Will workers compensation benefits from California’s sweeping reform law passed in 2012 help or hurt injured employees over the next four years?

Some people didn’t want to wait until 2020 to answer that question.

The Santa Monica-based think tank Rand Corp. issued a report this week that uses data on permanent partial disability collected over an eight-year period up to the passage of the reforms and superimposes that data on the current benefits structure in a “what if” scenario.

The California Commission on Health and Safety and Workers’ Compensation contracted Rand to assess recent trends in earnings loss and PPD benefits and how injury compensation will be affected by the 2012 reforms.

The post-reform data so far is insufficient for a comprehensive look, so the report’s authors got creative.

Projecting into the future is challenging, and there are countless variables that could change things over the next several years, acknowledged Michael Dworsky, an associate economist at Rand and one of the authors of the report.

“In terms of providing an early evaluation of the likely impact of these reforms, Senate Bill 863, this is the best available data that we could actually work with in the short term,” Dworsky said.

SB 863 raised PPD benefits and contained several provisions aimed at lowering costs in the system.

Several reports have emerged to show the reforms are working. At a recent workers comp conference in Southern California, Christine Baker, director of the California Department of Industrial Relations, and Bill Mudge, president of California’s Workers’ Compensation Insurance Rating Bureau, spoke well of the impact the reforms are having to date.

However, there are only a few years of data to be examined, and the results of workers comp claims tend to take a long time to be seen, so the authors had to find a solution to carry out their mission, Dworsky said.

The report, “Benefits and Earnings Losses for Permanently Disabled Workers in California: Trends Through the Great Recession and Effects of Recent Reforms,” studies accident years 2005 to 2012.

Dworsky said that using this period, which followed reforms made in 2004 under Senate Bill 899, was the best way to get a picture of how the reforms might play out in lieu of waiting for a few more years to pass.

Emphasis on the word “might.”

“There’s some really big uncertainties,” he cautioned.

Still, Dworsky was confident that the report’s data is solid enough for policymakers to begin formulating their own opinions about what, if anything, to do next.

“In terms of taking a worker with a given injury and asking what would happen with their benefits, we think we’re on pretty firm ground there,” he said.

The report finds that for the average worker injured between 2005 and 2012, the benefit increases enacted under SB 863 would have “significantly increased replacement rates of lost income compared to what they were under SB 899.”

The portion of after-tax earnings losses replaced by benefits would have risen by 21.4 percentage points, from 58.8 percent to 80.2 percent, according to the report.

Dworsky and his fellow authors aren’t necessarily suggesting any further reforms, but because the report includes a period of economic plight, they do opine that it might be a good idea to start thinking about the next down cycle.

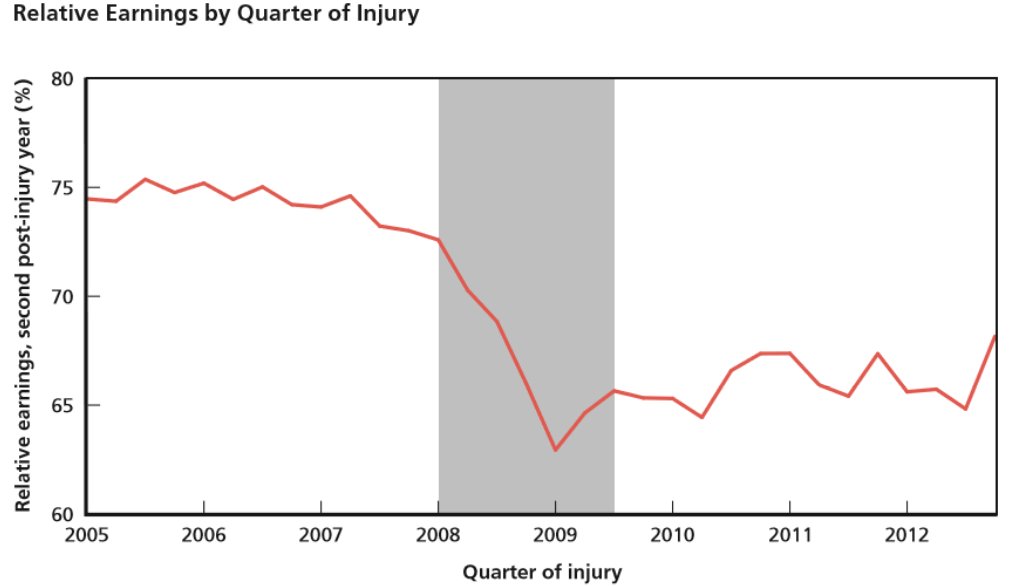

“We found that earnings losses were extremely sensitive to the business cycle,” Dworsky said.

The report shows that permanently disabled workers injured after the beginning of the Great Recession experienced much more severe earnings losses than workers injured before that time.

The authors said this suggests economic downturns may disproportionately affect injured workers compared to uninjured workers.

They also found that certain categories of workers may have suffered more severe economic losses than others during the recession.

Vulnerable workers—those with characteristics typically associated with higher earnings losses, like older workers who on average have more severe injuries and lower-wage workers—suffered on average the biggest wage losses during the recession, the report reveals.

Because the report finds that earnings losses for permanently disabled workers are “highly sensitive” to the business cycle, the authors believe that reinforces the need for California policymakers to take into account economic conditions when assessing benefits for injured workers.

“Careful monitoring is needed to assess the generosity of SB 863 as economic conditions change,” the report states. “Also, more should be done to develop effective strategies and policies for tying benefits to measures of economic conditions such as return to work, to help ensure that the adequacy of benefits does not rise or fall dramatically when underlying economic conditions change.”

SB 863 raised both the minimum and the maximum weekly wage to be used in calculating PPD benefits for the first time since 2006.

It also eliminated the future earnings capacity adjustment, a factor used to adjust the disability ratings for certain types of injuries, by setting the FEC for all injuries to the maximum value allowed under SB 899.

That move yielded higher ratings for all impairments that previously had an FEC factor below the maximum, the report says.

Lastly, the reform created a return-to-work benefit offering supplemental payments to injured workers whose permanent disability benefits are considered disproportionately low compared to their earnings loss.

Dworsky said that if policymakers are concerned about wage replacement rates staying stable during economic downturns, they can consider giving higher benefits to injured workers during such periods or take into account actual wage loss experienced by individual workers.

“They both have pretty clear potential for unintended consequences, so you’d have to be really careful about implementing either of those without further study,” Dworsky warned.

Another solution could be to use the overall unemployment rate as a guideline, but Dworsky noted that one possible solution may have already in part been created with SB 863’s return-to-work benefit.

“That’s something that almost has the flavor of one of these policy options that ties benefits to the individual worker’s experience,” Dworsky said.

The report’s authors found that the return-to-work benefit makes PPD benefit compensation “more progressive,” despite having a modest effect on overall wage replacement rates, because the benefit targets the lowest-earning and most at-risk workers.

The benefit may not be broad enough to cover the variety of injured workers impacted during an economic downturn, so it would likely have to be expanded upon.

Of course, more analysis—and more time—is needed to find out if that’s the case.

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster