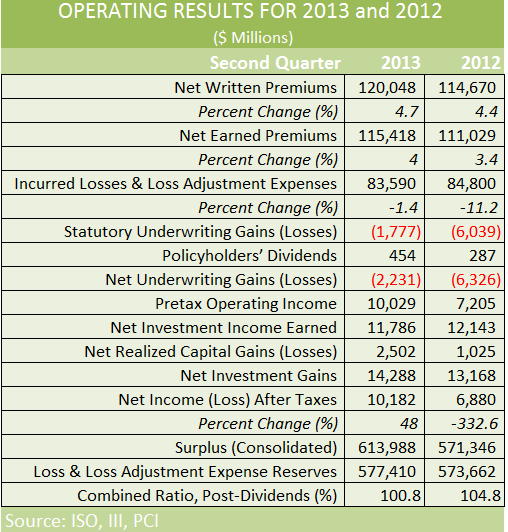

Although the property/casualty insurance industry combined ratio stayed above 100 in the second quarter, much of 4.0-point improvement from last year’s 104.8 was attributable to an improving top line, industry analysts reported Thursday.

The 4.7 percent jump in net written premiums in the second quarter marked the 13th consecutive quarter of growth, and the longest continuous period of growth in nearly a decade, according to Robert Hartwig, president of the Insurance Information Institute, who published a commentary about the industry financial results released jointly by ISO and the Property Casualty Insurers Association of America.

According to ISO, the 4.7 percent increase was the fastest second-quarter rate since the 5.1 percent for second-quarter 2004.

Turning to the combined ratio, ISO reported that the 100.8 for the 2013 second-quarter combined ratio was the lowest recorded since a 99.5 was recorded for second-quarter 2009, and was 4 percentage points below the 104.9 percent average for the second quarter based on quarterly records extending back to 1986.

Focusing on the top line, Hartwig noted that the principal drivers of growth in the P/C industry are exposure growth and rate, adding that exposure growth is being fueled primarily by the rebounding economy.

“Real (inflation-adjusted) GDP in the second quarter accelerated to 2.5 percent from a first-quarter increase of just 1.1 percent, meaning that the property/casualty insurance industry likely benefited from a quickening in the overall economy in the April through June period,” he wrote in the commentary.

“Not all economic growth, however, leads directly to the formation of insurable exposures. Indeed, historically, the most important determinant in industry growth is rate activity. With auto, home and major commercial lines all trending positively, overall industry growth could outpace overall economic growth in 2013, as was the case in 2012,” Hartwig continued.

Noting that improving labor market conditions in 2013 are also critical to top-line growth, for workers compensation insurers in particular, he said the U.S. economy added over 1.2 million private sector jobs during the first half of 2013, and nearly 1.5 million through August.

“Combined with modest increases in the hourly earnings of employees, payrolls expanded at an average annual pace of $216.5 billion during the half relative to the first half of 2012, which will contribute to billions of dollars in new premiums written being earned by workers compensation insurers in 2013.”

According to Hartwig, within the span of just a few years, workers comp “transformed itself from the fastest contracting major P/C line to the fastest growing, with direct premium growth in 2013 up by approximately 10 percent.”

Also pointing to a recovery in the residential construction sector and stronger car sales, Hartwig said moderate growth is likely to continue through the remainder of 2013.

Breaking down the premium changes by segment, Hartwig said:

- Carriers writing predominantly commercial lines saw net written premiums rise 3.8 percent in the first half of 2013, which was actually down from the 5.3 percent first-half growth rate recorded in 2012.

- Carriers writing predominately personal lines saw premiums rise 5.0 percent in this year’s first half, compared to a 3.0 percent first-half growth rate recorded in 2012.

- Carriers writing a mix of personal and commercial saw a 4.3 percent jump in premiums, up from last year’s first-half growth rate of 3.4 percent.

Sources: ISO, PCI, III

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies