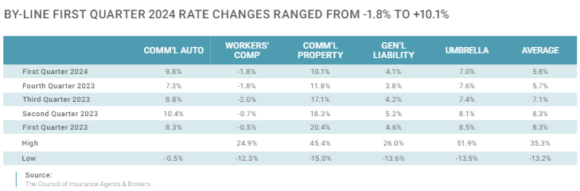

Overall commercial property/casualty premiums increased slightly for all account sizes to 7.7 percent on average in the first quarter of 2024.

According to The Council of Insurance Agents and Brokers’ Q1 Market Survey, the 7.7 percent average increase in Q1 compared to 7 percent in Q4 2023, is the 26th straight quarter with increases though there were signs of moderation in premium increases across individual lines of business.

Each line was either flat or lower than the previous quarter, with the exception of commercial auto where premiums increased by an average of 9.8 percent, up from 7.3 percent in the last quarter 2023

The average first-quarter increase for commercial property was 10.1 percent—lower than last quarter and much lower than the 20.4 percent average increase from Q1 2023 but still the highest increase out of all lines. CIAB said respondents still found commercial property a hard-to-place risk due to stricter underwriting, property value increases, and detailed submissions.

D&O premiums fell by an average of 0.8 percent in Q1 2024, one of only two lines to record a decrease in premiums. Workers compensation continued a recent trend with premiums falling 1.8 percent in Q1.

CIAB cited research from rating agency AM Best, who in March assigned a negative outlook to the U.S. D&O liability insurance segment due to an increase in capacity from new market entrants—driving prices down as concerning risk exposures persist. In its recent Marketplace Realities report, broker WTW said it saw flattened-to-reduced D&O premium outcomes, which are expected to continue in 2024.

A larger number of respondents reported an increase in claims in commercial auto, cyber, general liability, employment practices liability, and umbrella. More respondents said there was an increase in demand for commercial property, commercial auto, umbrella, and D&O.

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation