A new report outlines how insurers must focus their AI efforts to achieve a return on investment (ROI).

“How Insurers Can Supercharge Their Strategy With AI,” by Boston Consulting Group (BCG), details how insurers should focus on high-level core functions first, with investments not only in technology but also in people and processes.

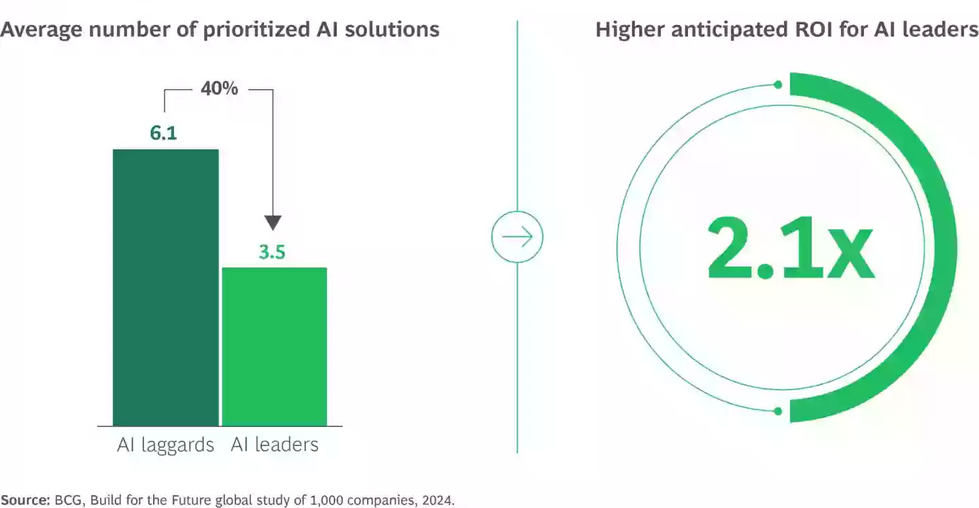

“Insurers need to avoid the temptation to spread scarce resources across multiple functions, which generally results in no initiatives gaining the backing or traction necessary to support strategic objectives,” the authors wrote.

That’s because focused objectives will lead to twice the ROI, according to BCG.

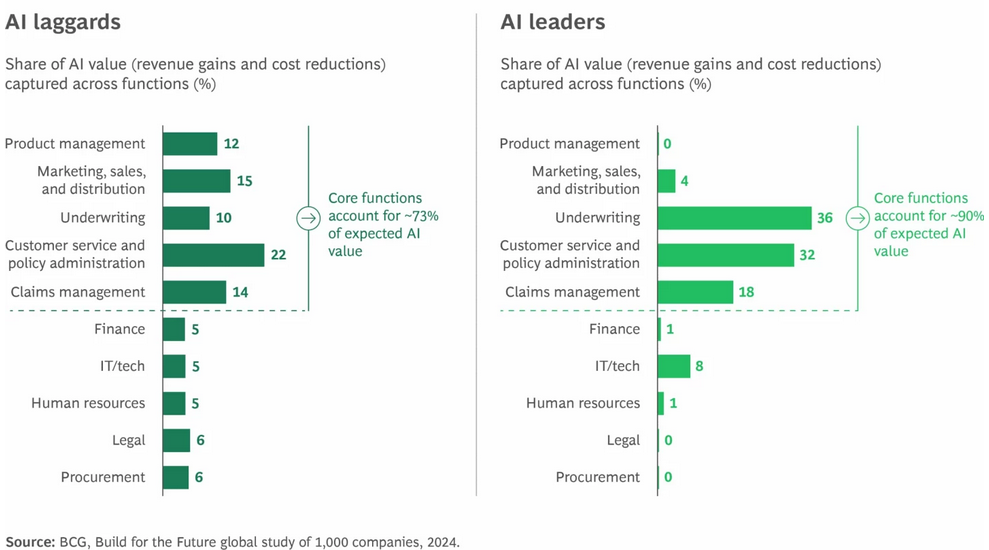

That means focusing on the applications that will have the most impact in the near term, which tend to be those that support processes where many employees perform standardized tasks or where a few specialized staff tackle mission-critical, data-heavy challenges.

These areas include underwriting, customer service, claims processing and sales.

While AI holds promise in other areas, such as marketing, product development and support functions, the report indicates the immediate profit and loss impact in these areas will be more limited, especially in the early stages of implementation.

With respect to underwriting, BCG’s AI work with U.S. and UK commercial P/C insurers indicates efficiency in complex lines of business can be improved by as much as 36 percent, by augmenting manual underwriting processes. A three percentage point loss-ratio improvement is also expected through better use of data and the ability to factor unstructured and previously inaccessible information into underwriting decisions.

Productivity gains of more than 30 percent have been seen through equipping P/C industry workers with AI tools.

In claims, AI standalone applications that automate first-notice-of-loss data extraction, document processing and smart triaging enhance efficiency and reduce manual workloads.

BCG is seeing cost reductions of up to 20 percent and increases in claims processing speed of as much as 50 percent.

A fully automated, end-to-end process redesign will embed AI across the entire journey for simpler claims, from data capture and triage to automated decision-making and settlement. Real-time resolution for up to 70 percent of simple claims will be realized, with operational costs reduced by 30-50 percent, while significantly improving customer satisfaction.

AI’s impact on insurance sales depends on the distribution model, according to BCG.

For direct writers, autonomous sales agents will play a key role, particularly in the upper stages of the sales funnel. AI-driven agents can process large volumes of unqualified leads, directing customers to the most suitable sales journey efficiently.

AI-assisted agents can deprioritize low-potential leads, enhancing conversion rates and reducing customer acquisition costs.

In agent- and broker-driven channels, AI can boost productivity by automating administrative tasks, preparing for and summarizing sales meetings, and making complex information and analysis more easily accessible.

Administrative tasks take up more than 50 percent of an agent’s or a broker’s time, according to BCG, limiting client engagement and business development opportunities.

In IT, AI’s use to test product migration has proven beneficial, cutting the time and cost to move from legacy to cloud-based architectures. Some basic IT support can also be automated.

Early adopters utilizing AI in IT will “gain (or regain) a competitive edge in innovation and delivery while curbing ever-increasing IT costs,” the authors wrote.

Two common mistakes seen when insurers begin the AI journey is not engaging employees early enough and declaring the success of AI projects too early.

Four of the top five challenges insurers cite in implementing AI are people-related: AI literacy, prioritizing opportunities, establishing ROI from identified opportunities, and reimagining workflows and implementing processes.

BCG recommends insurers devote 10 percent of available resources and effort to the algorithms, 20 percent to technology and data, and the balance to the human dimension.

In order to see results, the management team must realize the end result is operational transformation, with the new operating model dependent on cross-functional collaboration between the core functions and IT.

The focus and accountability will evolve over time, “from defining desired outcomes (the responsibility of the C-suite) to implementing and scaling up the technology (the CIO) to putting the necessary people, processes, and structures in place (business leaders) to making the functional transformation happen (the organization as a whole),” the authors stated, adding that “IT should be building reusable AI assets that align with the overall strategic road map. The tech function needs to manage and maintain assets, platforms, and an ecosystem of partnerships (avoiding early lock-in effects).”

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers