The private flood insurance market has been growing, but 2023 may provide a real test following Tropical Storm Hilary in California as well as future storms that may come during the remainder of the Atlantic hurricane season.

According to AM Best, the federal National Flood Insurance Program’s (NFIP) use of new data, models and technology incorporated within its Risk Rating 2.0 underwriting methodology has moved premiums higher to reflect true flood risk, although increases are capped at 18 percent per year. This has made private flood insurers more competitive.

In its market segment report, AM Best said providers of private flood insurance grew to 198 in 2022 from 47 in 2016. The total in 2022 is 11 more than 2021, when Risk Rating 2.0 was introduced. In 2022, which included the use of Risk Rating 2.0 for nine months, private flood direct premiums written (DPW) were up 24 percent to about $1.2 billion while NFIP direct premiums written were down about 12 percent to nearly $2.8 billion.

Commercial businesses have used the private flood insurance market most, according to AM Best, since limits offered by NFIP ($500,000 for the structure and $500,00 for contents) are often lower than needed by businesses. By contrast, the median home value in most states is lower than the NFIP policy limit ($250,000).

The NFIP is more than $20.5 billion in debt as of 2022, and financial results in 2023 aren’t likely to improve thanks to the floods California experienced from Tropical Storm Hillary. This catastrophe will also test private flood insurers.

“The California floods and mudslides earlier this year will pose a good test of the private flood market,” said Christopher Graham, senior industry analyst, AM Best. “California has a larger share of flood DPW in the private market than any other state with at least $100 million in DPW.”

Furthermore, AM Best’s report was published as Hurricane Idalia formed in the Gulf of Mexico. According to the latest report from the National Hurricane Center, Idalia is expected to strengthen to a major hurricane this week and strike Florida’s Gulf Coast somewhere north of Tampa. “Florida has by far the largest flood premium volume, either federal or private, of any state in the country,” AM Best said.

The effect 2023’s catastrophic weather events will have on the private flood insurance market is unknown, but events thus far have highlighted the low take-up rate for any kind of flood insurance. Vermont has also seen major floods in 2023, but many property owners are uninsured. In fact, according to AM Best, it is possible that a larger share of the population is uninsured against flood in Vermont than in Florida, where it was realized following Hurricane Ian in 2022 that less than half of residents have flood insurance.

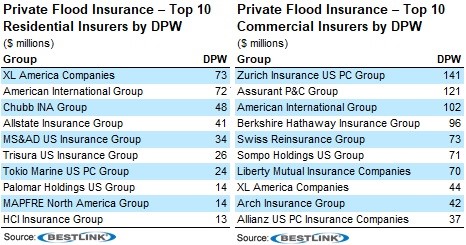

AM Best’s list of the top 10 private flood insurers exposes the “nascent nature” of the line of business. No residential insurer writes more than $75 million, and the top insurer of private commercial flood has less than $145 million DPW.

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec