Florida-based insurers still aren’t profitable, overall, but their net losses and underwriting losses are getting smaller.

In addition, two more property insurance companies are preparing to enter the Florida market. And the number of Citizens Property Insurance Corporation’s commercial policies is growing—so much so that the state-created insurer is considering a new, commercial-lines take-out program.

Those were some of the takeaways from a wide-ranging hearing held Tuesday by the Florida Senate’s Banking and Insurance Committee on the state of the insurance market. Insurance Commissioner Michael Yaworsky told senators that the historic 2022 and 2023 legislation reform legislation will need more time to have an impact on rates, but already has helped “restore rationality” to the market. The recent approval of take-outs of more than 646,000 Citizens’ residential policies—along with five new insurers in the market—is proof of that, he added.

“A lot of companies are acting on optimism,” Yaworsky said.

The commissioner declined to name the two additional carriers that are preparing to enter the Sunshine State, but said his office had met with company representatives.

“This is not a Wild West scenario, where we’ll take anybody with a dollar to come into our market,” Yaworsky told committee members. “They are coming in with business plans. We have an expectation that they will use those business plans during the course of operations.”

While a Citizens takeout offer is a good way to get a company started, new carriers also need a solid, organic growth plan before being approved, he noted.

Growth plans appear to be getting a little easier to draft.

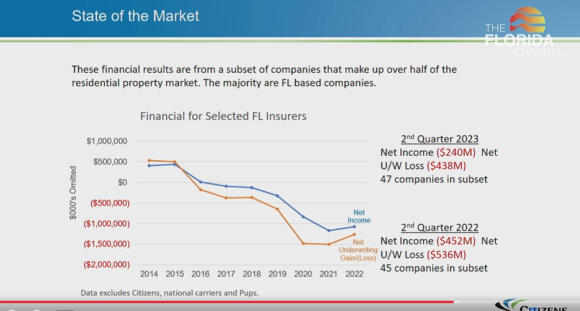

Net income for 47 Florida residential insurers, excluding Citizens, national carriers and Florida-only subsidiaries of national carriers, was still in the red for the second quarter of 2023, Citizens’ President Tim Cerio explained.

But the losses have turned a corner. Net losses for second-quarter 2023 were $240 million and underwriting losses were $438 million, a significant improvement over those carriers’ numbers for second-quarter 2022: $452 million in net losses and $536 million in underwriting losses.

“There is some encouraging data,” Cerio said. “It’s still in the red. But the numbers are better.”

Even as Citizens is in the process of shedding thousands of residential policies due to its depopulation program and recent take-outs, its commercial lines are growing. The number of commercial residential and non-residential policies dropped steadily from 2007 to 2021, from more than 65,000 to just under 5,000.

But since then, the number has climbed sharply, to more than 11,500 by August of this year, Cerio explained.

“We are seeing interest from companies in participating in a commercial depop program,” he said. “It has been several years we’ve heard of such interest, so we are encouraged about that. But we do have to address this explosion of commercial growth.”

To help put it all in perspective, Cerio posted data from the Property Insurance Plans Service Office that shows that Florida’s Citizens is far and away the largest state-created residual property insurer in the country. It has about 1.2 million policies in force and $423 million in exposure. That’s 51 percent of the exposure in the state, much more than California’s program that has 261,421 policies in force and 25 percent of the exposure in that state.

Unlike the residual insurers in most other states, Florida Citizens is strictly limited on rate increases, a glidepath that Cerio called “actuarially unsound.”

Claims litigation, a costly endeavor for Citizens and other Florida insurers, started moving in the right direction even before the 2022 and 2023 legislative changes that ended one-way attorney fees and assignment-of-benefit agreements, he noted. The share of non-catastrophe claims that were litigated dropped from 21.3 percent in 2017 to 15.2 percent in 2022.

Senators on the committee had questions and noted that the majority of calls they have received from constituents in recent months have been about escalating insurance premiums.

Sen. Blaise Ingoglia, R-Spring Hill, suggested that insurers could do a better job of explaining the costs that are driving insurance rates. While Yaworsky presented a pie chart showing some of those costs—with reinsurance and loss adjustment expenses (largely from litigation) being the largest slices—carriers should include similar information on policyholders’ declarations pages, Ingoglia said.

Insurers also should explain how inflation and building material costs are adding to losses and premiums, he said.

Yaworsky also hinted that other changes are in the works. Just as Florida has a wind-mitigation grant program that provides grants and premium discounts, it may be time to expand that to include premium credits for leak detection devices and other measures.

“The statute allows, and we should be able to afford, credits for mitigation for things beyond just windstorm,” he said.

Florida House Bill 799, approved in spring 2023, requires OIR to review mitigation credits allowed for some insureds. The form used to apply for those credits has not been updated since 2009 and the office may soon revise the form to include evaluation of other types of mitigation credits.

“I’m a huge supporter of that, allowing more credits,” Yaworsky said.

This article was previously published by Insurance Journal. Reporter Will Rabb is the Southeast Editor of Insurance Journal.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance