Claims can be a high-stress and high-stakes process for carriers and policyholders. Often called the “moment of truth,” the claims process can dictate the moment when the client is secured for life or lost to a competitor. Issues or inefficiencies can likewise cost a carrier hard dollars in addition to client loyalty.

Executive Summary

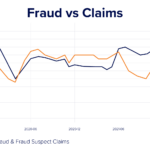

Losses due to claims inefficiencies or failures can be referred to as claims leakage, meaning profit that is lost to carriers through things like inaccurate assessment of total damage, determination of repair costs or findings of fraud. Elizabeth Del Ferro, vice president and general manager for Nearmap, writes that minimizing claims leakage is crucial to the success of a carrier. In this article, she explains how high-resolution aerial imagery can be help carriers avoid claims leakage.Such loss can be defined as claims leakage, or profit lost through inefficiencies or failures in carrier processes such as inaccurate assessment of total damage, determination of repair costs or findings of fraud. Minimizing claims leakage is crucial to the success of the carrier. One solution that addresses needs across the claims process is the location intelligence that can be derived from high-resolution aerial imagery. By leveraging this intel, carriers can find efficiencies and mitigate loss at this crucial junction for policyholders.

First Notice of Loss and Damage Assessment

The first opportunity to streamline operations and proactively address possible claims leakage is the policyholder’s first notice of loss. The intel derived from quality aerial imagery such as a historical view of tree overhang, structural measurements and roof condition can allow carriers to save time and resources with remote inspections. Adjusters can use the intel to evaluate the impact and loss from their desks rather than delaying settlement by sending an adjuster out to conduct an on-site inspection.