Trackers of InsurTech deals revealed a 19-20 percent uptick in InsurTech funding for the third-quarter of 2023,compared to second-quarter totals, but year-to-date deal volume is less than half of last year’s nine-month total.

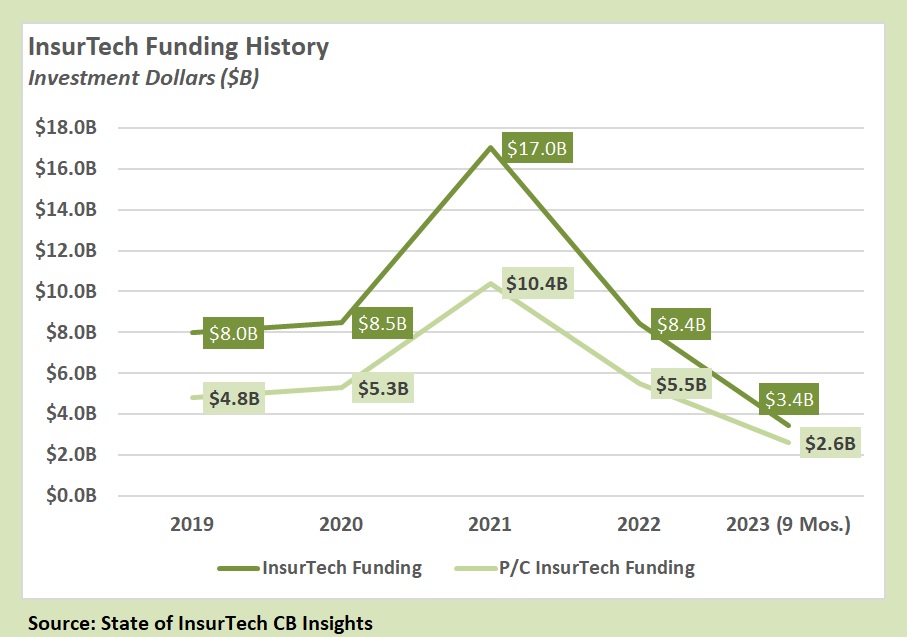

While the exact tallies in CB Insights “State of InsurTech” and Gallagher Re’s “Global InsurTech” reports are slightly different, both reports also show InsurTech funding totals on track to fall to the lowest level in six years for full-year 2023.

The CB Insights report puts total InsurTech funding at $3.4 billion for the year so far, down from $7.4 billion for the same period last year.

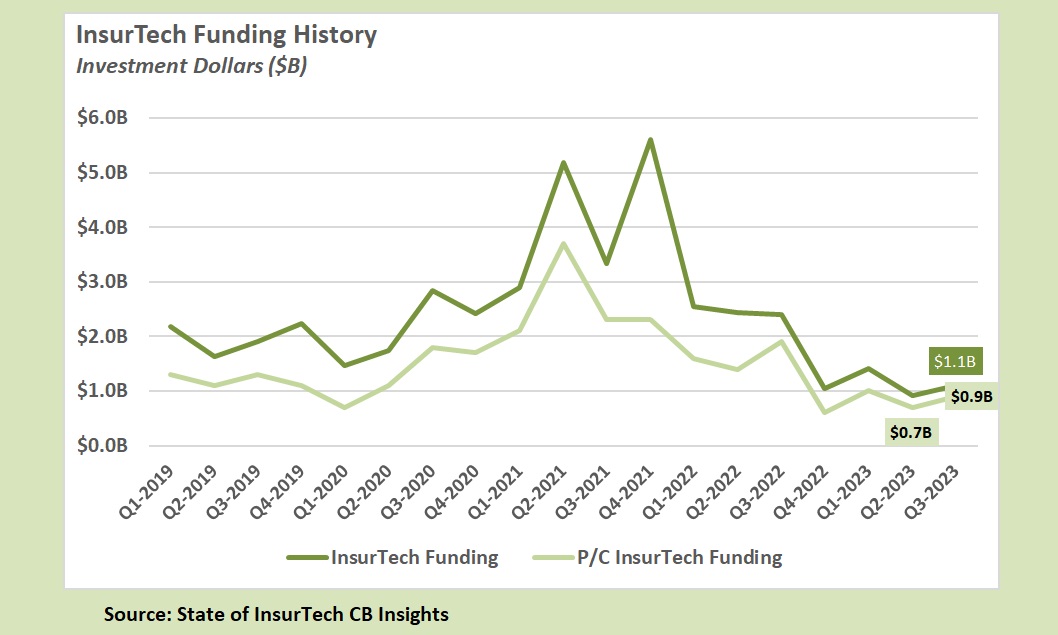

For just the third quarter, the funding total calculated by analysts at CB Insights was $1.1 billion, representing a 19.3 percent rise from a level of $920 million for second-quarter 2023.

The Gallagher Re report shows a slightly different prior-year and prior-quarter data ($7.0 billion for the first nine months of 2022 and $912 million for second-quarter 2022) but the reports deliver similar conclusions.

“Annual InsurTech funding is on track to hit $4.5 billion for all of 2023, which would mark the lowest annual total since 2017,” CB Insights notes.

Third-quarter 2023 “saw average InsurTech deal sizes dip to a six-year low,” Gallagher Re reported, noting that the average deal size was $10.4 million in third-quarter 2023, down from $12.4 million in second-quarter 2023. The last quarter to see lower average InsurTech deal sizes was third-quarter 2017 at $7.0 million, the Gallagher Re report says.

(Editor’s Note: A footnote to the Gallagher Re report notes that Gallagher Re uses CB Insights data for much of its numerical analysis, but adds that the global reinsurance broker has its own method for collecting and cataloging InsurTech investment data which produces some differences in historical reporting.)

Both reports point to property/casualty InsurTechs as the driver of the rise in deal funding for the quarter. Third-quarter 2023 funding for P/C InsurTechs alone was $931 million, representing 82 percent of the $1.1 billion total for all InsurTech and a 25 percent increase over second-quarter 2023 P/C insurance funding of $743 million.

Year-to-date, P/C funding of $2.6 billion is more than three-quarters (roughly 76 percent) of total InsurTech funding for the year. In prior years, P/C investments represented between 60 and 65 percent of total funding.

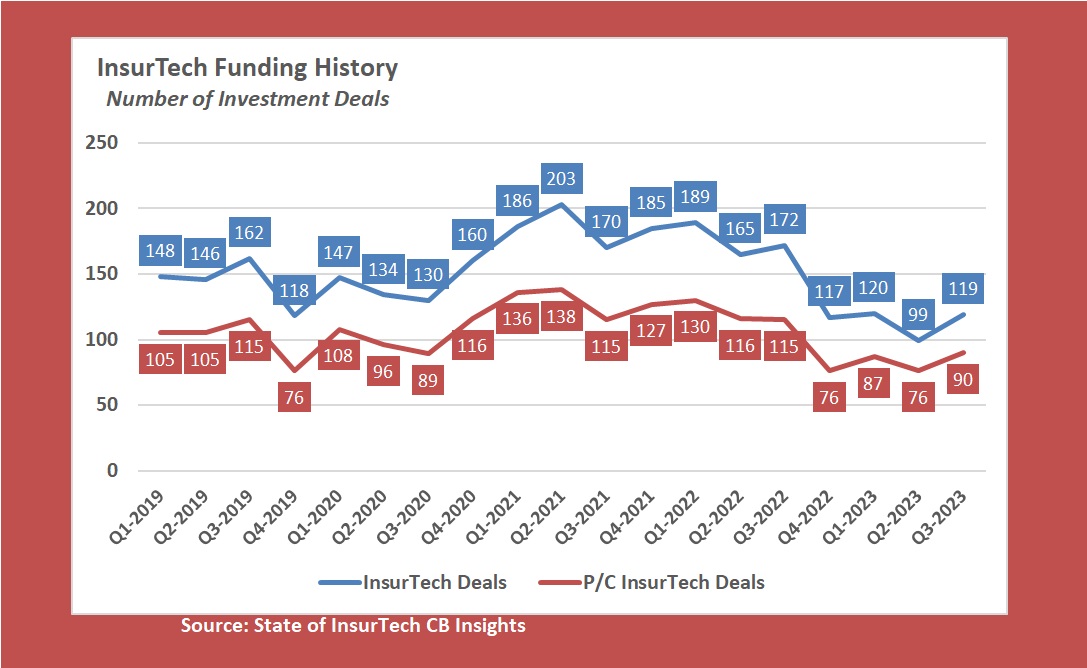

The number of P/C deals rose to 90 for the third-quarter, up from 76 in second-quarter 2023 (according to CB Insights), representing about 75 percent of all deals. In recent prior years, P/C deals accounted for roughly 70 percent of all deals.

The CB Insights report notes that this year’s third quarter included two P/C InsurTech mega-rounds (funding rounds in excess of $100 million)—for home insurer Openly and cyber insurance startup Resilience, and the birth of one new InsurTech unicorn (private company with a $1 billion-plus valuation)—home insurance startup Kin.

Much of the preface to the Gallagher Re report focuses on what the report’s editor, Andrew Johnston, describes as an inflection point for the global InsurTech space—moving from “the great experiment” of phase one to a new phase of development during which InsurTechs are focused on “sustainable profitability” and “precision” rather than volume. Johnston, who is the global Head of Gallagher Re InsurTech, noted that some $42 billion was invested into InsurTech globally during phase one between 2012 and 2021. Reviewing some of the manifestations of this inflection point, including Hippo’s decision to pause writing insurance and Vesttoo’s bankruptcy filing amid fraud investigations (without mentioning either InsurTech by name), Johnston turned a critical eye on investors providing “easy cash and wide berths” to InsurTechs without scrutinizing how capital would be deployed.

With “wealthy backers writing enormous checks,” InsurTechs cut corners and focused “on the wrong metrics [of] growth and divergence,” instead of loss ratios and customer retention, he said, “because, in truth, those were the same metrics that many of the investors were focused on.”

Johnston also noted that most InsurTechs were funded through equity deals, citing a drawback of investors not being able to perform continued due diligence once funds were passed over—in contrast to debt financing which carrier with it the consistent ability to check company finances.

Today, he notes, “the right types of investors and the right types of InsurTechs” are focused on sustainability and long-term value creation from Day 1.

Still, “while many individual InsurTechs have not been successful…., one could argue that their net contribution overall has been enormous,” he wrote, offering the contribution of “bringing the topic of technology investments into the boardroom” as one example.

The preface also touches on the extent of investments by insurers and reinsurers in InsurTech, noting that 2023 stands as the year with the highest number of insurer and reinsurer investment deals to date, with 73 recorded through the first half of 2023, and another 34 announced in the third quarter.

The majority of tech investments from insurers and reinsurers were early stage for the fifth consecutive quarter, the report says.

The main focus of this installment of Gallagher Re’s quarterly look at InsurTech investment is Series B and Series C rounds—referred to at “mid-stage expansion” by the authors. Garnering about 29.5 percent of the quarters funding in dollars ($323 million), these mid-stage deals accounted for only about 15 percent of deal counts (lower than prior quarters which came in around 20 percent).

The report offers a profile of P/C InsurTech Boost Insurance as one of three case studies of companies that have reached the mid-stage expansion stage, also noting that Boost, a provider of compliance, capital and tech infrastructure to other InsurTechs and MGAs, announced the addition of a segregated cell captive platform, Boost Re, during the quarter.

Lists of individual deals in the quarter are included in both the CB Insights and Gallagher Re roundups.

Total counts by quarter for P/C and all deals shown below.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists