Mobile phones are a part of us now. Most of our lives are spent within inches of a mobile device. We need them almost like we need food and water. They allow us to run most of the logistics of our life wherever we may be. They allow us to constantly communicate — merging life and work into a seamless fabric. For good or bad, our lives are now less compartmentalized and more integrated into a unified flow of information, work, wellness, communication, purchasing, entertainment, and upkeep.

However, phones and mobile services are more expensive than ever. This has placed mobile phone service providers under increased customer value scrutiny, especially because there are so few providers and so many subscribers. The sheer volume — the ratio of subscribers to providers — is staggering. It has stretched mobile provider billing systems and it has frustrated millions of customers. It has also made competition fierce.

Think about your own mobile provider experience, especially about billing and service. Since the big three (AT&T, Verizon, and T-Mobile) mostly carry the same phones, they are now in a situation where value, service and billing are possibly the greatest determiners of customer loyalty and retention. What drives you to stay or switch? Are you all about cost or do you prioritize using a customer-friendly brand that makes mobile use a rewarding experience and offers other value?

Customer loyalty is fragile in any industry; insurance is no exception.

Great customer experiences, interfaces, easy transactions, and intuitive service can build your brand and enhance customer loyalty. Customer service issues: whether through billing and payment of policies or claims payments, can drive customers away. Customers still, figuratively, vote with their feet.

Roundtable perspectives on insurance billing and payments

Deloitte and Majesco hosted a roundtable with experienced billing and payments industry leaders to discuss the market trends and subsequent strategies and tactics to elevate billing and payments as a key part of the customer journey and experience. We documented some of the findings and many of the roundtable discussions in a recent thought leadership report, Rethinking Billing and Payments in the Digital Age.

In a day and age where competition is as stiff as it has ever been, most of our participants agree that billing and payments deserve closer scrutiny, greater attention, and higher priority so that it reaches its full potential as an efficient, effective brand builder.

Stepping Up to the new era of customer billing and payment expectations

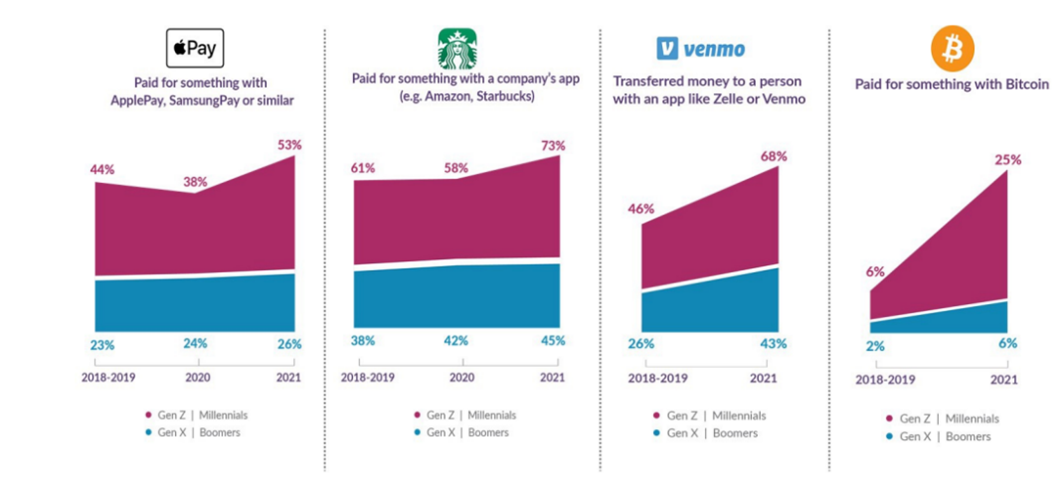

We see it across all industries and businesses – customers are paying attention to how they are billed and paid. Their expectations, whether met or unmet, are one determining factor in whether they choose to switch to or stay with an insurer. These expectations are being driven by an ever-growing set of options that encompass everything from customizable billing schedules to digital payment methods like ApplePay, Venmo, company apps, and others to make or accept payments. At the same time, customers are expecting a seamless digital experience.

Majesco’s customer research, reflected in Figure 1, highlights the growing demand for these alternative payment methods, particularly for Gen Z and Millennials.

Figure 1: New Customer Digital Commerce Expectations

While insurers must adapt their strategies to be digital-centric, some customers still prefer writing a check. As one roundtable participant said, 70% of P&C payments in their line of business are made via check – an astounding number considering how many people have adapted to digital options. To retain trust and loyalty, and keep revenue unobstructed, insurers must meet all billing and payment options.

These rising expectations accelerate the shift of billing and payments from its traditional role as one of the most “back office” processes to the “front office” as a crucial capability in delivering a great customer experience. Insurers increasingly realize the significant role that billing plays. They are waking up to the fact that exceptional service is important beyond the financial operation. First-rate service is crucial to building and enhancing relationships with customers, partners, and distributors. In today’s increasingly digital world, legacy billing systems do not meet these growing needs and expectations.

Cultivating customer experiences that support the brand.

Advanced billing and payment capabilities can no longer be viewed simply from a transactional perspective, but now must fill a crucial role in creating an inviting and holistic digital experience. Every touch point is an opportunity to humanize and personalize the brand relationship and strengthen brand trust and loyalty.

In rethinking billing and payments, insurers are focused on key business priorities including:

- Customer experience – The prevalence of digital buying and payment options across other industries, heightens the expectation for insurance to deliver similar capabilities to be “on par.” Insurers compete with outside experiences.

- Transparency and flexibility – Customer trust is influenced by transparency.

- Customers are looking for a single bill for multiple policies, regardless of product or segment.

- New products such as usage-based or gig insurance (which reflect reality, not estimates) require more frequent and personalized pricing and billing.

- Customers want to run scenarios. Can they preview the impact on bills if they change plans or options?

- Advanced analytics for brand management – Insurers want insight into:

- Propensity to renew or lapse.

- Likely response rates for cross-sell or upsell offers.

- Customer experience satisfaction.

- And, profitability for proactive/responsive business management.

- Value-Added Services – Increasingly insurers are looking to enhance the customer relationship and grow revenue by offering value-added services. The billing and payment options for these services often require different approaches than traditional risk products.

Communication is critical.

Timely, frequent, and personalized digital communication is equally as important.

Digital channels like voice, smart speakers, email, or text/SMS are increasingly used to enhance the relationship and experience. Communications are no longer limited to billing statements or payment statuses. Frequent communication regarding other products or value-added services is acceptable. How are insurers becoming helpful, not just transactional? Suggestions regarding alternative billing options that might better align with a customer’s life may provide greater customer personalization and engagement. It is increasingly important to avoid policy lapses or late renewals.

“Payments, from a billing perspective, is the most frequent touchpoint that you have at any given point with your insurers. This is the opportunity to have that great customer experience, where they say this was easy, this was frictionless.” – Roundtable Participant

Insurers must strategically and tactically begin to bring billing and payments into customer experience and digital engagement plans. A diverse set of digital payment options, advanced technologies, and a coordinated mix of digital communication methods will lay a solid foundation and meet the growing expectations of customers, agents, and partners.

“We’ve created an organizational change management team underneath our chief experience officer. They are building out an entire portfolio of messaging. We want to understand the obstacles that people see. If we can get that information and speak back in terms they are using, we can influence them to the environment we want.” – Roundtable Participant

Digital billing and payments: where do insurers begin?

Digital billing and payments can re-energize an insurer’s ability to meet retail trends head-on.

To get to the next level and rethink billing, they needed to overcome hurdles like crippling legacy debt that hinders their effectiveness and customer experience as it relates to billing and payments and rethink their future state. What opportunities would arise if insurers could become highly digital, with a new operating model and a solid, yet flexible technology foundation?

Deal with the hurdle of legacy debt.

One of the critical hurdles for digital transformation is legacy debt – both the operating model and technology – stifling an insurer’s ability to meet customer digital expectations, expand billing and payment options and drive down operational costs. An insurer’s legacy debt removes the ability to launch new, innovative products such as embedded, on-demand, UBI, and value-added services due to the limitations of the technology. Billing technology like Majesco Billing for P&C, Majesco Billing for L&AH, Majesco Digital Electronic Bill360 for P&C and our ecosystem of partners enables, not inhibits.

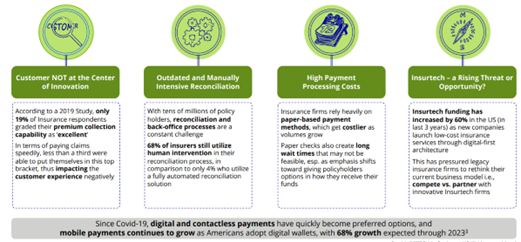

Each of the areas reflected in Figure 2, highlights the market trend challenges and operational realities of legacy debt.

Figure 2: Current state of payments in the insurance sector

Addressing the current state requires a strategy and plan that tackles the operational model, including all processes, technology, and culture. Today’s customers expect their preferred brands to instinctively update their processes and transaction capabilities to keep up with what their devices and lifestyles have made possible.

They want a risk product, value-added services, and an experience that provides them with what they need to manage their lives. Insurers must humanize the process and experience. But traditional product-oriented strategies handicap insurers. Insurers need to “think outside their own boxes” and keep customer lifecycles and needs in focus.

Insurers that pay attention to these shifts should take the next step and make quick moves to remove their crippling legacy debt.

Unify the technology strategy and customer-focused tactics.

The future state demands an operational model and technology that provides a foundation to adapt, innovate and deliver at speed to execute strategy and market shifts. The rising importance and adoption of platform technologies, APIs, microservices, digital capabilities, new/non-traditional data sources, and advanced analytics capabilities are now crucial to market leadership.

From the front office to the back office, SaaS next-generation platforms are reshaping the business focus from policy to customer, from process to experience, from static to dynamic pricing, from point-in-time underwriting to continuous underwriting, from the historical view of data to predictive and prescriptive data, from traditional products to new, innovative products, and so much more. Insurers’ ability to deliver increased value to the customer relationship will deepen and differentiate customer loyalty.

Central to the increased value is improving customer choices, yet with choice comes complexity. This complexity can be simplified, managed, and optimized with a next-gen billing and payment unified strategy.

A unified billing and payment strategy provides a holistic, enterprise approach to business capabilities, processes, and customer engagement. It moves billing and payments from the back office and a defensive position to the front office and an offensive position for customer engagement, leading to higher satisfaction, loyalty, and retention.

Traditional example: Direct and Agency Bill

Direct and Agency bill are two of the most used billing types. Direct bill is when an insurer sends the bill to the policyholder for payment directly to the insurer. In contrast, agency bill the agency bills the insured and collects the premium then pays the insurer. Specific processing is required to support both of these. There are other types of billing including list or group bill, third party bill (such as mortgagees), and split or multipayer billing.

While these continue to be dominantly used, as products change and how premium is calculated – more frequently or in real-time – innovative billing options are emerging. Insurers must be able to support these new options to meet product demands of customers.

Innovative example: Computable contracts

One tactic of an offensive strategy that is being considered by some companies is including the ability to have computable contracts (putting the policy agreement into code) for each policy. For example, a rock hits your windshield. You take a picture and submit a claim. Because the data about your car and policy are known through this computable contract, the payment can flow immediately and digitally. The process is fast, and it naturally reduces operational costs.

Innovation focused on the customer can drive additional offensive plays while accelerating transformation. Creating a holistic customer experience not only provides digital billing and payment options, but also enables broader communication and engagement including cross-sell or up-sell of policies with additional products, amendments, or value-added services based on their unique demographics.

Innovative example: Buy now, pay later.

Inflation is causing customers to evaluate all their expenses. As a result, some are considering alternative financing options such as Buy Now, Pay Later (BNPL). BNPL is a relatively low-cost, flexible credit option that provides faster access to credit compared to other unsecured loan products, thereby reducing uncertainty and easing purchase decisions for customers.

This option is primarily driven by Fintechs who are offering access to credit for customers with low credit scores. It gives them the products they need with a lower up-front responsibility. They receive:

- Instant gratification (unlike layaways).

- Better cash flow management through flexible repayment plans & interest rates (0-30%).

- A significantly more private and safe transaction that is less costly and more accessible than credit cards.

It is estimated that 40% of customers expect installment loans as a payment option, but in major downturns, Deloitte estimates that installment loans can act as an important bridge for over 90% of customers.

This payment option could be a consideration in helping people pay large premiums. For some insurers, this kind of tactic may not seem crucial. However, if you consider that part of brand building is making transactions easy and painless, it fits squarely within the insurance brand strategy.

In our next article, we’ll look at how insurers can arrive at the future state. How can insurers choose and use the right combination of billing and payment technologies that will fit customer-focused strategies and build the brand through the best possible experiences? Deloitte and Majesco together are working forward thinking, leading insurers in the industry, to rethink their billing and payments operation and technology to elevate their brand and customer loyalty in a world of rapidly changing expectations.

For a deeper look, be sure to download the Majesco/Deloitte report, Rethinking Billing and Payments in the Digital Age.

Today’s article is co-authored by Denise Garth, Chief Strategy Officer at Majesco, and Ajay Radhakrishnan, Principal, Deloitte Consulting

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Preparing for an AI Native Future

Preparing for an AI Native Future