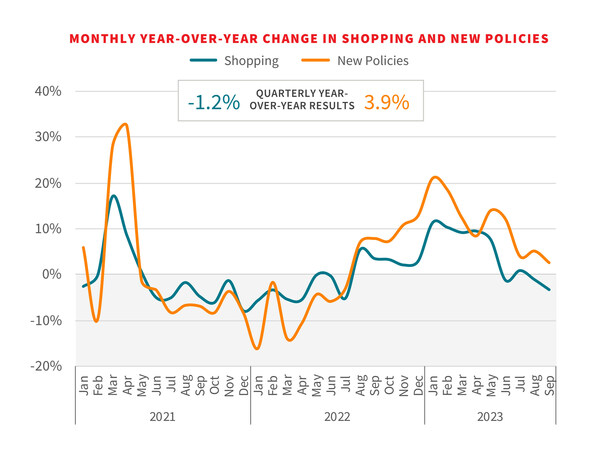

The quarterly, year-over-year U.S. auto insurance shopping growth rate declined to -1.2 percent in Q3 2023, down from a 5.2 percent increase in Q2 2023, as rate increases and tightening budgets continue to impact consumers, according to the latest edition of the LexisNexis Insurance Demand Meter.

New policy growth was also down from last quarter at 3.9 percent, compared to 10.2 percent in Q2 2023.

Despite Q3’s decline, August and September saw record volumes of new policies.

“This quarter’s Demand Meter reminds us that the industry is still reconciling with significant macro trends that have shifted the auto insurance market significantly,” said Adam Pichon, senior vice president of Auto Insurance and Claims at LexisNexis Risk Solutions. “Ongoing rate increases and changing demographics continue to contribute to near-record shopping volumes, while claims severity continues to drive profitability challenges for insurers. The combination of these trends has created a challenging environment that has been the theme for insurers in 2023.”

For the first time since Q2 2022, shopping growth registered as “Cool” on the Insurance Demand Meter, a downward trend that began in June. This shouldn’t be a surprise, said LexisNexis, since the industry is overcoming elevated market activity that began in Q3 2022.

Efforts by insurers to scale back new business have suppressed shopping rates, but consumers are still shopping at high volumes despite this.

Auto insurance rates are projected to net out at over 14 percent on average for 2023.

As consumers shop around, notable demographic shifts seen.

Growth in the 65+ age group and declines in younger age groups — specifically those under 35 years old — have been noted, according to the report.

Those 65 and over make up 14 percent of new auto insurance policy purchases, up from 10 percent in early 2022, while new policy purchases for those under 35 have dropped from 40 percent to 35 percent in that same period.

Household consolidation may be impacting this trend, first seen influencing insurance shopping trends in Q2 of this year.

The average number of drivers per policy continues to increase, as parents add their adult children to their policies or adult children add their retired parents, the report noted.

EV sales continue to rise, as do the number of new auto insurance policies covering them.

This quarter, electric (battery/plug-in hybrid/fuel cell electric vehicles) and hybrid vehicles rose to 1.4 percent of all new policy business, and purchase volumes of electric/hybrid vehicles through Q3 of this year have already outpaced those from 2022, LexisNexis reported.

There has been an overall drop in new policy volume and shopping linked to new and used vehicle purchases, which are at four-year lows.

Of note, there has been a significant increase in claims severity and that is expected to continue into 2024, the report noted.

“Profitability challenges persist even after the implementation of significant rate increases and strict underwriting restrictions, so much so that insurers’ financial ratings have started to be downgraded,” the report stated. “But these same rate increases and strict underwriting restrictions are driving consumers to shop their policies, and that now includes even long-term customers who may have been out of the market for 10 or more years.”

“Changing shopping demographics and behaviors are likely to be the norm thanks to tightening consumer budgets and ever-increasing auto insurance premiums,” said Pichon. “Claims frequencies continue to hold steady, but with severity levels still well above historical averages — largely fueled by high vehicle repair costs — insurers remain focused on making key strategic decisions on whether to implement additional restrictions or conversely look to gain market share as they move toward profitability.

Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages