Insurers around the world are going to be putting more of their firms’ money into private equity and green bonds this year, according to an asset manager’s recent survey of carrier investment and financial officers.

Fifty-eight percent of carrier CIOs (chief investment officers) and CFOs selected private equity among the top three asset classes they believe will garner the highest returns in 2022, according to the 11th annual Goldman Sachs Asset Management Insurance Survey titled, “Re-Emergence: Inflation, Yields, and Uncertainty.” And 42 percent said they were planning to increase their firm’s allocation to private equity investments in the next 12 months.

An equal percentage—42 percent—said they would buy more green or impact bonds over the next year as well, but regional variations put green and impact bonds ahead of private equity in Europe and Asia. In the Americas, private equity tops investment choices, with 53 percent of respondents saying they will allocate more investment dollars to that asset class, followed by middle market corporate loans and U.S. investment grade private placements (both at 48 percent). In Europe, however, 58 percent of respondents said green bonds were earmarked for greater allocation, with infrastructure debt and equity as the next two choices (38 percent and 35 percent).

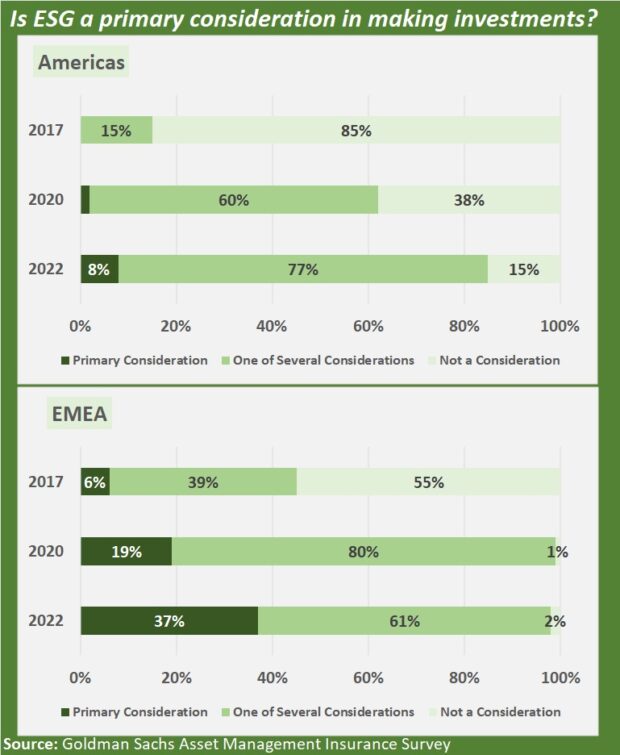

Even though green bonds weren’t among the top investment choices of insurers in the Americas (the U.S and Bermuda), the increasing importance of environmental, social and government considerations in investment choices showed up in answers to another question: Is ESG a primary consideration in making investments?

“We have been surveying on this question every year, and every single year the impact of ESG on investment considerations just continues to increase,” said Michael Siegel, Global Head of Insurance Asset Management for Goldman Sachs Asset Management during a webinar presenting the results.

In 2017, 85 percent of U.S and Bermuda carriers said it was not a consideration at all, but this year, only 15 said it wasn’t. “Europe continues to be the leader,” he said, noting that only 2 percent of EMEA insurers said ESG was not considered in investment decisions.

The survey analyzed responses from 328 participants at global insurance companies representing more than $13 trillion in balance sheet assets, which represents around half of the balance sheet assets for the global insurance sector, Siegel said. Property/casualty and multiline insurers and reinsurers accounted for 57 percent of respondents.

Responding to a CM question about investment preferences by sector, Siegel did not have breakdowns of P/C vs. life but said that P/C carriers tend to have more capital on their balance sheets, and as a result are able to invest more in public and private equity. Life companies, with longer liabilities lean into investment grade private placements, commercial mortgage loans, and infrastructure debt, he said.

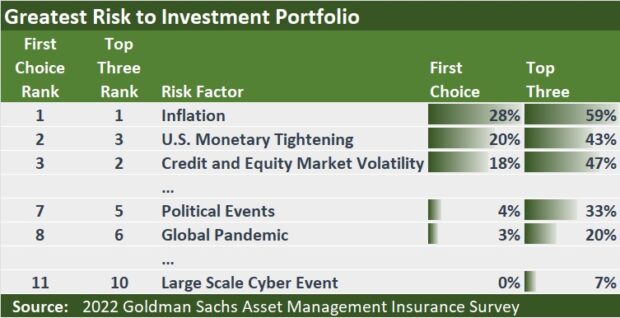

In addition to the ESG question, Siegel said that Goldman Sachs asks insurers to identify the greatest risks to their investment portfolios, noting that inflation topped the list for the first time in 11 years, with 28 percent ranking it first, and 59 percent in the top three. Monetary tightening and volatility in the credit and equity markets ranked behind inflation among carriers’ risk concerns.

Political events and the global pandemic ranked much lower. Between the two, political concerns overshadow the pandemic, however, with 33 percent putting political events in the top three risks to their investment portfolios and 20 percent saying that pandemic is a top-three risk.

Siegel noted that the survey was conducted in mid-to-late February, when “the Russian-Ukraine difficulties were in the press and being discussed in the market, but the invasion had not yet started.”

The survey also asks carriers their views on assets believed to be the best inflation hedges (real estate, floating rate assets and equities), expected interest rate levels, the likelihood of a recession (two-thirds expect it in 2-3 years), investments in InsurTech (Asia predominates) and overall investment risk appetites. For the first time this year, Goldman Sachs also asked about carrier interest in investing in cryptocurrencies. “We did this because every time we meet with companies, they ask us about cryptocurrency, how to think about it,” Siegel said.

“Ninety-four percent said ‘not considering,’ but that means 6 percent are either invested or considering” cryptocurrency investments,” Siegel said, adding, “I will be quite frank with you. I was surprised by this result. I thought that there would be far fewer consider considering investing in crypto. But we see 2 percent of the global industry is invested another 4 percent are considering.”

“In our dialogues with the companies that are invested or considering, the primary motivation is to understand the instrument, to understand the market and, in particular, to be prepared if it becomes a more dominating market—and maybe, at some point, premiums are denominated in crypto, companies want to understand that,” he said, characterizing a lot of the investment as experimentation.

On a different survey question, when asked which asset classes would provide the best and worst returns for 2022, Siegel reported another result he found confusing: 9 percent of the companies thought that crypto would be one of the top three asset classes and a 22 percent thought it would be one of the three lowest returning asset classes.

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit