“We’re going to see more changes in the next 25 years than we’ve seen in the last 100,” a futurist told a group of insurance professionals at an industry meeting last week.

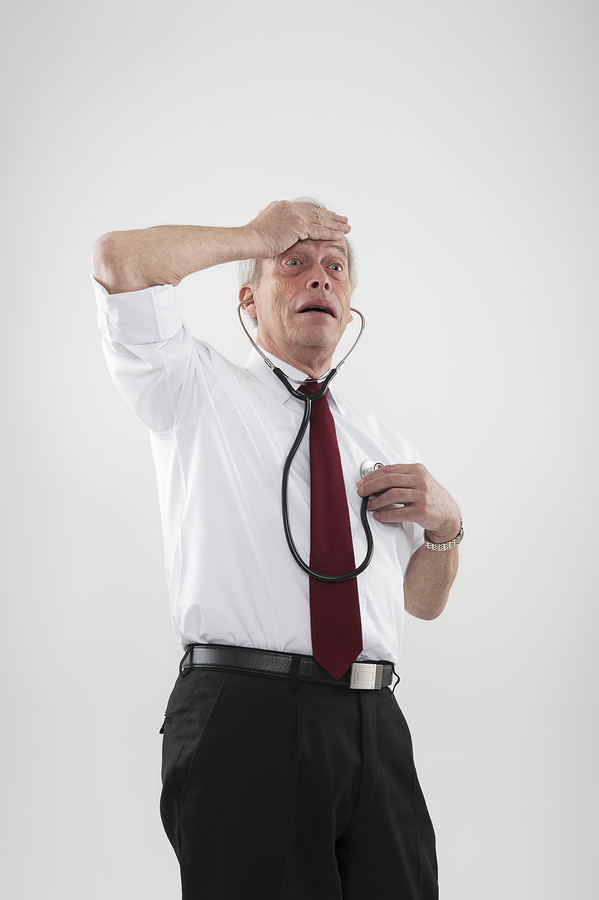

The pronouncement by futurist Jack Uldrich at the Casualty Actuarial Society’s Centennial meeting may have frightened some of the more than 2,000 actuaries gathered for the event, but it was his presentation of one change in the works that drew a gasp from the crowd. The audible reaction came during a session titled “How to Think Like a Futurist,” when Uldrich showed a video in which a speaker described a combination of technologies that will allow a smartphone user to receive a heart attack ringtone alert well in advance of a coronary episode.

Uldrich prefaced the video with a discussion of Siri, the intelligent personal assistant on Apple’s iPhone that answers questions posed by phone users. “What you have to appreciate is that the computer processes and algorithms behind Siri may allow artificial intelligence to get 1,000-times smarter in the near future. We can go from a world where we ask our phones questions and get answers to a world where our phones and devices and environment know us so well that they tell us things we need to know before we know to ask the question,” he said.

Uldrich prefaced the video with a discussion of Siri, the intelligent personal assistant on Apple’s iPhone that answers questions posed by phone users. “What you have to appreciate is that the computer processes and algorithms behind Siri may allow artificial intelligence to get 1,000-times smarter in the near future. We can go from a world where we ask our phones questions and get answers to a world where our phones and devices and environment know us so well that they tell us things we need to know before we know to ask the question,” he said.

Earlier in the session, he discussed sensor technology and nanotechnology and computers that are small enough to embed in pills that humans can ingest to monitor health conditions. Putting the trends Uldrich described together, the video narrator described a project that will use a nanosensor smaller than a grain of sand to pick up a signal in someone’s bloodstream when cells are coming off the artery lining—the precursor to a heart attack—prompting the special heart attack ringtone on a phone.

Trend #1: Wearable Technology

Example: Google glass is being used in the insurance industry today by claim adjusters to record exactly what they’re seeing as they report results of visual inspections back to their offices, Uldrich said.

Uldrich did not identify insurers but displayed a video from technology service provider Cognizant demonstrating the claims-handling application.

Trend #2: 3D Manufacturing

Example: In China, a construction company is building 10 houses a day using a 3D printer, Uldrich said, as he showed a video of the process (available on theguardian.com.)

The unspoken implication is that this could totally transform the nature of construction insurance risks.

Trend #3: Nanotechnology

Example: A thin, strong nanomaterial known as graphene can be used to turn on a small light bulb, according to another video (available here). “The amazing thing is it doesn’t stop working. After charging for two or three seconds, we ran the light for over five minutes,” said a professor of biology and chemistry speaking on the video. “I thought the world changed at that point.”

Example: A thin, strong nanomaterial known as graphene can be used to turn on a small light bulb, according to another video (available here). “The amazing thing is it doesn’t stop working. After charging for two or three seconds, we ran the light for over five minutes,” said a professor of biology and chemistry speaking on the video. “I thought the world changed at that point.”

Uldrich suggested what is so transformative about the five-minute illumination with these questions: “What if you could charge up an electric vehicle not in four hours but in less than 30 seconds? Is that a game-changing technology?”

Uldrich didn’t address the possible implications for liability insurers of the graphene producers nor the changes in automobile insurance risks.

Trend #4: Robotics

Examples: Starting from a base of hundreds of thousands of robotics applications today, “we’re going to grow potentially to hundreds of millions within the next decade,” Uldrich said, introducing a robot known as Baxter used in manufacturing, which he said was now available for $20,000. “It’s being purchased by small- and medium-sized manufacturers throughout the world. They’re using that technology to remain competitive with low-cost labor,” he said. (Editor’s Note: Various reports in NPR and USA Today in 2013 had put the cost in the $22,000-$25,000 range last year.)

Uldrich presented more familiar examples of robotics technology—Google’s self-driving car (now legal to drive in the states of California, Florida and Nevada) and drone technology that could be used by Amazon to deliver products ordered from the online retailer. A less well-known example is a “soft exoskeleton” developed at Harvard “that you wear like a pair of pants.” (Video available here.)

Here, Uldrich explicitly cited a potential implication for insurers: Workers comp claims might go down for workers who get injured lifting heavy things. “This technology is going to allow nurses to lift a 350-pound patient,” potentially also lowering liability claims related to patient pressure ulcers.

Trends #5: Sensors

Examples: According to Uldrich, the number of computer chips, or radio frequency identification chips, embedded in our physical environment is exploding—from a base of millions today to billions by the end of the decade. The Minnesota resident recalled the 2007 collapse of a bridge in Minneapolis and noted that the bridge has since been rebuilt with 400 sensors. “We made it a smart bridge.” (See, for example, Oct. 15, 2010 report on cnn.com titled, “Is this the ‘safest bridge in America?'”)

Noting that the terms “Internet of Things” and “The Industrial Internet” are being used to describe the attachment of sensors into physical objects, Uldrich noted that GE, which used the latter term as the title of a report published 18 months ago, sees this world of smart objects as a $15 trillion opportunity for businesses.

Uldrich went on to show a video of a television commercial by CISCO, another leading provider of the Internet of Things. The voiceover includes the following narrative:

“Trees will talk to networks that will talk to scientists about climate change. Cars will talk to road sensors that will talk to stoplights about traffic efficiency. The ambulance will talk to patient records will talk to doctors about saving lives….it’s not that far away.” (Video available here.)

Uldrich commented: “Just think about some of the applications. A couple of years ago, PG&E had a tragic gas explosion in San Bruno, Calif. If we put sensors on pipes, the ability to predict problems before they happen is going to be a real possibility.”

He also referred to tragic mudslides in the Northwest U.S. earlier this year, reporting that IBM is already putting low-cost sensors in hills to send warnings in advance of mudslides.

“This technology is going to change how we think and understand our world, and it has implications for a lot of the work you do,” Uldrich told the actuaries. He went on to give a more familiar example of sensor technology at work in the insurance industry: Progressive’s Snapshot, designed to monitor driving behavior of auto insureds with their permission, potentially saving them money on premiums. Beyond that, the P/C insurance implications of fewer homeowners claims from mudslides, auto and liability claims from bridge collapses and explosions become apparent from a review of articles and videos on recent disasters:

- Emerging Risks: Deficient Bridges (video)

- Four Victims Sue Consulting Firm in Minnesota 35W Bridge Collapse

- Insurers Prepared for Claims from Fatal Minneapolis Bridge Collapse

- Homes Damaged by Washington Flash Floods, Mudslides

- Workers Sifting Debris at Site of Washington Mudslide

Trend #6: Gene Sequencing Technology

Examples: Uldrich told the audience that gene sequencing technology—the technology that alerted Angelina Jolie to high likelihood of developing breast cancer last year—has been doubling in capacity every four months.

Examples: Uldrich told the audience that gene sequencing technology—the technology that alerted Angelina Jolie to high likelihood of developing breast cancer last year—has been doubling in capacity every four months.

Suggesting that the cost was roughly $150 million when Dr. Craig Venter embarked on a genome project in 2007, Uldrich said the doubling of capacity means the cost is also cut in half every four months. If you cut $150 million in half every four months starting in 2007, at the end of 2012 it’s down to $10,000. At the end of last year, $1,000.

“And by the end of the decade it is estimated that it’s going to be more expensive for you to flush your toilet then it is to sequence your genome.” (Editor’s Note: Sources like Wired cite experts from Singularity University drawing the analogy to the pennies it costs to flush a toilet. However, the $150 million cost starting point that Uldrich referred to seems to date back a decade earlier. Several reports in 2008, including a New York Times article,”Gene Map Becomes a Luxury Item,” March 4, 2008, put the cost at that time at roughly $350,000.)

Uldrich noted the huge implications for the health care and pharmaceutical industry. He also noted the prospect of easing world hunger problems with genetically modified wheat and corn that can be grown with little water or pesticides.

See related video, Emerging Risks: Genetically Modified Organisms, for more on the risk and P/C insurance implications.

Trend #7: Computers

Example: “A lot of us think because we have PCs and laptops and smartphones that we have lived through the Computer Revolution. We’re only a fraction of the way through it,” Uldrich said, referring to the computer processing advances behind the heart attack alert (described earlier) and accident detectors in automobiles. He showed a video of a commercial for the Infiniti Q50 in which a woman driving a car receives a warning of a collision two cars ahead of her. (Video available here.)

“This is where we are today [with] sensor technology and laser technology that actually goes under that truck [ahead of her], preventing a problem before that driver even knows she has a problem.”

Trend #8: Big Data

Examples: All the sensors in all our devices are creating an astounding amount of data, Uldrich said. Among the users of this data are Google and Amazon.

Referring to Google’s purchase of Nest Labs, a thermostat company, for more than $3 billion earlier this year, Uldrich explained that Google doesn’t want to be in the thermostat business. “They want to be in the data business.”

The devices learn homeowners’ behavior—when they wake up, go to work, return home—and adjust the lighting and temperature accordingly. Beyond that, however, Google can take that data (with the users’ permission) to utility companies. On really hot days when a utility might have to fire up an auxiliary power plant to prevent a blackout, Google can turn down the air conditioning in homes of people who have a Nest, he said.

Uldrich went on to play a video clip of a “60 Minutes” interview with an executive of Amazon to demonstrate how the company is making use of its massive amounts of consumer data. During the interview, Amazon Vice President Dave Clark stated: “Anything you want on earth, you’re going to get from us,” suggesting that Amazon’s ultimate goal is to deliver things to customers before they even know they need them.

“It’s not just products. It could be insurance; it could be services. Anything,” Uldrich said.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  The Future of HR Is AI

The Future of HR Is AI  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation