For the insurance industry, 2014 was not a year of big losses. However, look more closely and you will see a string of near misses and important reminders of the forces that can wreak destruction and produce sizable losses.

Executive Summary

While 2014 was a year of near misses, the insurance industry must remain on guard. Historic events serve as stark reminders of the devastation and losses caused by major disasters, warning us to strive for continued improvements in risk management as we wait for the next major catastrophe.Napa Earthquake Reminds the Industry of Potential Risk

While worldwide there were as many as 150 magnitude 6.0 earthquakes this year, there was only one earthquake of note in the United States: an August earthquake that hit Napa, Calif., damaging buildings and causing losses for the local wine industry. RMS estimates that total insured losses for the earthquake did not exceed $250 million.

The Napa earthquake was a clear reminder that the West Coast has enjoyed a long period without a major earthquake. For the industry, it was a warning that big earthquakes affecting densely populated cities can produce sizable losses. The recovery from a major California earthquake will be considerably harder due to the low penetration of earthquake insurance.

Globally, (Re)insurers Face Heightened Uncertainty Around Terrorism Coverage

After this year, (re)insurers will also be poring over their terrorism clauses—not because of any major attacks but owing to uncertainty over the renewal of the U.S. Terrorism Risk Insurance Act (TRIA), a $100 billion federal backstop for losses from terrorist attacks. At the time of this writing, the Senate failed to reach agreement on the provisions of several “add-ons” to the bill before winter recess. As a result, a lapse of coverage is likely before the Senate resumes negotiations in January.

Prior to the recess, both houses of Congress passed TRIA bills by overwhelming majorities. These bills increased the copayment for insurers to 20 percent from 15 percent in the previous version of TRIA, resulting in up to $5 billion less protection for the industry in the event of an attack. Furthermore, the minimum threshold loss trigger doubled to $200 million from $100 million.

If the act is signed into law with these parameters, insurers will have to bear considerably larger terrorism risk in 2015. For reference, the Boston attacks resulted in approximately $2 million in insurable damages—one hundredth the amount of the proposed TRIA trigger level.

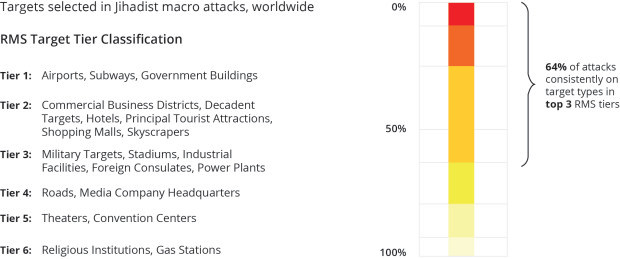

Many insurers still do not take into account the probability of terrorism when pricing insurance coverage. There is a commonly held but erroneous belief that there isn’t enough data available to model terrorism probabilistically, so the underwriting and management of terrorism risk is done somewhat arbitrarily. But in the 10 years since the London bombings and the 13 years since the 9/11 attacks, we have a substantial amount of new data about terrorism plot rates, the probability of plot interception, countersecurity prevalence and targeting preferences. Good terrorism models use this data to create an informed view of attack probability.

Terrorism insurance is a large market—more than 60 percent of businesses in the United States purchase it—and insurers that are able to leverage this new data to better understand the risk, underwrite it more granularly and price it more accurately will be able to capitalize on this market opportunity at the expense of those that don’t.

Earlier in the year RMS released new views of risk for terrorism with its updated terrorism model for Canada, Denmark, Ireland, Italy and the United Kingdom in alignment with global trends on large-scale attack frequency and advances in countersecurity in each of the countries. The model focuses exclusively on macro-attacks that threaten insurer solvency. Macro-attacks involve multiple operatives and so are more likely to be intercepted by counterterrorism authorities, in contrast to small-scale attacks, which involve less planning and can more easily evade detection.

A Quiet North Atlantic Hurricane Season Contrasted Near-Record Activity in the Pacific Ocean

The hurricane season in the North Atlantic was quieter than usual. Storms either made brief landfall or skirted the United States altogether, resulting in minimal property damage. While the Caribbean and Bermuda had a busier hurricane season, overall activity was still below average.

Irrespective of the lack of hurricane activity, hurricane-driven coastal flooding is an increasingly material risk to the industry, especially as sea levels rise and coastal exposures grow.

In contrast to the quiet North Atlantic hurricane activity, the Eastern Pacific Ocean had one of its most active seasons on record, with 15 of the 20 named storms reaching hurricane status. Ideal conditions for Eastern Pacific hurricane formation led to a series of storms that tore up the west coast of Central America and Mexico. Hurricane Odile in September produced the highest costs with almost $1 billion of insured loss in Cabo San Lucas, Mexico. The Category 4 hurricane impacted many U.S.-owned assets in the region, driving insurance claims higher than might have been expected.

Nonmodeled Risk Continues to Increase

The continued increase in nonmodeled risk, being driven in part by burgeoning coastal developments, is of particular prominence for the industry in regions such as Asia.

The snowstorms that hit Japan in February resulted in approximately $2.5 billion of insured industry losses and were one of the largest catastrophe loss events in 2014, highlighting yet again how nonmodeled perils can be a driver of losses.

While insurers will always carry nonmodeled risks on their books, they are coming under increasing pressure by shareholders and regulators to understand the extent of these exposures.

In Asia, probabilistic models do not exist for many perils. Modeling firms help companies assess potential asset exposures and support more informed portfolio management with tools that identify high-risk geographic zones, such as RMS’s global tsunami catalog.

An Important Take-Away From 2014

While 2014 was a year of near misses, the industry must remain on guard. Many historic events serve as stark reminders of the devastation and losses caused by major disasters, warning us to strive for continued improvements in risk management as we wait for the next major catastrophe.

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Preparing for an AI Native Future

Preparing for an AI Native Future  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll