U.S. hurricane is the peril most likely to cause the largest insured catastrophe losses and therefore financial impairment for insurance companies that are not adequately prepared. To date, rating agencies have relied most heavily on the 1-in-100-year PMLs (probable maximum losses) in the catastrophe components of their financial strength rating methodologies. These PMLs have also been used to determine reinsurance requirements.

Executive Summary

Rating agencies are revising how they incorporate catastrophe loss information into their rating methodologies. Starting this year, information on large loss potential beyond the PML will be used explicitly in the financial solvency ratings produced by A.M. Best and Demotech. Risk expert Karen Clark discusses these changes and how they could impact reinsurance purchasing and the ILS market.The past 10 years have been relatively light with respect to U.S. hurricane activity. According to historical averages, a Category 4 hurricane makes landfall about once every seven years, but it’s been 11 years since a hurricane of this intensity has crossed the U.S. coastline. During this time, insured coastal property values have continued to grow, and should a major hurricane strike the “wrong” place, insurers with significant exposure concentrations could experience losses far exceeding their reinsurance protections.

Rating agencies are now acting on the fact that the 1-in-100-year PMLs do not tell the whole story when it comes to large loss potential. In particular, the PMLs are highly uncertain numbers that can mask exposure concentrations and give a false sense of security. The opaque models and third-party processes typically employed to estimate the PMLs serve to accentuate the uncertainty surrounding these loss estimates.

For these and other reasons, new rating agency formulas will be introduced in 2017. A.M. Best’s proposed new methodology will use return periods beyond the 1-in-100-year PMLs as rating metrics. While insurers have been providing A.M. Best with longer return periods for several years, until now, those numbers have not factored explicitly into the BCAR (Best’s Capital Adequacy Ratio). Demotech is also adding new risk metrics to its financial stability rating methodology.

New rating agency formulas will likely have a greater impact on insurers that have exposure concentrations and higher likelihoods of solvency-impairing losses. This could increase the demand for more tailored risk transfer solutions.

The New Rating Agency Methodologies

The existing BCAR is calculated as the adjusted surplus divided by the net required capital. The largest net 1-in-100-year hurricane PML is subtracted from the adjusted surplus, and the BCAR must be over 100 for a secure rating. A.M. Best’s stress tests also use the 1-in-100-year PML for the U.S. hurricane peril.

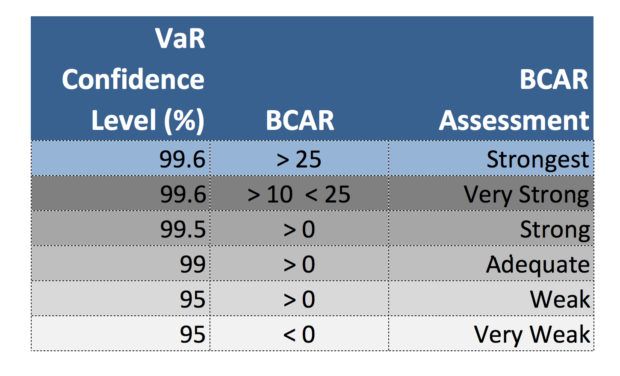

Under the new proposed BCAR methodology, catastrophe losses will factor into the formula for net required capital, and the 1-in-200- and 1-in-250-year PMLs (99.5 and 99.6 VaRs, respectively) will be used along with the 99th and 95th percentile points from the exceedance probability (EP) curves.

The proposed BCAR formula is:

The BCAR will be assessed as follows:

If a property insurer has larger 99.5 and 99.6 VaRs relative to the 99 VaR, that can be an indication that the company has more concentrated property values and may be more exposed to solvency-impairing losses from a single event.

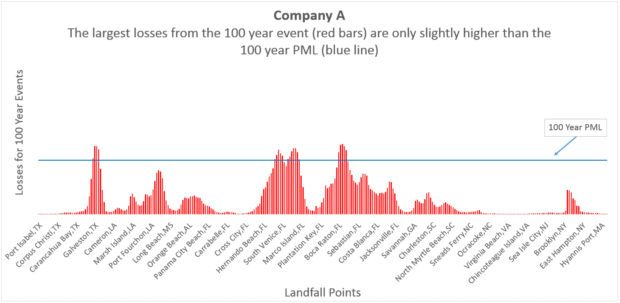

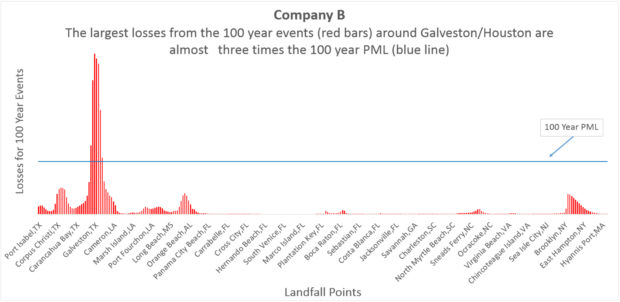

For example, the two sample companies in the illustration below have similar 1-in-100-year PMLs (99 VaRs) and reinsurance protections but very different risk profiles. The charts show the losses these companies would experience using the same set of hurricane events occurring at 10-mile spaced landfall points along the coast. Company A is more diversified geographically and is not as exposed to a single-event loss significantly exceeding its reinsurance protections as Company B.

The hurricane events used to compare the companies are the 100-year CEs (characteristic events). CEs are defined probability events in which the parameters are based on the hazard at a specific location. For example, the 100-year hurricane CE will be a much weaker storm in the Northeast than in the Gulf region.

The CEs illustrate how an insurer’s loss potential varies by geography, and they provide consistent metrics for comparing insurers on an “apples-to-apples” basis. In the past, these companies may have been treated similarly by the rating agencies with respect to catastrophe loss potential. But under the new proposed A.M. Best methodology, Company B will have higher 99.5 and 99.6 VaR losses relative to their 99 VaR losses and so will have a lower BCAR score than Company A.

Demotech is revising its rating methodology to incorporate the CEs more directly. The CEs will provide enhanced differentiation between companies with respect to large loss potential.

How the New Rating Agency Formulas Could Impact Risk Transfer Decisions

If an insurer’s exposure concentrations will result in a lower rating under the new methodologies, the company can either employ underwriting guidelines to reduce exposure concentrations or transfer the risk using reinsurance or the insurance-linked security (ILS) market.

Traditional catastrophe reinsurance provides horizontal geographical coverage and vertical financial coverage for individual event losses. A typical reinsurance tower may cover $1 billion in excess of $100 million. Because of this fixed structure, Company A and Company B will get very different protection from the same reinsurance program.

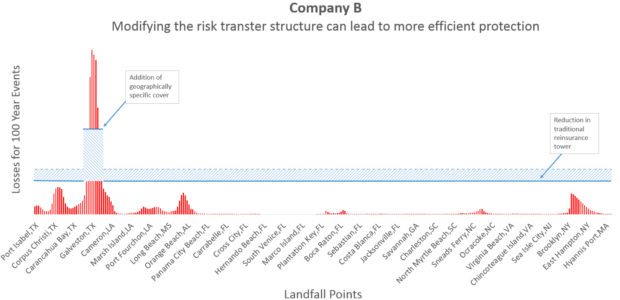

Given its exposure concentrations, Company B may need more reinsurance to keep its rating. But is another layer of traditional reinsurance the most efficient type of protection for this company?

Essentially, Company B is likely only to experience a solvency-impairing loss if a major hurricane makes a direct strike on Galveston-Houston. The 100-year hurricane loss anywhere else along the coast does not approach the top of Company B’s reinsurance program.

Instead of broad horizontal geographical coverage, Company B can consider more regionally focused protection. For example, by reducing the traditional reinsurance tower by $200 million, Company B can potentially use the savings to buy over $500 million to cover hurricanes making landfall along a defined stretch of coastline and thereby more effectively covering peak exposures as shown in the illustration below.

This type of cover can be purchased as part of its reinsurance program or separately as an insurance-linked security. The ILS market generally favors transactions with the following characteristics:

- Transparency.

- Easy to calculate.

- Quick to settle after an event.

- No moral hazard.

- Peril and region specific.

Detailed analyses can be conducted to determine the threshold hurricane wind speed that will likely cause Company B to experience losses over the top of its traditional reinsurance program from a Galveston/Houston event. By further refining the transaction, the likelihood of a trigger decreases, which should lead to a lower price to the insurer.

CEs clearly highlight for insurers the geographic regions and types of events driving tail risk. These metrics provide essential information for managing large loss potential through underwriting and risk transfer decisions.

From an ILS investor’s perspective, an “indexed-CE” type of transaction is very transparent and easily understood. Investors can build their own portfolios of geographically specific securities and take on as much risk as desired. A uniform structure will make these covers easy to trade and will lower transaction costs, which have already been falling in the ILS market.

Meeting the Challenge

Rating agencies are enhancing their financial strength rating formulas with respect to catastrophe and other risks. While these formulas are important, the rating agencies typically stress that other, more subjective factors are equally important and that the rating process is not a purely numerical exercise.

Nevertheless, the push for additional information on catastrophe loss potential is leading to more focus on how property insurers are identifying and managing exposure concentrations. Rating agencies don’t want to be surprised by financial impairments resulting from hidden pockets of aggregate accumulations. The new formulas and methodologies being introduced this year will not impact all companies, but they will better differentiate insurers with respect to their catastrophe-exposed business.

Insurers can employ underwriting guidelines to reduce exposure concentrations or transfer the risk using traditional reinsurance or the ILS market. Traditional catastrophe reinsurance is more of a “one size fits all” type of cover, while ILS transactions can be easily tailored to an insurer’s specific book of business. If widely available, geographically specific ILS transactions could also become the most efficiently priced form of protection.

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs