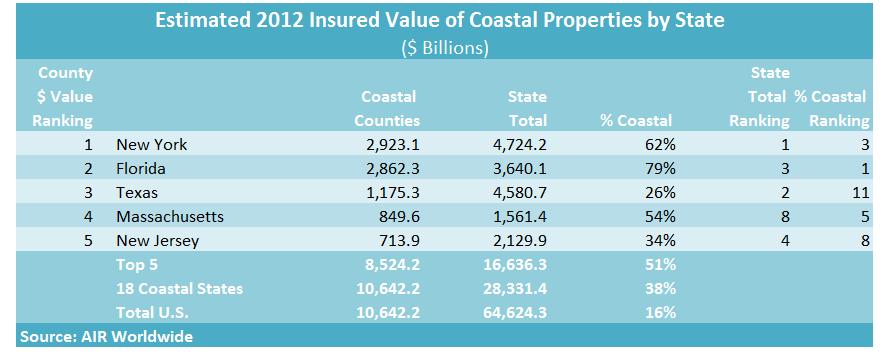

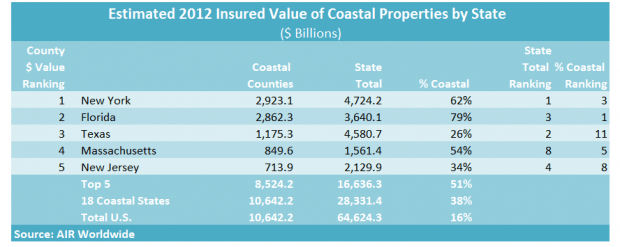

More than $10 trillion is at risk for residential and commerical properties located in the more than 100 coastal counties of 18 states along the Eastern and Gulf coasts, according to a recent report from AIR Worldwide.

Just two of the states—Florida and New York—account for more that half of the $10 trillion estimate, the catastrophe modeling firm said in the report titled, “The Coastline at Risk: 2013 Update to the Estimated Insured Value of U.S. Coastal Properties. Insured values located in coastal counties of those two states total roughly $2.9 trillion each, the report reveals.

- Florida ranks higher when evaluated in terms of the percentage of the total statewide insured property value that is situated in coastal counties. For Florida, this coastal percentage is 79 percent ($2.9 trillion as a percentage of $3.6 trillion worth of total insured property for the state).

- For New York, the coastal percentage is 62 percent ($2.9 trillion as a percentage of $4.7 trillion in insured property values for the entire state).

- For Connecticut, AIR also calculates a relatively high coastal percentage. Connecticut’s coastal values accumulate to $567.8 billion, which when compared to a statewide insured property total of $879.1 billion results in a 65 percent coastal percentage.

- Still, while Connecticut has the third-highest coastal value percentage, it doesn’t even make the top-5 states ranked by dollar values of coastal property—outranked by New York, Florida, Texas, Massachusetts and New Jersey.

- Texas, coming in with the third-highest figure for dollars of coastal property value at over $1.1 trillion, has a coastal percentage that is just 26 percent (of a statewide total TIV of $4.7 trillion).

For the purposes of AIR’s report, total insured values of properties are estimates of the cost to replace structures and their contents, including additional living expenses and business interruption coverage, for all residential and commercial property in the state that is insured or can be insured.

For more information about the AIR Worldwide report, and a separate report by CoreLogic, which estimates that 4.2 million residential properties are exposed to storm surge, with values at risk totaling $1.1 trillion, see related article, “Trillions Of Dollars Of Insured Value At Risk In Coastal States: AIR Worldwide.”

The Future of HR Is AI

The Future of HR Is AI  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers