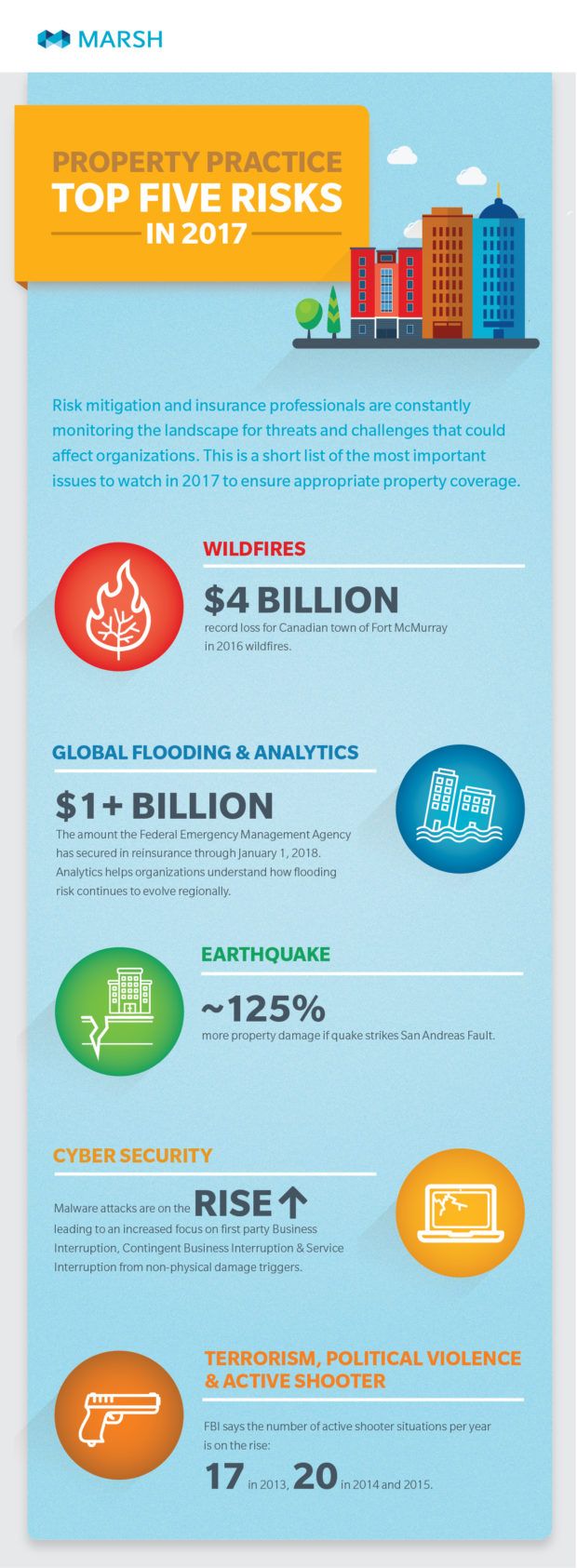

Insurers in the U.S. property insurance market may want to consider that three of the five major risks Marsh has highlighted as big worries in 2017.

Wildfires, global flooding and earthquakes are all major points of concern over the coming year, Marsh said. The firm also warns that cyber-attacks and terrorism/political violence/active shooters will be a worry for the U.S. property market.

Duncan Ellis, leader of Marsh’s U.S. Property practice, elaborated in a Feb. 21 blog posting why each of the five items made Marsh’s “5 Risks to Watch” list.

Floods, Ellis said, are the costliest natural hazard in the U.S., but the risk is moving, geographically speaking.

“This risk is slowly changing – growing in the northern half of the U.S. and declining in the south,” Ellis noted. Underscoring the importance of this risk and the associated costs to come, he noted that the U.S. Federal Emergency Management Agency (manager of the National Flood Insurance Program) has nailed down $1 billion in reinsurance to help deal with major storms between Jan. 1 2017 and Jan. 1. 2018.

Wildfires are also a major U.S. property risk now, thanks to droughts that Ellis pointed out could worsen through 2017.

“The southern plains will see an increase in seasonal wildland fire activity beginning in February,” Ellis wrote in his blog posting. “And although winter precipitation there was higher than normal, parts of California remain dry.”

Earthquakes made Marsh’s list, with Ellis pointed out that catastrophe modelers are working hard to understand and address evolving risk concerns in this area.

“Both major modeling vendors continue to learn more about ongoing seismic activity, actual losses and construction innovations,” Ellis said. “New models expected to be released this year will incorporate these findings and include the latest information around fault systems, ground-motion decay, and vulnerability enhancements.”

As far as terrorism/political violence/active shooters, Ellis pointed out that “buyers and underwriters are keenly aware of the potential for a terrorist attack” in central business districts even with the stability the market gained after Congress renewed the Terrorism Risk Insurance Program Reauthorization Act through 2020.

Cyber Security scores high on the list, Marsh said, in part because malware attacks such as ransomware are on the rise.

“A cyber-attack using ransomware or other sophisticated means could shut your operations down for weeks or months, creating a business interruption cost you may not be able to afford,” Ellis asserted in his blog posting. “Keep in mind that cyber is no longer just a third-party or data privacy issue – it is just as much a first-party risk.”

For Ellis’s full blog posting, click here.

Source: Marsh

Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Preparing for an AI Native Future

Preparing for an AI Native Future