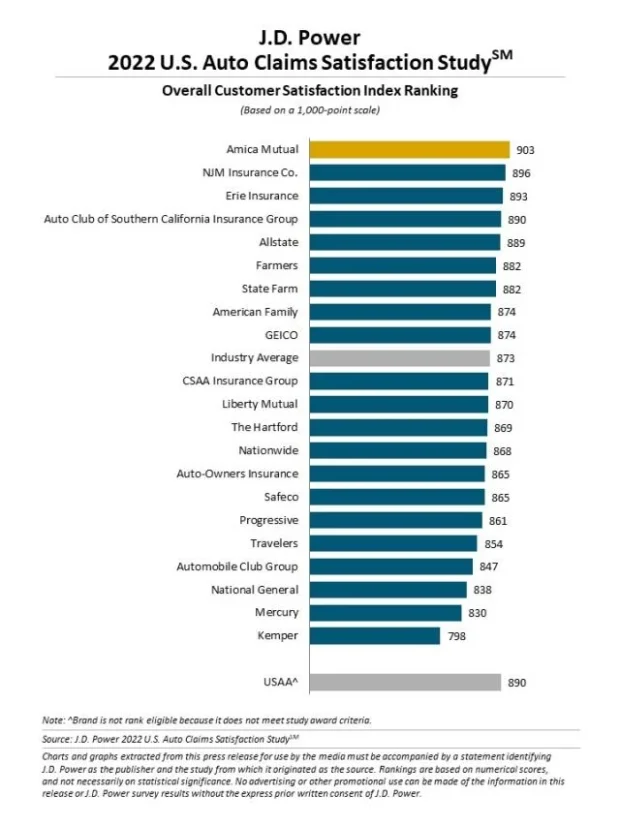

Customer satisfaction with the auto claims process has eroded after four consecutive years of improvement, dropping 7 points to 873 (on a 1,000-point scale) compared to 2021, according to the J.D. Power 2022 U.S. Auto Claims Satisfaction Study.

J.D. Power said that while customer satisfaction is down across nearly all factors in the study, satisfaction with the repair process showed a 9-point decline—the first time a majority of customers cited supply chain issues as the reason for delays in getting their vehicle back on the road. The average repair cycle time is nearly 17 days, J.D. noted, compared with a pre-pandemic average of about 12 days.

“Insurers are in a tight spot with their own profitability strained and a host of external factors causing their customers to grow increasingly disillusioned with the entire claims experience,” said Mark Garrett, director of global insurance intelligence at J.D. Power. “The best way forward is for insurers to start focusing on carefully managing customers’ expectations and fine-tuning their digital engagement strategies to shepherd their customers through the process.”

Expectation management is key to customer satisfaction. The satisfaction score was 837 when customers had to wait more than three weeks for their repair. However, when customers were provided an accurate time estimate beforehand, that score jumped 71 points to 908. J.D. Power advised being empathetic to customers throughout the process, especially for longer-tailed claims.

Claims servicing is not one size fits all. One-third of customers would prefer working with people rather than using digital communication; however, satisfaction is 31 points lower than among those who are equally comfortable with both channels.

Not all digital experiences are created equal. Satisfaction was 56 points higher when digital was used for delivering status updates, with those using text messaging having the highest levels of satisfaction. However, when digital was used to report first notice of loss via the Internet or mobile app, overall satisfaction fell 4 points.

Amica Mutual ranked highest in customer satisfaction with a score of 903. NJM Insurance Co. (896) came in at No. 2, followed by Erie Insurance (893) in third place.

The 2022 U.S. Auto Claims Satisfaction Study is based on responses from 8,239 auto insurance customers who settled a claim within six months of participating in the survey. The study excludes claims for only glass/windshield damage or those who only filed a roadside assistance claim. The study was fielded from November 2021 through September 2022.

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb