If you think the colors of the triangular yield sign on North American roadways are yellow and black, then you might not be ready to lead your organizations into the future.

While futurist Jack Uldrich didn’t state his view using exactly those words during his presentation at the Casualty Actuarial Society’s Centennial meeting last week, his newsflash that yield signs have been red and white for the past decade came with a simple message: To think like a futurist, you need to be humble enough to realize that there might be things that you’re not seeing correctly—or that you’re not seeing at all.

Executive Summary

P/C insurance leaders can stay ahead of the curve on emerging technologies by behaving like futurists, according to Futurist Jack Uldrich. Among other tips, Uldrich suggests that executives use “reverse mentors” and take “think weeks” to gain an accurate perspective on emerging trends that are doubling in impact every four to 24 months.“When our way of viewing the world has been so conditioned to see something one way, even when the new is staring us in the face we don’t process it immediately,” he said, displaying a red ace of spades from a deck of cards and noting that many people take a full minute to recognize that it’s the wrong color.

“Your world has already changed, and it is as odd as a red spade. You have to be aware of the change that is here today before you can even begin thinking about tomorrow,” he said.

Uldrich spoke twice at the CAS meeting, which marked the 100-year anniversary of the actuarial society and was themed “Celebrating the Past, Focused on the Future.” During a keynote address, Uldrich showed dozens of examples of emerging technologies that executives might not have seen or processed. At one point, he ran a video of doctors reading cardiograms on their smartphones, for example. Another video clip featured an executive from electric car company Tesla demonstrating how the company might use virtual reality goggles to shape engine parts with their minds and then print them on 3D printers.

Uldrich spoke twice at the CAS meeting, which marked the 100-year anniversary of the actuarial society and was themed “Celebrating the Past, Focused on the Future.” During a keynote address, Uldrich showed dozens of examples of emerging technologies that executives might not have seen or processed. At one point, he ran a video of doctors reading cardiograms on their smartphones, for example. Another video clip featured an executive from electric car company Tesla demonstrating how the company might use virtual reality goggles to shape engine parts with their minds and then print them on 3D printers.

Also among his examples were images of skyscrapers soaring past the clouds at twice the size of the Freedom Tower, virtual grocery stores, smartphones that healed their own scratch marks and cars that didn’t need to be painted.

During a later session titled “How to Think Like a Futurist,” he drove home a point that all the technologies needed to make these things possible are not far off in the distant future. “They’re here today,” Uldrich said, referring to advances in mobile computing, 3D printing and nanotechnology, among other trends.

Uldrich, who was introduced as “global futurist” and author of 11 books (including “Jump the Curve: 50 Strategies to Help Your Company Stay Ahead of Emerging Technology” and “Foresight 20/20: A Futurist Explores the Trends Transforming Tomorrow”), explained that a big part of being a “futurist” is simply seeing what is going on right now. He used the acronym AHA—with the three letters standing for “alert,” “humility” and “action”—to fully explain what it takes to think like a futurist.

He demonstrated the first concept of alertness by showing a video of six people—three dressed in black and three dressed in white—tossing a ball around. He directed session attendees to count the number of times the folks in white shirts passed the ball.

Actuaries congratulating themselves on counting 16 handoffs were surprised to learn that three other events took place that they missed—the most obvious of which was a man in a gorilla suit walking into the center of the frame. A background curtain also changed color and a player left the group. (The video made by psychologist Daniel Simons is available on YouTube here.)

“In your day-to-day job, you’re similarly focused like a laser on whatever your specific responsibility is. A futurist, however, has the luxury of stepping back and looking at the big picture,” Uldrich said.

Like the 800-pound gorilla, emerging technologies “are walking front and center into our lives,” prepared to “transform every aspect of your job and your industry.” In addition, “customer behaviors and business models are changing in some really subtle ways, like the curtain.” And certain jobs and industries have faded away,” he said. All that is worth noticing, but your attention is focused elsewhere.

“It’s difficult to see all this transformation, but if you want to think like a futurist, you have to become aware of what’s right in front of you.”

How Can Insurance Leaders Get Alert and Humble?

“Get a reverse mentor,” Uldrich recommended at one point. Insurance professionals who are 40 or older should continue to mentor younger people, but they also “have to pivot 180 degrees, show some humility and get reverse mentors—people who are younger [and] have less experience,” he said. The younger people “see the world from a different perspective, and they understand these [emerging technology] tools from a different perspective.”

“Get a reverse mentor,” Uldrich recommended at one point. Insurance professionals who are 40 or older should continue to mentor younger people, but they also “have to pivot 180 degrees, show some humility and get reverse mentors—people who are younger [and] have less experience,” he said. The younger people “see the world from a different perspective, and they understand these [emerging technology] tools from a different perspective.”

Focusing on the “action” part of the “AHA” instruction, Uldrich suggested a more unlikely action. “Take a ‘think week’—a week just to think,” he said, recognizing that leaders would object because of their busy schedules. Countering the likely objection—”Don’t you understand how busy I am?”—Uldrich noted that executives who say this are actually conceding that they don’t have 2 percent of their time available to think about the future.

Recommending that they “give themselves permission to step away from the grind” for at least an hour each week “to read, think and reflect on how their world is changing,” Uldrich named resources for executives to seek out. These included a daily newsletter available from MIT Technology Review and a technology quarterly review published by The Economist.

“The other thing I would encourage you to do as a futurist is to give up on answers; stick with questions,” he said, noting that management studies have found that the most successful leaders are those that embrace ambiguity.

One question he recommends that leaders ask is the “pre-mortem question.” It goes like this: “It’s five years in the future, and we’re out of business. What didn’t we see coming?”

“Far from being depressing, you can open up a candid conversation with your team. You’ll identify threats to your business that you otherwise would miss, and spot opportunities.”

“You’ll have humility to the idea that there might be new ways to do business in the future,” he said, noting that the likes of Blockbuster, Borders and BlackBerry could have benefited from this exercise.

The lesson is that “even the biggest companies can go belly-up. We should all have some humility to the idea that we’re not seeing how fast the world is changing around us,” he said.

How Fast Is It Changing?

How Fast Is It Changing?

Throughout much of the 90-minute session, Uldrich provided examples of what executives might see during a “think week” as he described nine emerging technology trends—all of which he said are doubling in impact every four to 24 months.

“Advances in biotech, nanotechnology, 3D printing, sensor technology and the collection of data are not creeping up linearly. They’re shooting up exponentially,” he said, referring to a few of the trends.

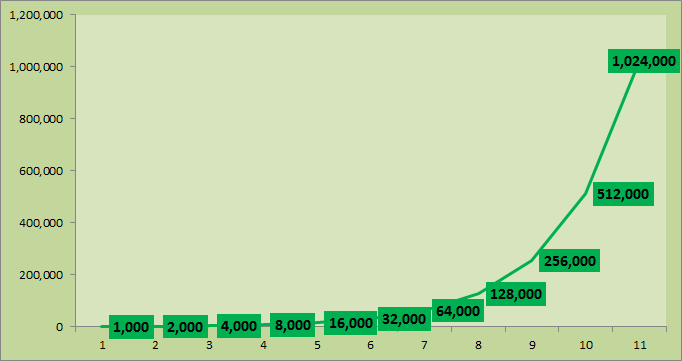

He also explained why, in spite of the speed of change, even the most alert insurance professionals still say that their world doesn’t feel terribly futuristic using a visualization exercise. He asked the actuaries to envision a pond that had one lilypad on the first day of November. On the second day there are two; on the third day, four; on the fourth day, eight, etc. It keeps doubling, and the pond is covered with lilypads on the last day of the month. “On day 20, what percentage of the pond would be covered with lilypads,” he asked.

The answer is less than 1/10 of 1 percent, he reported.

“My message to you is that these technologies have, in fact, been doubling. But what you have to appreciate is that you are at day 20. The really big change is just ahead of us,” he said. (Editor’s Note: Anyone who does the math will find that the pond is 3.2 percent covered on Day 25, if it jumps to 50 percent full on Day 29 and 100 percent on Day 30.)

Uldrich offered the doubling mathematics several times during his presentation. If 1,000 people make use of a certain technology today, and it’s doubling every year, then 10 years from now one million people will use it. Starting at one million users today, there will be one billion users in 10 years for an annually doubling technology, he explained.

Illustrating this graphically, he said that futurists and innovators are able to “jump the curve.”

While the amount of change that lies ahead is going to require a lot of awareness and humility, Uldrich told his audience to be optimistic, noting that we have all already lived through a similar amount of change. He noted, for example, that cellphones were owned by less than 1/10 of 1 percent of the population in the mid-1980s when the movie “Wall Street” was popular—a movie in which actor Michael Douglas is shown using a bulky Motorola DynaTAC8000x—a model weighing nearly 2 pounds and costing roughly $5,000. Flash forward to today, and smartphones are ubiquitous, he suggested as he displayed a photo of people standing on an unemployment line on the real-life Wall Street—every one of them using a smartphone.

“Big data, the advances in nanotechnology, robotics, the 3D printers—as sophisticated as they are, [they currently are] at Michael Douglas’s cellphone stage.”

Helping the actuaries to further visualize this during his keynote lunch address, Uldrich reflected on the 50th anniversary of the animated futuristic television program “The Jetsons.” According to Uldrich, the program aired for only one year in 1964. The reason: While the show was produced in color, 99 percent of the viewers still had black-and-white televisions. “It didn’t feel that futuristic.”

Like color TV 50 years ago, robotics and big data, nanotechnology and sensors, genomics and space travel commercialization are all here today. “The world doesn’t yet feel futuristic because 99 percent of the world isn’t yet embracing these technologies. But within the next 25 years, we’re going to move from 1 percent of the world embracing robotics and nanotechnology to 2, to 4, to 8, to 16 and eventually 99 and 100 percent,” he said.

The three-day CAS Centennial event had many reminders of the fact that actuaries had lived through a mountain of change, starting with an opening retrospective video during the kick-off session.

John W. Weider, the oldest living actuary, described the birth of the CAS—as the Casualty Actuarial and Statistical Society—which came in response to the fact that workers compensation laws had been enacted, driving a need for professionals to put a price on the insurance.

Minutes later, after another of the oldest members, Frank Harwayne, spoke about joining the CAS when “the auto boom was in full swing,” Weider reappeared with this recollection:

“INA came out with something that nobody else thought could be done or should be done. They called it a homeowners policy. This kind of competition caused the fire company executives to say why don’t we call up some qualified actuaries—some CAS members—and see what they could do to professionalize the fire insurance business …That was the entrance of casualty actuaries in the property insurance business broadening the whole perspective.”

Uldrich later reminded the crowd that at the time the CAS was founded 100 years ago, “50 percent of all North Americans worked on farms, there were only a few thousand cars on the road, and life expectancy was 47 years.”

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Preparing for an AI Native Future

Preparing for an AI Native Future