During separate earnings conference calls this week, executives of two property/casualty specialty writers—W.R. Berkley Corp. and RLI Corp.—signaled a changing E&S property insurance market.

Both companies reported double-digit jumps in top lines and in net income, with underwriting and investment income driving descriptions of “solid” and “strong” financial results from the leaders of both companies. Digging into details of the markets in which they produced their results, however, W.R. Berkley CEO W. Robert Berkley Jr. and Jen Klobnak, the chief operating officer of RLI, both indicated competition is dampening solid pricing in the E&S property market.

“As far as we can see, the momentum for the [E&S] liability lines…continues to be as strong as ever. To the extent you’re seeing any slowing in the momentum of E&S, it’s likely to be property-related,” said Berkley. “We think that [E&S property] still does have some momentum but it probably does not have the level of momentum that it had last year,” he said. “We’re still seeing rates moving up and we expect they will continue to move up for the immediate future.”

Klobnak focused some of her commentary on the hurricane market where “competition has resurfaced.”

“While rates were still up 25 percent in the quarter, the increases are slowing. Our competitors, particularly the MGAs utilizing Lloyd’s capacity, have become more aggressive. They are increasing limit deployment, which reduces the number of carriers needed to participate on layered accounts and are more aggressively pricing business,” she reported. “For our underwriters, new business is more difficult to win although we continue to achieve rates above our renewal book on those accounts that bind.”

Still, while RLI’s hurricane exposure decreased a bit in the first quarter, RLI managed to grow overall gross property premiums by 14 percent. E&S property drove the jump, with E&S property premiums rising 15 percent, and rates up 19 percent. “The rate increases over the last few years have made a positive impact to our bottom line as the premium earns through,” Klobnak said, also noting that all other RLI property businesses are growing (including Hawaii homeowners and marine).

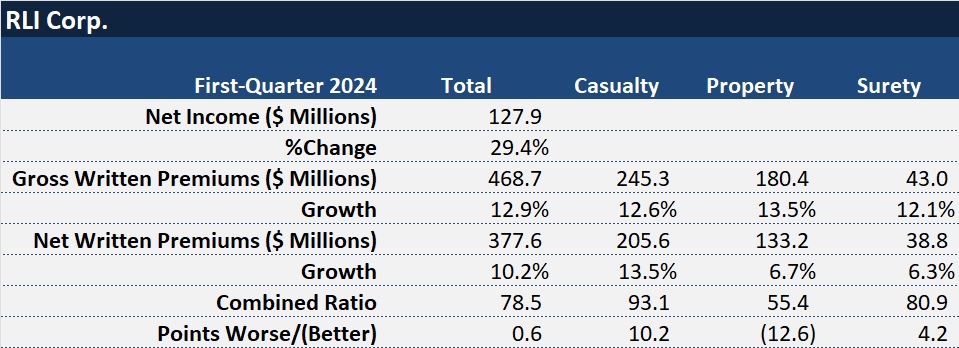

In fact, the underwriting income contribution to the bottom line from RLI’s property segment more than doubled to $57.7 million from $29.4 million in first-quarter 2023. Expressed as a combined ratio, property came in at a 55.4—down nearly 13 points from first-quarter 2023.

Across all three of its product segments—property, casualty and surety—RLI’s underwriting income grew 14.0 percent to 77.7, million, translating to a combined ratio of 78.5.

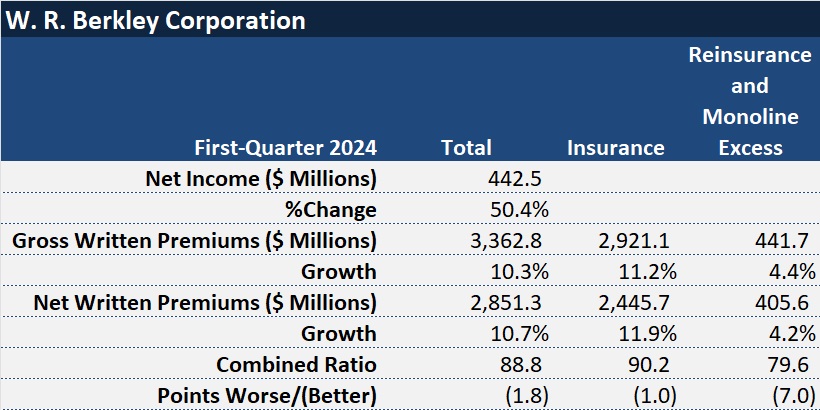

Berkley noted that property was a growth engine at W.R. Berkley. Tables displaying net premiums by line in the company’s financial report reveal that net written property insurance premiums jumped 25 percent in the first quarter, contributing over $0.5 billion to $2.4 billion in net written premiums for Berkley’s insurance segment. Overall, the insurance segment’s net written premiums grew 11.9 percent.

While Berkley’s financial report in a media statement doesn’t break out combined ratios for property and casualty separately, the company reported a combined ratio of 88.8 overall in the first quarter—90.2 for its insurance business and 79.6 for reinsurance. Other liability represented more than 40 percent of Berkley’s insurance book with net premiums of over $1.0 billion in the line.

Property Forecast

Looking ahead, conditions in the property market aren’t entirely clear. “With an elevated hurricane forecast, the market is tenuous and could easily restrict capacity or coverage if significant landfalling storms occur this season. We stand ready to assist our policyholders if that happens, and we’ll continue to adapt to changing market conditions,” said Klobnak.

Asked directly whether competition is making the E&S property market less attractive to RLI, Klobnak said opportunity is still present. “Yes, competition is returning and it’s making some waves. The MGAs have some capacity back and they feel like they have to use it—very quickly, it seems like. So, they do put out those larger limits and are cutting some rates.”

“With an elevated hurricane forecast, the market is tenuous and could easily restrict capacity or coverage of significant landfalling storms occur this season. We stand ready to assist our policyholders if that happens, and we’ll continue to adapt to changing market conditions.”

Jen Klobnak

“We’re in a competitive market. However, the starting point is very attractive. So, we’re focused on hanging on to our renewals and making sure that we have authority at the underwriting desk to maneuver through this changing market that we have.”

Klobnak also noted that catastrophe model changes are on the horizon. “We use the RMS model at the underwriter’s desk that is increasing the view of risk going forward,” she said, noting that RLI has already incorporated that into the company’s view of risk. “We are being a little more conservative on growth from an exposure standpoint. So, most of our growth at this point in time is coming from rates.”

Berkley told an inquiring analyst that there’s opportunity left in both the E&S property insurance market and the property reinsurance market. Discussing reinsurance first, he said that “because pricing has peaked that doesn’t mean there’s not some good margin to have.”

“If you look at our reinsurance business and the opportunity that we still see in property, we view it as still a healthy line. That having been said, barring the unforeseen event, we think that property-cat [reinsurance market] specifically, has perhaps seen the peak. We’ll see with time.”

Then he noted the “waterfall effect” that the reinsurance market has on the insurance market—with a bit of a delay. “The reinsurance market, which forced the [insurance market] firming, I think, is out ahead. There’s still margin to be had there” in property reinsurance.

“The impact that it’s had on the insurance market is still very real as the insurance market is still coming to grips with that higher cost of capacity that they rent from the reinsurance marketplace. But I don’t think that there is the same level of pressure or urgency in the insurance marketplace, in particular E&S, that we saw or felt a year ago.”

“We think that opportunity generally speaking still exists in property. How quickly that will dissipate I don’t know, but we pay close attention to it and we will not have an issue shutting off the spigot if we don’t think it is a good use of capital going forward.”

Robert Berkley Jr.

“That doesn’t mean there’s not still opportunity. That doesn’t mean we don’t still like the margin and don’t still want to have a second helping of whatever the market can offer,” he said, noting that the company has a view as of what level of rates are adequate rate in order to achieve an appropriate risk-adjusted return. “We think that opportunity generally speaking still exists in property. How quickly that will dissipate I don’t know, but we pay close attention to it and we will not have an issue shutting off the spigot if we don’t think it is a good use of capital going forward,” he stated.

Casualty Momentum, Liability Reinsurance ‘Green Shoots’

One analyst, who reported that stamping capacity in three large E&S states turned negative in March, asked Berkley to discuss the flow to the E&S market.

“We continued to see, during the first quarter, very robust activity on the E&S front, particularly on liability,” he said, noting that W.R. Berkley is more of a liability shop than a property shop.

“On the liability front, there is nothing that leads me to believe that the momentum is going to be subsiding anytime soon…The reality is that social inflation, the legal environment, the social environment persists—and that continues to drive loss costs. And I think that there’s some reasonable chance that the reinsurance marketplace is becoming more acutely aware of this social inflation issue and [that] you’re going to see them look for opportunity to try and put pressure on the insurance marketplace when it comes to casualty and liability lines like they did on the property front.”

“We look forward to the reinsurance market embracing greater discipline on the casualty lines,” he said.

At an earlier point in the call, Berkley made a similar remark after noting that “rates for property-cat reinsurance were off at Jan. 1 by 5 percent or more” on a risk-adjusted basis. “That having been said, we are seeing some potential green shoots of discipline returning to the liability market under the umbrella of reinsurance,” he said.

Responding to a similar question about the flow of business into the E&S market, Klobnak said on the property side, more non-wind non-quake business is moving into the E&S space, referring to Midwest business exposed to secondary perils and California business exposed to wildfires. “More of that business has shifted into the E&S space that we are taking advantage of that where it makes sense. And so the pricing there has moved toward our direction.”

In casualty, increased submissions are mainly for habitational business. “We think the habitational market is still a bit underpriced. So, we have a fairly small portfolio of that,” she said.

During the first quarter, RLI’s gross written premiums for the casualty segment grew 13 percent, with rates rising 7 percent. “This was led by personal umbrella, which grew 33 percent, including a 13 percent rate increase,” Klobnak said, noting changes in underwriting appetite for personal lines primary insurers have fueled demand for RLI’s standalone personal umbrella product.

Also within casualty, RLI’s transportation business premium grew 27 percent with submissions up 8 percent, she said. While reporting that some of the growth could be explained by a single large trucking account that renewed early in the quarter, “with the adverse loss development reported by the industry, we have observed some competitors introducing underwriting changes. This is causing accounts to shop,” she said.

Later, Klobnak offered a similar observations about competitor loss reserve actions on casualty construction business as well. “Several carriers have reported adverse loss development for general liability and have referenced construction business. We have not seen this trend emerge in our own business but are aware that claims are taking more time to resolve,” she said. “This data point, in addition to increased severity in the industry, has resulted in an even more cautious approach in [our] initial loss estimates and in our reserving analysis,” she said.

An analysis of RLI’s underwriting results by segment reveals that a 10-point deterioration in the casualty combined ratio appears to be entirely attributable to this cautious approach, which saw the company reporting a lower level of favorable development for prior accident years. (By Carrier Management’s calculation, in first-quarter 2024, $18.1 million of favorable prior-year development shaved about 9 points off the for the casualty combined ratio, while $35.9 million of prior-year development recognized in first-quarter 2023 translated to a takedown of 19 combined ratio points.)

Klobnak said marketplace reaction to loss trends in construction is mixed. “Some of our competitors are taking underwriting actions based on their results, but we continue to see less disciplined markets who are buying the business to meet top line goals. We have also encountered new carriers and MGAs in particular that are hoping to take advantage of the E&S market momentum.”

“We have served the construction market with liability coverages for decades, and we’ll continue to adjust to these changing market conditions as leaders and remain disciplined in our approach,” she said.

The Bottom Line

Both RLI and W.R. Berkley reported increased first-quarter net income, with RLI’s bottom line rising 29.4 percent to $127.9 million and Berkley’s vaulting 50.4 percent to $442.5 million.

Investment income contributed to both overall profit gains.

At W.R. Berkley, investment income grew 43.2 percent to $319.8 million. Net investment income at RLI grew 21.3 percent to 432.8 million.

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb