More acquisition opportunities and continued competition across the market is expected in 2024, according to a new report, the “2024 Insurance M&A Outlook,” by Deloitte.

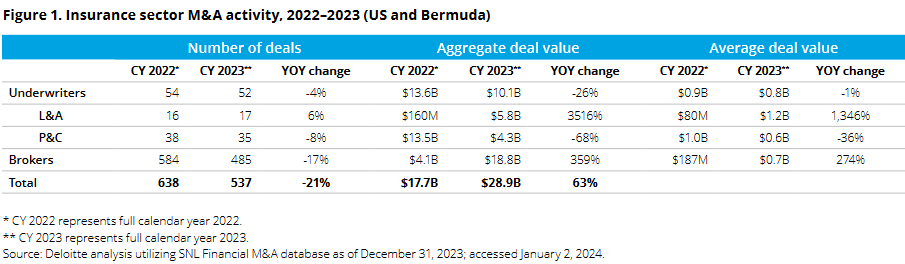

Property/casualty mergers and acquisitions in the U.S. and Bermuda took a dip in 2022 and 2023 with 38 deals and 35 deals, respectively.

As future opportunities take shape, an important consideration will be the corporate minimum tax requirements now in place in parts of Europe and Bermuda.

The adoption of the Organisation for Economic Co-operation and Development (OECD) global minimum tax in Europe, known as Pillar Two, requires certain multinational enterprises with €750 million or more in annual revenue to pay a 15 percent minimum tax on net income earned in each country where they operate, the Deloitte report explained.

The United States has not adopted Pillar Two, so the extent of its application to U.S. deals is unknown.

In late, 2023, Bermuda enacted the Corporate Income Tax Act in response to Pillar Two, establishing a 15 percent corporate income tax on Bermuda businesses that are part of multinational enterprise groups with annual revenue of €750 million or more. The effective date for the tax is Jan. 1, 2025.

Because of the interplay of the two tax requirements to Bermuda-based businesses, Deloitte advises considering tax implications as early as possible int he deal process.

In addition, in the United States, the 15 percent corporate alternative minimum tax (CAMT) is effective for taxable years beginning after December 31, 2022, the report noted.

The CAMT generally is focused on corporations (or groups of corporations) that have significant financial statement income but aren’t viewed as having significant U.S. federal income tax liabilities, according to the Deloitte report.

“In practice, these tax matters are expected to have an impact on a number of deal workstreams including due diligence efforts, structuring, deal funding, valuation efforts, contractual representations and warranties and post-integration compliance obligations for both purchaser and vendor groups,” the report stated.

Property/Casualty

A number of factors tamped down M&A activity in the property and casualty market in 2023, including social inflation and third-party litigation.

Retained losses—and the initial estimates that actuaries make on losses—rose as a result, affecting not only companies in the insurance M&A space, but corporations that retain significant risk under large deductible and self-insured retentions, as well.

In 2024, Deloitte expects a slowdown in the reinsurance market given the rise in property-catastrophe rates.

“Some companies may look for scale in the reinsurance market, but others could decide to reap the rewards of the high interest environment,” the report stated.

Climate-related perils like extreme weather, flooding and wildfires trigger additional legislation in 2024, potentially leading to more consolidation as insurers strengthen their balance sheet and decide where to do business in the future.

As the broader market pulls away from certain risk classes, the report said to expect specialty carriers to expand their footprint with innovative solutions tailored to specific risk profiles.

This may be the year InsurTech takes off, the report noted, indicating extra data collected can assist insurers in modeling and mitigating risk before they happen.

Insurance brokers

Insurance brokers continues to be a highly fragmented market, the report stated, making it a ripe area for deals.

Private equity investors are especially interested, with private equity accounting for 50 percent of the transactions in 2023 compared to approximately 70 percent in previous years.

More acquisition opportunities is expected in 2024, as many private equity investors are “undeterred by higher premiums and will continue to pursue a strategy of aggregating smaller brokerages.”

Even with continued pricing pressures,the market will remain competitive as private equity goes head-to-head with corporate buyers aimed at growing through M&A in the middle market.

Carriers and broker/dealers looking to make a deal in 2024 should clean up their books of business and financial data, sharpen their growth strategy and create a system and process to deal with Pillar Two requirements, the Deloitte report recommended.

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark