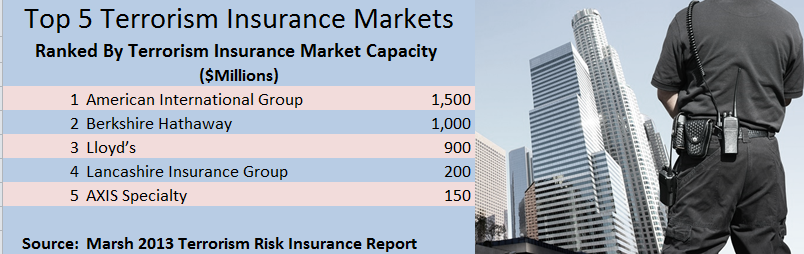

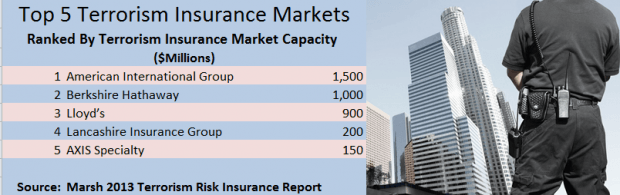

According to Marsh’s 2013 Terrorism Insurance Report, roughly $750 million to $2 billion per risk in standalone capacity is available to companies that do not have sizable exposures in locations where standalone insurers have reached or are approaching aggregation limits.

Still, the theoretical marketwide capacity would be difficult to acquire at a reasonable cost for any individual client, the report says, adding that few clients seek coverage above $1.5 billion.

For a client with significant exposures in central business districts of Tier 1 cities or those with exposure schedules with properties perceived as targets for terrorism attacks or where there have been instances of foiled plots, the available capacity is lower.

Insurer capacity (and pricing) is affected by accumulation of aggregates within ZIP codes including Tier 1 cities such as New York, Chicago, Washington, D.C. and San Francisco.

For more information from Marsh’s report, see related article, “Demand For Terrorism Insurance Coverage Remains Steady: Marsh.”

Source: Marsh

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies