You probably know them well: the GEICO Gecko, Flo from Progressive, the Liberty Mutual Emu, Allstate’s Mayhem, Jake from State Farm. In a nearly $800 billion dollar industry, with nearly half of it in personal lines, property/casualty insurers seek to obtain profitable business through name recognition—mainly accomplished through advertising.

But TV viewers saw those characters less in 2022 as private passenger auto carriers struggled with profitability issues and cut back on the easiest expense for a carrier to adjust—advertising. Some insurance icons started to re-emerge in 2023 as rate hikes began to earn into underwriting results. Even the GEICO Caveman reappeared in a new ad during the holiday season.

While expense figures aren’t yet available for 2023, a look back at 2022 gives a sense of which carriers may be spending more ad dollars in 2024.

By the Numbers: 2022 Ad Dollar Concentration

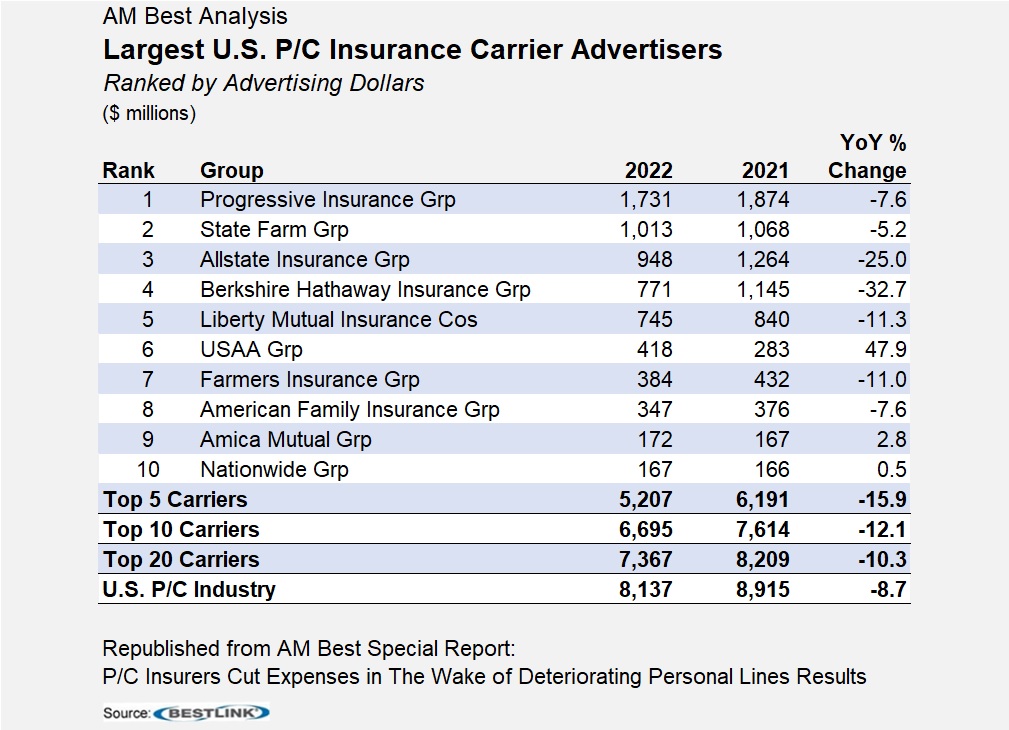

A few companies making the greatest use of advertising are by far the leaders in spending, as the five largest advertisers accounted for nearly 65 percent of all industry advertising in 2022. However, with catastrophe and secondary peril losses significantly pressuring the U.S. P/C industry’s results, insurers have been able to augment their bottom-line results by cutting underwriting expenses.

Each of these top companies has a well-known character or mascot associated with its brand, which has enhanced its brand recognition. Each also has a significant share of the highly competitive and compulsory personal auto market, which is where most advertising dollars are spent. The insurers spending the most on advertising also have sufficient premium to support the associated expenses as well.

But even though brand recognition has facilitated sizable top-line premium growth in recent years, with results having deteriorated in the private passenger auto insurance market across the board in the past two years, some insurers have pulled back on their advertising spend.

The two companies that spent the most on advertising in 2022—Progressive and State Farm—surpassed $1 billion in advertising expenditures, with Progressive as the biggest advertiser by far, spending over 50 percent more than Allstate. The two insurers that followed them—Allstate and Berkshire Hathaway (GEICO)—spent more than $1 billion in advertising expenditures in 2021 but cut back significantly in 2022, by 25 percent and 33 percent, respectively. Despite topping the $1 billion mark, Progressive and State Farm also made modest cuts to their 2022 spend, at 8 percent and 5 percent, respectively.

Progressive has nearly doubled its annual net premium written over the five years ended 2022, without sacrifices to its bottom-line profitability. As the market leader, Progressive has reported a combined ratio of below breakeven in the past five years on its personal auto business and 90.5 or better on its commercial auto writings. The company remains an outlier, though, as the other top five insurance advertisers saw their combined ratio deteriorate into triple digits in 2022.

Given Progressive’s heavy auto focus, it has had to be more effective strategically in underwriting and pricing. For example, commercial auto for some insurers may be a loss leader or a diversifying line that is written as part of a package. For Progressive, commercial auto represents 85 percent of its commercial business. Progressive also closes out claims faster than the rest of the industry, and by doing so is largely able to stay out of the court system, where the brunt of rising social inflation would be felt.

The five largest advertisers (the top four plus Liberty Mutual) by dollars spent are also among the 20 largest advertisers by advertising dollars as a percentage of direct premium written. The leading advertisers, as a share of DPW, are Amica Mutual Group, NJM Insurance Group (which ironically focuses its advertising messaging on not needing a mascot to build its brand) and Lemonade Insurance. Elephant Insurance Company, which was a top 20 advertiser in 2021 and led all insurers with their spend as a share of DPW, fell out of the top 20 in 2022. The spending by these companies reflects the importance of strategic advertising to establish their market presence.

That said, insurers may not find it beneficial to advertise for products that can’t generate an adequate return on equity. Although Progressive generated a positive ROE of nearly 7 percent in 2022, it was well below its most recent five-year average of 22 percent. The remaining top five companies by advertising spend all posted negative ROEs in 2022. In fact, 19 of the 20 largest insurance advertisers generated a return on equity in 2022 that was lower than their five-year averages, with Allianz being the exception.

While cutting advertising expenses helps to lower the underwriting expense ratio—it may also have a secondary benefit for insurers. With private passenger auto insurance struggling, insurers appeared willing to steer clear from growing their portfolios overall in 2022 and 2023. Just as insurers advertise to attract new business, cutting advertising may be part of their plans to limit expansion in private passenger auto insurance and adjust their business mix.

Auto insurers may benefit from an improvement in underwriting and operating income in 2023 on the back of highly sought after rate increases and other corrective underwriting and claim handling actions taken to strengthen their results. Progressive’s CEO noted that personal automobile insurance claims severity slowed in the third quarter as higher rates lifted premiums. Liberty Mutual also pointed to higher personal lines renewal rates, while Allstate said annualized written premiums should rise by about $1 billion on strong double-digit auto rate increases approved by regulators in California, New York and New Jersey. Berkshire Hathaway said its loss ratio improved 17 points in the third quarter at GEICO, citing the impact of higher average premiums-per-policy, increased favorable development of prior accident years’ claims estimates and lower frequency.

Next Stop: The Super Bowl

Once company financial statements for 2023 are filed, AM Best will closely analyze the performance of these leading companies and aggregate the results of all insurers underwriting these lines to determine how much bottom-line results truly improved.

As primary carriers strengthen their income, they would potentially benefit from reinsurance rates subsequently subsiding as well. Whether these improvements came early enough in the year to translate into higher advertising figures in 2023 remains to be seen, but it does increase the likelihood of higher spending in 2024.

State Farm got a Super Bowl commercial “bye” last year, as the carrier’s name was seen prominently across the Arizona stadium where the Kansas City Chiefs defeated the Philadelphia Eagles. Putting your brand in front of fans of America’s favorite televised sporting event—at nearly 100 million viewers in 2022—comes at a hefty price. A 30-second spot during the big game reportedly will cost $7 million this year.

The game in Las Vegas will be played at a stadium not sponsored by an insurer, but you can bet that insurers will maintain their usual high visibility around the event.

(Editor’s Note: This article was originally published in January 2024, before the Chief beat the 49ers in the Super Bowl, and GEICO’s Caveman and Gecko made their appearances during pregame programming.)

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers